During that time the insurer invests the money Warren BuffettBerkshire Hathaway shareholder letter. In an insurance operation float arises because premiums are received before losses are paid an interval that sometimes extends over many years.

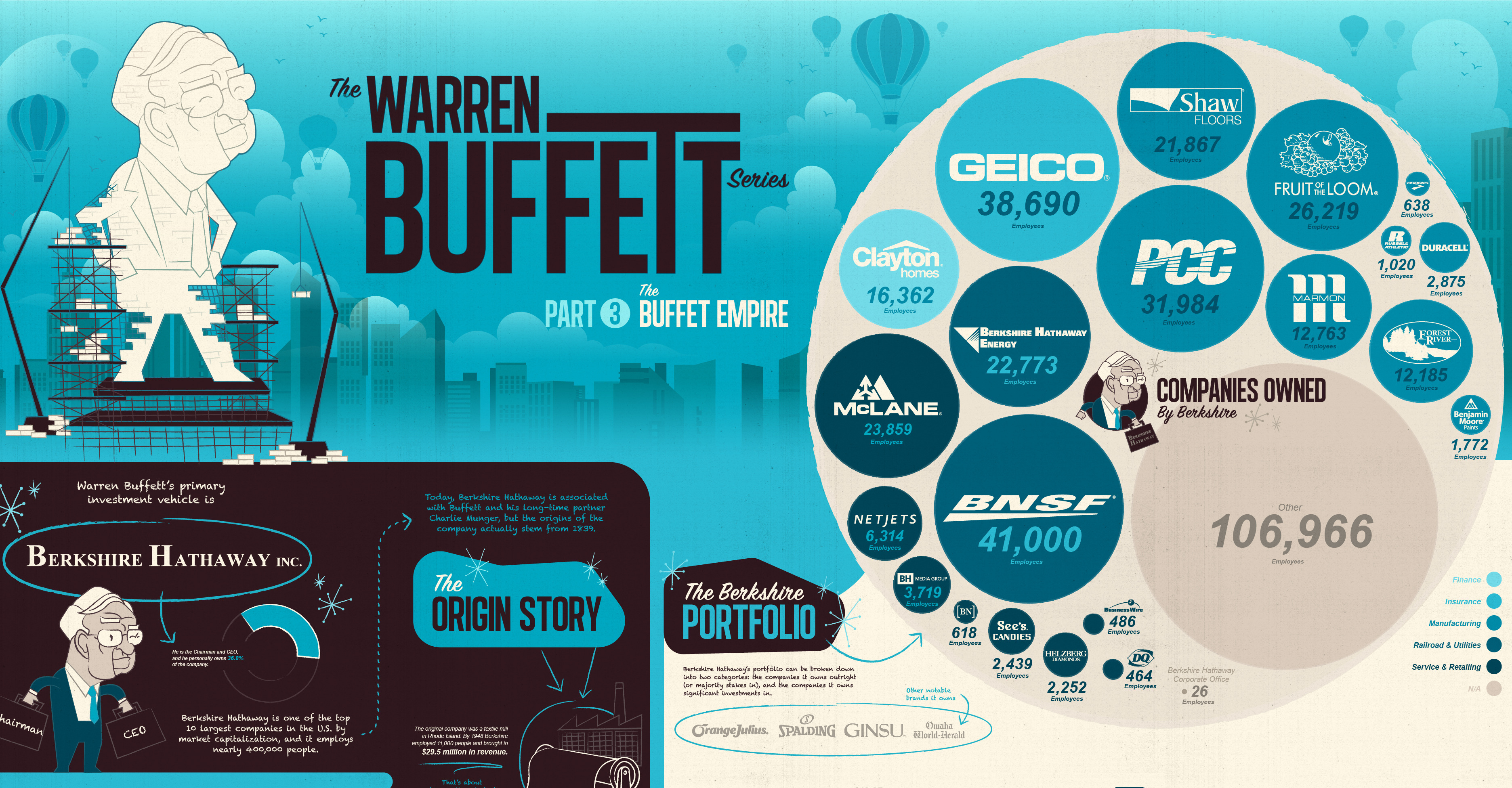

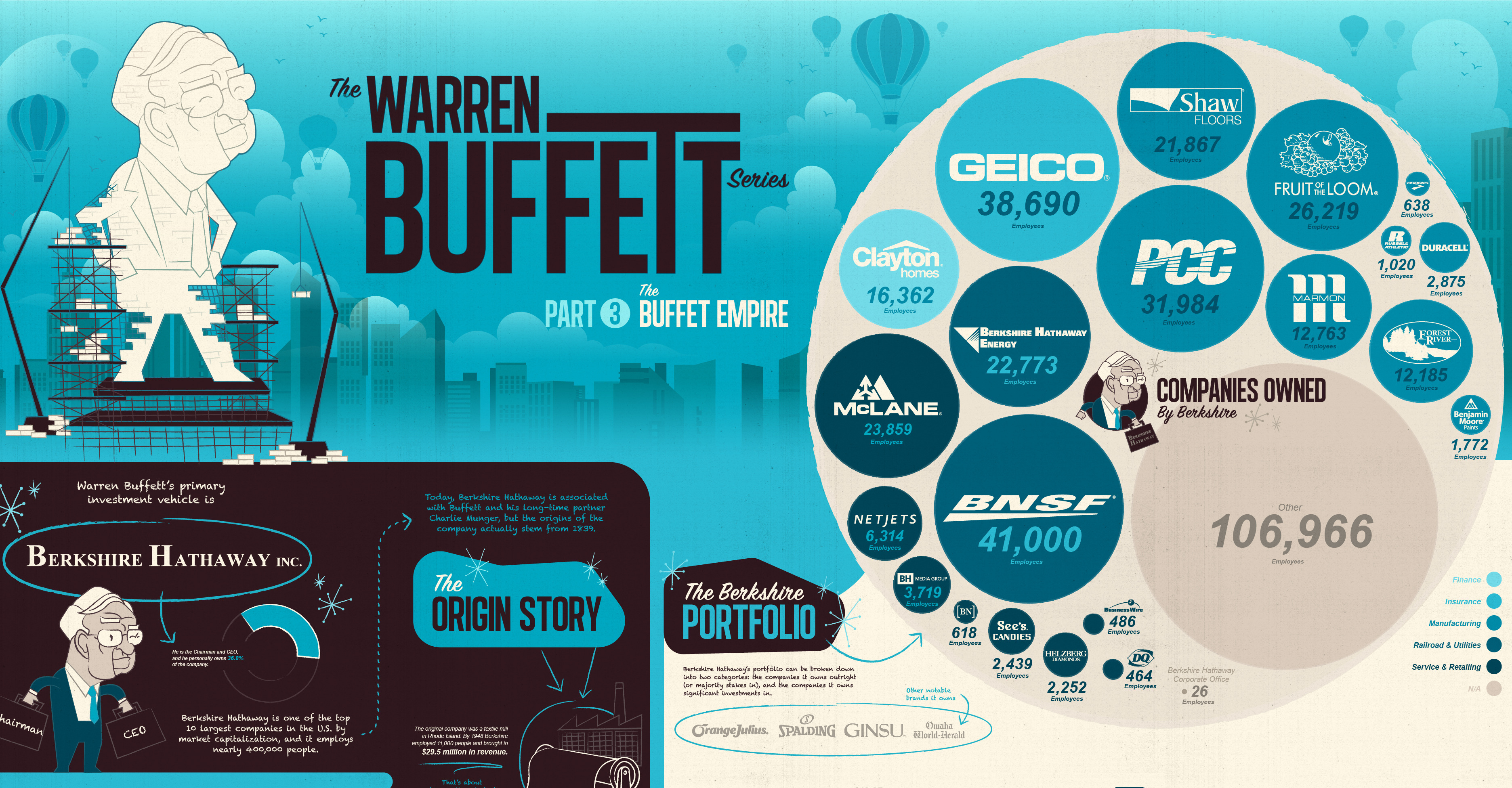

The Warren Buffett Empire In One Giant Chart

The Warren Buffett Empire In One Giant Chart

Buffett is one of the best investors in the world.

Warren buffett insurance company. Then he switched to owning small banks. Heard of superinvestor Warren Buffett. 22 2019 it will be 52 years to the day since Warren Buffett took his first serious dive into the insurance business when Berkshire Hathaway NYSEBRKA NYSEBRKB entered into an.

His initial foray was modest by current. Warren Buffett Likes Insurance Companies Many people are aware that Warren Buffetts company Berkshire Hathaway is a vast conglomerate with dozens of companies in its holding company system. These companies are attractive because of their float or cash with a near-zero cost of capital that comes from the insurance premiums insurance companies collect every month.

Warren Buffett famously made use of this money and invested it for higher returns. Warren Buffett made his first million by running a hedge fund. Floats are created from the difference between premiums received and claims paid out which create a reserve of capital for insurance companies.

Warren Buffett Owns These 15 Companies Selena Maranjian 1125. Insurance company float is money that the company holds onto between receiving premiums and paying out claims. In 2011 Buffett said California-based Sees had generated 165 billion in total profits since he acquired the company nearly 40 years earlier.

Insurance is an industry that is misunderstood by many people which is why Buffett has been able to draw such enormous profits from the sector. Considering that Warren Buffetts Berkshire Hathaway NYSE. Fruit of the Loom.

In his most recent letter to Berkshire Hathaway shareholders Warren Buffett discussed why the company originally got into the insurance business and why reinsurance is particularly appealing to it. It is simply huge and Mr. Warren Buffetts Favorite Life Insurance Company.

