Somewhere near 1 million 80 to 90 of your annual pre-retirement income 12 times your pre-retirement salary. If youre a defined contribution DC pension saver youll need to pay money into your retirement pot although how this works depends on the type of scheme youre in.

How Much Money Should You Have Saved For Retirement The Irrelevant Investor

How Much Money Should You Have Saved For Retirement The Irrelevant Investor

Set a Goal for Your Retirement Savings.

How should you save for retirement. You have to do something different if you want your habitsand your futureto change. At your age in 2021 as in 2020 youre legally allowed to save 19500 in a 401k retirement plan. If your company offers an employer-sponsored retirement plan like a.

Workplace pension Under auto-enrolment AE a total of 8 contribution must go into your pension each month of which the employer minimum is 3. But whats right for you. Assume youre 40 years old with 0 in retirement savings.

And how do you know youre on track. How Much Should You Save for Retirement. We covered this in Chapter 1 but well hammer it again.

Determine the current value of your savings at retirement. The 16728 Social Security bonus most retirees completely overlook If youre like most Americans youre a few years or more behind on your retirement savings. How to save for retirement in three steps Get your free money.

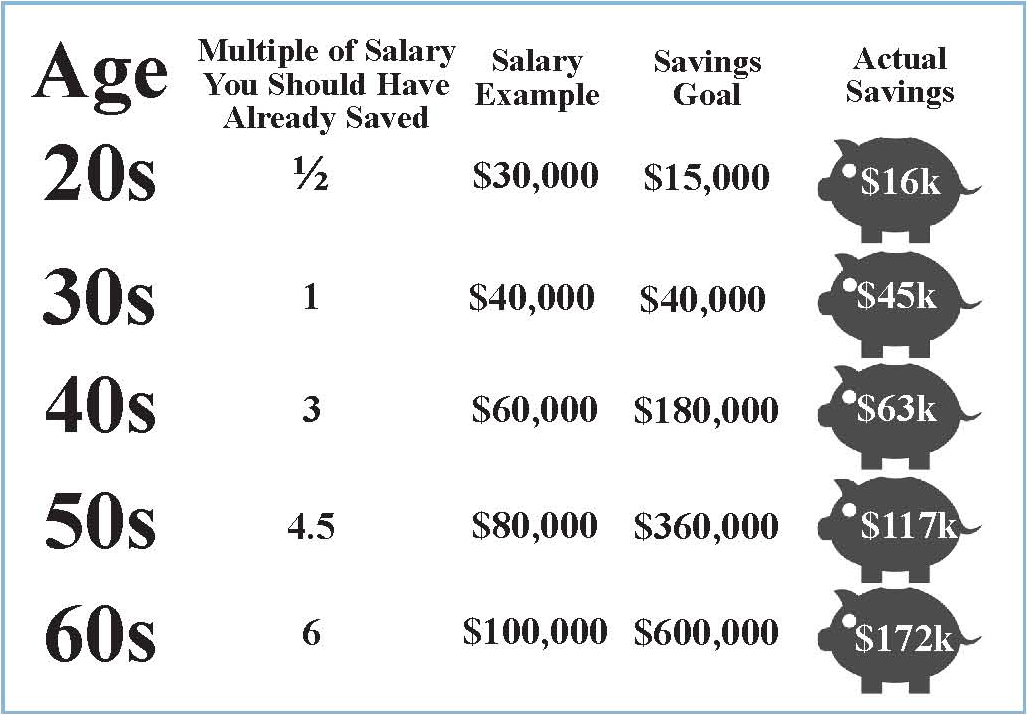

If youre between 55 and 64 years old you still have time to boost your retirement savings. At age 50 you should have six times what you earn annually saved for retirement. Make sure youre contributing as much as you can before you retire.

High earners generally want to. Our rule of thumb. But the truth is the actual amount you need to save for retirement depends on a lot of factors including.

