Fund managers invest a minimum of 80 of the mutual funds 187 billion in assets in municipal bonds that pay interest exempt from personal income tax on the federal level with the majority of. GWK Municipal Bond Intermediate Strategy Highlights include.

Short Term Municipal Bond Strategy Baird Advisors

Short Term Municipal Bond Strategy Baird Advisors

The statistics are using the credit quality breakdown of the Bloomberg Barclays Municipal Bond Index as of December 31 2018.

Municipal bond managers. We are extremely aggressive. We are extremely conservative. All nine of.

A professional municipal bond manager is likely well-equipped to navigate these complexities especially during periods of volatility. Leading the way in municipal bonds. As a leader in municipal bond investing we provide market perspectives to clients who rely on us to meet their needs for tax-exempt income.

Municipal Bond Boutique Since 1984. The complexities of the municipal bond market need not deter individual investors. GWK is a recognized market leader and pioneer in municipal bond investing having managed portfolios for clients since our founding in 1974.

Skip believed that the best means of securing these was to found a registered investment management firm. Last year less than a third of active municipal-bond managers beat their benchmarks. During an environment of low yields and economic uncertainty municipal supply and demand have stabilized demonstrating the resiliency of the underlying investments.

Gurtin Municipal Bond Management a PIMCO company is a premier muni asset manager bringing high-grade enhanced investment solutions to tax-aware investing. Adam Banker a spokesperson for Fidelity. Municipal bonds managed by MacKays Municipal Managers are suitable for income-oriented investors seeking to achieve attractive after-tax total returns for tax-sensitive accounts and attractive total returns for tax-exempt accounts.

Over the past 10 years the average default rate for investment grade municipal bonds was 010 compared with a default rate of 228 for. The manager has extensive experience in portfolio management trading and credit analysis. The unique benefit to BCMs clients of working with the municipal bond portfolio manager is individual investors can receive the same level of portfolio management and services previously reserved only for large institutions.

Managers AMG GW. Apply to Portfolio Manager Credit Consultant Credit Analyst and more. Barnet Sherman is a director and the portfolio manager of the TIAA-CREF Tax-Exempt Bond Fund at TIAA-CREF.

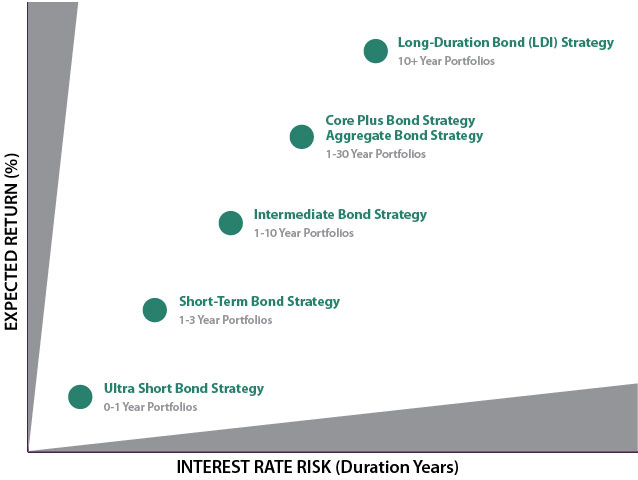

Our investment approach is active flexible and rooted in disciplined research to preserve and enhance principal and income. We provide unique access to separate account management through a hybrid-advisor offering both active and passive municipal bond strategies. They also needed the expertise and market skills of municipal bond traders and analysts in an arrangement that would align the interests of the client and adviser.

The most recent study covers defaults from 1970 to 2018. The best managers in the Intermediate Municipal Debt category over the past three years on a risk-adjusted basis and with strong absolute returns over one three and five years too are the Citywire-AAA rated trio of Peter Hayes Michael Kalinoski and James Pruskowski alongside AA-rated Theodore Jaeckel on the BlackRock Strategic Municipal. Municipal National Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois.

Municipal Bonds Risk Management Jun 25 2015 While municipal bonds are considered to be one of the safest investments on the market not all munis are created alike. Our state of the art software is designed to reduce time costs and resourcing for asset management firms and. Total Return Approach Research Expertise and Active Management.

We have developed a technological solution for fixed income portfolio management including the management of fixed income bonds like municipal bonds enabling faster and more efficient portfolio construction and analyses. For over three decades Bernardi Securities has specialized in municipal bond portfolio management and innovative public finance services. Fidelitys national mutual funds missed their bogeys.

But its a fact easily masked by the way muni bond prices are tracked and reported.