BRKB sells commercial property and casualty insurance its worth asking how much of an impact recent events might have. Diversified investments property and casualty insurance Utilities Restaurants Food. Insurer from its beginnings as the Government Employees Insurance Company.

Read on to find out how Warren Buffett used Berkshire Hathaway float. Warren Buffett said Elon Musk s Tesla will probably struggle as it ventures into the insurance business a field in which. When people say the Warren Buffett Company they mean Berkshire Hathaway Inc the 9 th largest listed company in the USA worth over 536 billion.

The bulk of Warren Buffett Trades Portfolios fortune has been made in the insurance business and Berkshire Hathaway is at its core an insurance conglomerate. Buffett is oftentimes referred to as the Oracle of Omaha to reflect his investment prowess. Warren Buffett Chairman and CEOCharlie Munger Vice ChairmanProducts.

1953 Warren Buffett and Western Insurance Securities Company August 25 2012 Many people do not know that Buffett wrote another article for The Commercial and Financial Chronicle besides his famous GEICO one. What Is Insurance Float. The Warren Buffett Company.

22 2019 it will be 52 years to the day since Warren Buffett took his first serious dive into the insurance business when Berkshire Hathaway. Buffett bought his first stake in the insurance business in 1967 at the age of 37 with National Indemnity Company and National Fire and Marine Insurance Company. This article profiled a little-known company called GEICO which was at the time the young investor.

What Does Warren Buffett Own. It is a good source of other peoples money that Warren Buffett can use to make acquisitions and other types of investments interest-free. Then finally he shut down his hedge fund.

Earlier this year marked 52 years since Warren Buffett first bought into the insurance industry. Warren Buffett is famously known as the Oracle of Omaha and loved for his folksy humor. At the end of 1951 a young Warren Buffett penned an article for the Commercial and Financial Chronicle titled The Security I Like Best.