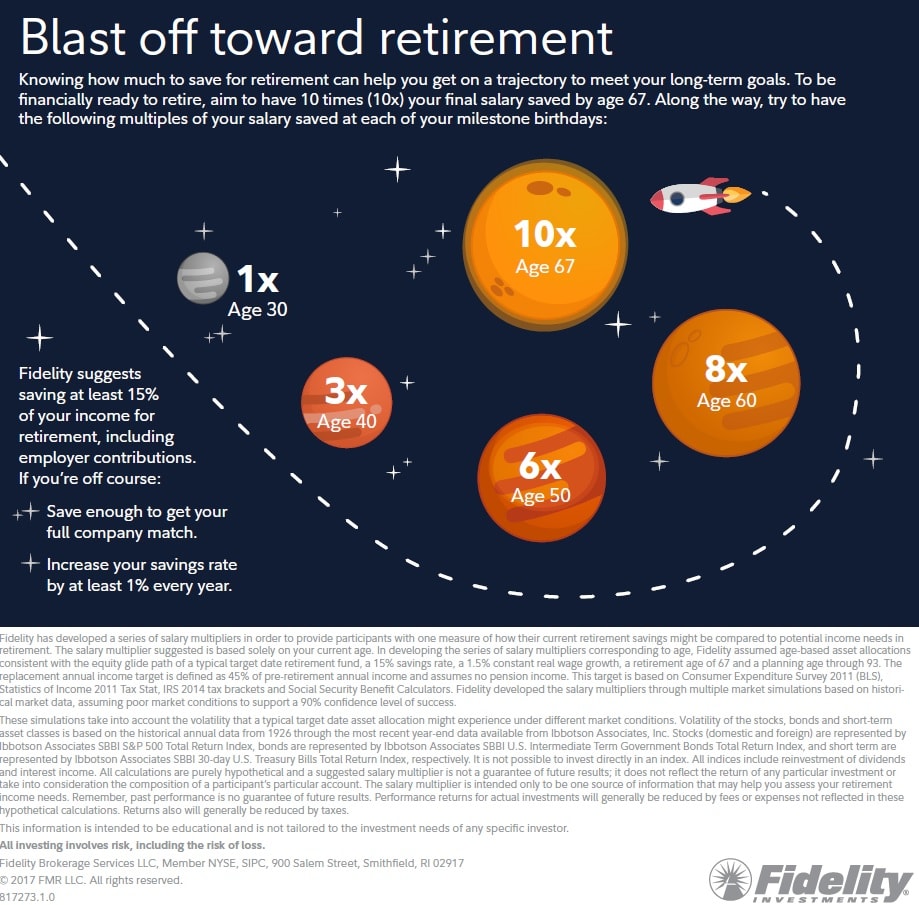

By the time you hit age 60 the goal is to have eight times your salary saved and it should reach 10 times. Thats assuming you save for retirement from age 25 to age 67. That 20 includes your employers match.

8 línur Retirement savings. If you were born in. Thus if you earn 100000 annually youll need to save at least 4000 annually for retirement.

Whether your employer matches contributions. As a rule of thumb most experts recommend an annual retirement savings goal of 10 to 15 of your pretax income. And the truth is saving for retirement is easier than you think.

Beyond that most people should save about 20 of their total salaries each year for retirement. Together with other steps that should help ensure you have enough income to maintain your current lifestyle in retirement. The 4 Rule.

The 4 Rule There are different ways to determine how much money you need to save to get the retirement income you want. Retirement experts have offered various rules of thumb about how much you need to save. This simple-to-follow rule involves multiplying your annual salary by 004.

But a handful of little-known. Figure the amount of savings you need at retirement. Were going to cover three steps.

Aim to save at least 15 of your pre-tax income 1 each year. The worksheet takes you through four steps. A good rule of thumb is to save between 10 and 20 of pre-tax income for retirement.

If you get a late start youll need to save more. Estimate the amount of income you need in the first year of retirement. This is how much you will need to last you through retirement.

Youre entitled to your full monthly Social Security benefit based on your unique wage history starting at full retirement age. Whether you plan to retire early late or never ever having an. Its 26000 if youre 50 or over Those are the maximums set by the Internal Revenue Service IRS for the 2020 and 2021 tax years.

Invest 15 of Your Income Into.