The following table includes certain tax information for all Municipal Bond ETFs listed on US. Exempt from Federal Taxes and Possibly State and Local Taxes Most muni bonds are free from federal income tax.

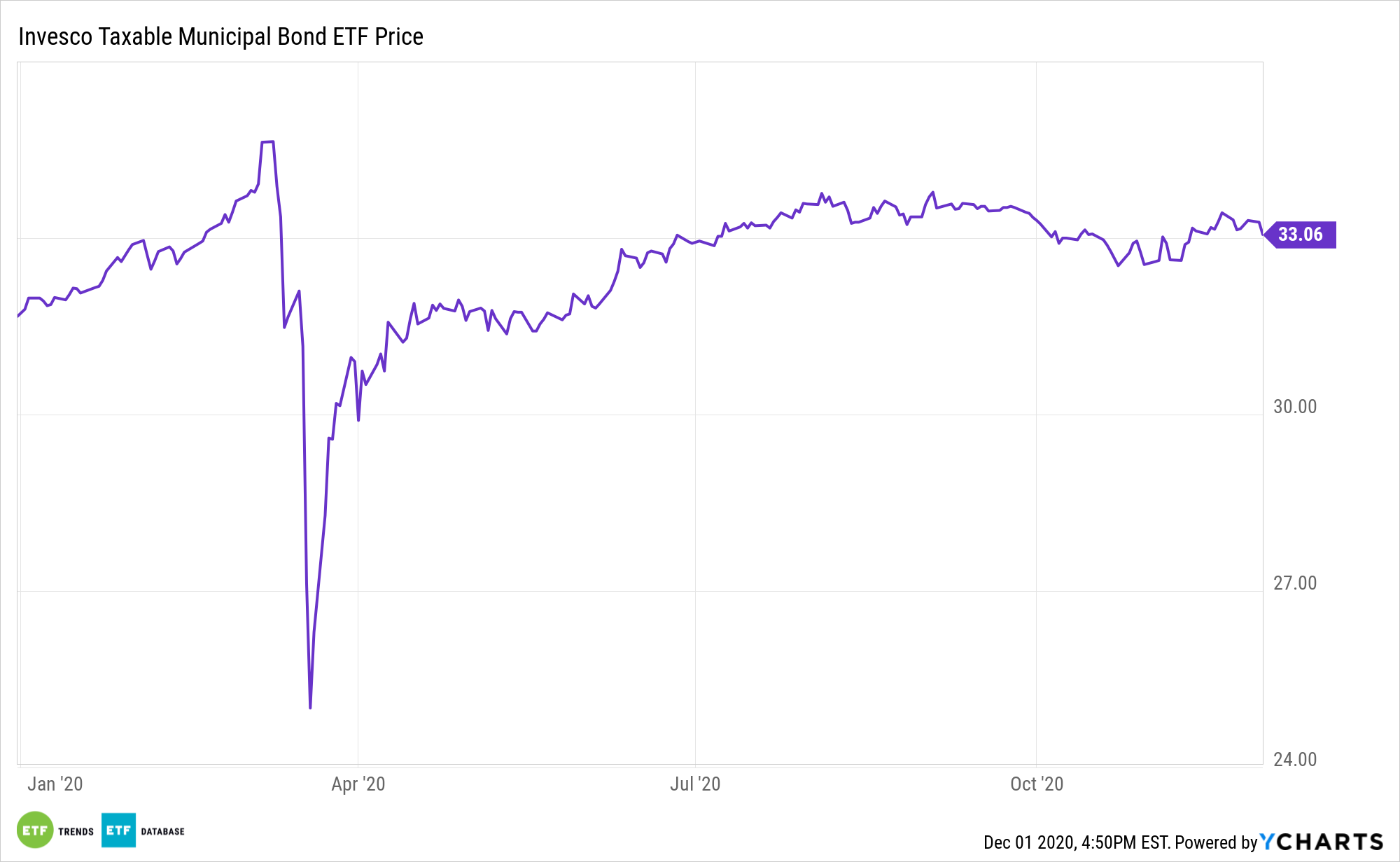

The Fastest Growing Fixed Income Sector Taxable Muni Bonds Etf Trends

The Fastest Growing Fixed Income Sector Taxable Muni Bonds Etf Trends

But they arent sure where to buy them and often end up using exchange traded.

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

Muni bond etf taxes. INVESTMENT OBJECTIVE The iShares National Muni Bond ETF seeks to track the investment results of an index composed of investment-grade US. The market for municipal bonds may be less liquid than for taxable bonds. FMBs active approach comes with a 050 expense ratio versus MUBs 007 price tag.

Interest rates dove and a major repricing occurred due to the improved tax advantages of municipal bonds. Depending on where you live and where the bonds are issued that income also might be clear of state and even local taxes. Municipal bonds sometimes referred to as munis are issued by various government entities such as states counties and municipalities.

Municipal bonds and tax-exempt debt are no longer synonymous a. As a result the ETF does not need to make purchases or sales in its portfolio in response to these shareholder trades and with a lower volume of portfolio sales there is a lower likelihood of the ETF realizing gains on. Exchanges that are currently tracked by ETF Database including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported.

In some cases the dividend stream from muni bonds is taxable if it falls under the AMT. The market for municipal bonds may be less liquid than for taxable bonds. This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US.

An ETF is a basket of securities in this case municipal bonds that trades as shares on a stock. Why are ETFs tax efficient. However interest on some municipal bonds is subject to both federal and state income taxes.

Federal income taxes and the federal alternative. Taxation of Municipal Bond ETFs Exchange-Traded Funds. Municipal bonds are commonly tax-free at the federal level but can.

At a minimum muni bond income is exempt from federal tax. Capital gains distributions if any are taxable. These bonds known as taxable municipal bonds generally pay higher interest rates than tax-exempt munis to make up for the lack of tax benefits.

It mostly invests in. A municipal bond also known as a muni is debt security used to fund capital expenditures for a county municipality or state. Some investors may be subject to federal or state income taxes or the Alternative Minimum Tax AMT.

Shares of ETFs are bought and sold at market price not NAV and are not individually redeemed from the fund. However with muni bonds you are investing in a local government so muni bond and ETFs are tax-free. Capital gains distributions if any are taxable.

Interest income from muni ETFs that hold only tax-exempt bonds is free from federal tax. You are paying 7x the passive choices cost for that chance to capture outperformance. Some investors may be subject to federal or state income taxes or the Alternative Minimum Tax AMT.

Use to seek tax-exempt income Effective March 1 2016 MUB changed its fund name from the iShares National AMT-Free Muni Bond ETF to the iShares National Muni Bond ETF. Most high bracket investors love the idea of tax-free muni bonds. However one caveat to the tax advantage of muni bonds being tax-free is the AMT alternative minimum tax amount.

Municipal bonds undoubtedly had a great year in 2019. Unlike traditional mutual funds the majority of buying and selling by shareholders takes place on an exchange and not directly with the ETF. Default rates regularly run a lean 01 to 02.

MMIN is an actively-managed ETF that aims to provide investors with current income that is exempt from federal income taxes by investing primarily in insured municipal bonds. These muni bond funds offer tax-exempt income. Most munis pay interest that is exempt from federal and potentially state income taxes.

Shares of ETFs are bought and sold at market price not NAV and are not individually redeemed from the fund. Taxable munis are one area that ETF investors can leverage with a fast-growing space in the municipal debt or bond markets.