Stap in vóór 1 juni. The fund manager either follows a passive investment strategy and replicates the portfolio of a mid-cap growth benchmark index.

Best And Worst Q4 2020 Mid Cap Growth Etfs And Mutual Funds Seeking Alpha

Best And Worst Q4 2020 Mid Cap Growth Etfs And Mutual Funds Seeking Alpha

Echt duurzaam beleggen begint bij Meewind.

Best mid cap growth etf. Not only does IWP contain a. Echt duurzaam beleggen begint bij Meewind. 6 tot 7 procent.

The Vanguard Mid-Cap ETF VO is the most popular ETF for the mid cap market segment and for. 6 tot 7 procent. Prefer to tilt Value.

Mid-caps typically falls between 1. SPDR SP Kensho New Economies Composite KOMP Best Growth ETFs 5. Mid-growth funds invest in stocks medium-sized companies that are projected to grow faster than other mid-cap stocks.

In this case they simply buy the stocks of the benchmark index in the given proportion. Both earn an Attractive rating. Best Mid-Cap ETF to Buy Expense Ratio.

The lowest expense ratio of 004 was offered by both the Vanguard Mid-Cap ETF VO and the Schwab US. The iShares Russell Mid-Cap Growth ETF is the largest mid-cap growth ETF out there and the most popular way to play this strategy. The MSCI USA Mid Cap index measures the performance of the mid cap segments of the US market.

This Investment Guide for European mid cap stocks will help you navigate between the peculiarities of the EURO STOXX Mid MSCI EMU Mid Cap MSCI Europe Mid Cap STOXX Europe Mid 200 and ETFs tracking them. Best Growth ETFs 3. The index covers approximately 15 of the free float-adjusted market capitalization of the US market after the largest cap stocks representing appr.

Click on the tabs below to see more information on ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more. VOT Vanguard Mid-Cap Growth ETF. The 5 Best Mid Cap ETFs VO Vanguard Mid-Cap ETF.

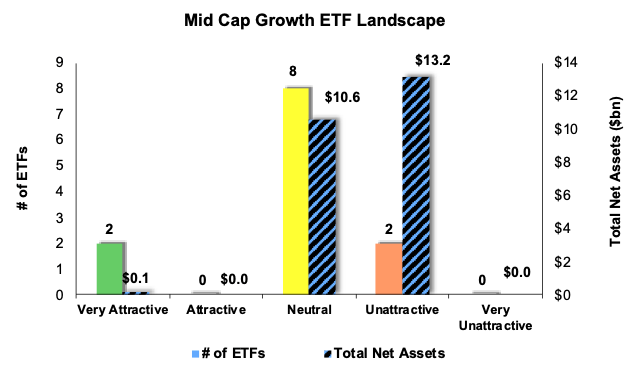

Invesco SP Mid Cap Momentum ETF XMMO is the top-rated Mid Cap Growth ETF and Touchstone Mid Cap Fund TMPIX is the top-rated Mid Cap Growth mutual fund. The Vanguard Mid-Cap Growth ETF VOT is one of the most popular mid cap growth ETFs. 20 rijen Mid Cap Growth Equities ETFs offer exposure to domestic mid cap size securities deemed.

Mid-Cap ETF SCHM so thats a tie. Wie écht vooruitkijkt belegt bij Meewind. SPDR SP 600 Small Cap Growth ETF SLYG.

Mid cap Value stocks have beaten mid cap Growth stocks. The index is based on free float market capitalization. MDYG is the first of 3 ETFs that seeks to track the SP MidCap 400 Growth Index.

Stap in vóór 1 juni. 015 The Invesco NASDAQ Next Gen 100 ETF follows the formula used by the successful Invesco QQQ Trust NASDAQ. QQQThat is it relies on cap.

Barrons 400 ETF BFOR is the top-rated Mid Cap Growth ETF and Touchstone Mid Cap Fund TMPIX is the top-rated Mid Cap Growth mutual fund. MDYG SPDR SP 400 Mid Cap Growth ETF. IShares SP Mid-Cap 400 Growth ETF IJK Best Growth ETFs 4.

All Mid Cap Growth ETFs How Mid Cap Growth Equities ETFs Work. There are essentially four indices available to invest with ETFs in European mid cap companies. XMMO earns an Attractive rating and.

Mid-Cap Growth ETFs invest in growth stocks that are deemed to have a medium market capitalization size generally between 2 and 10 billion. Wie écht vooruitkijkt belegt bij Meewind. The ultra-popular ETF iShares Core SP Mid-Cap ETF IJH tracking the mid-cap stocks has gained 47 in the same time frame compared to growth.

70 of the market. Working of Mid cap growth ETFs is simple. VOE Vanguard Mid-Cap Value ETF.

IVOG Vanguard SP. The market capitalization range for US. The 4 Best Mid Cap Growth ETFs VOT Vanguard Mid-Cap Growth ETF.