Even the Canada Revenue Agency stresses that its own list isnt exhaustive so chances are your significant medical expenses qualify when filing your taxes. Add up your total out-of-pocket medical expenses for the year.

Medical Expense Tax Deduction More Difficult Now But You Can Qualify With Planning

Medical Expense Tax Deduction More Difficult Now But You Can Qualify With Planning

A person is considered a dependent if they are a relative who lives with you and.

What qualifies as medical expenses for tax deductions. For example if your total qualifying expenses were 11000 you may be able to take a medical. Medical expenses incur red and paid outside South Africa Its important to note that over the counter medicines - such as cough syrups headache tablets or vitamins dont qualify as medical expenses - unless specifically prescribed by a registered medical practitioner and acquired from a pharmacist. If your total is 7500 or less you wont have enough deductible expenses to qualify for the medical expense deduction.

The IRS allows you to deduct unreimbursed expenses for preventative care treatment surgeries and dental and vision care as qualifying medical expenses. However the tax filer or his or her spouse must have been born before January 2 1951 a minimum of 65 years of age for this deduction. You can also deduct unreimbursed expenses for visits to psychologists and psychiatrists.

141 Zeilen You can claim only eligible medical expenses on your tax return if you. How to calculate the medical expense deduction. On a federal income tax return eligible medical expenses that exceed 10 percent of the taxpayers adjusted gross income may be deducted.

Batteries and repairs qualify. 25 x R8176 R2044. Heres a partial list of deductible expenses.

A person generally qualifies as your dependent for purposes of the medical expense deduction if. For you to include these expenses the person must have been your dependent either at the time the medical services were provided or at the time you paid the expenses. Medical expenses may be one of the most under-utilized tax credits says Hamilton Ontario accountant Alan Rowell.

Follow these four steps to calculate your medical expense deduction or to see if you qualify. You figure the amount youre allowed to. Who qualifies for the medical expense deduction.

Artificial limbs and eyes may be deducted. Expenses like medical supplies eyeglasses and hospital services can be deductible. You generally receive tax relief for health expenses at your standard rate of tax 20.

You may deduct only the amount of your total medical expenses that exceed 75 of your adjusted gross income. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. If your qualifying medical expenses are more than 7500 subtract 7500 from your total expenses to learn the dollar amount you may be able to deduct on your federal tax return.

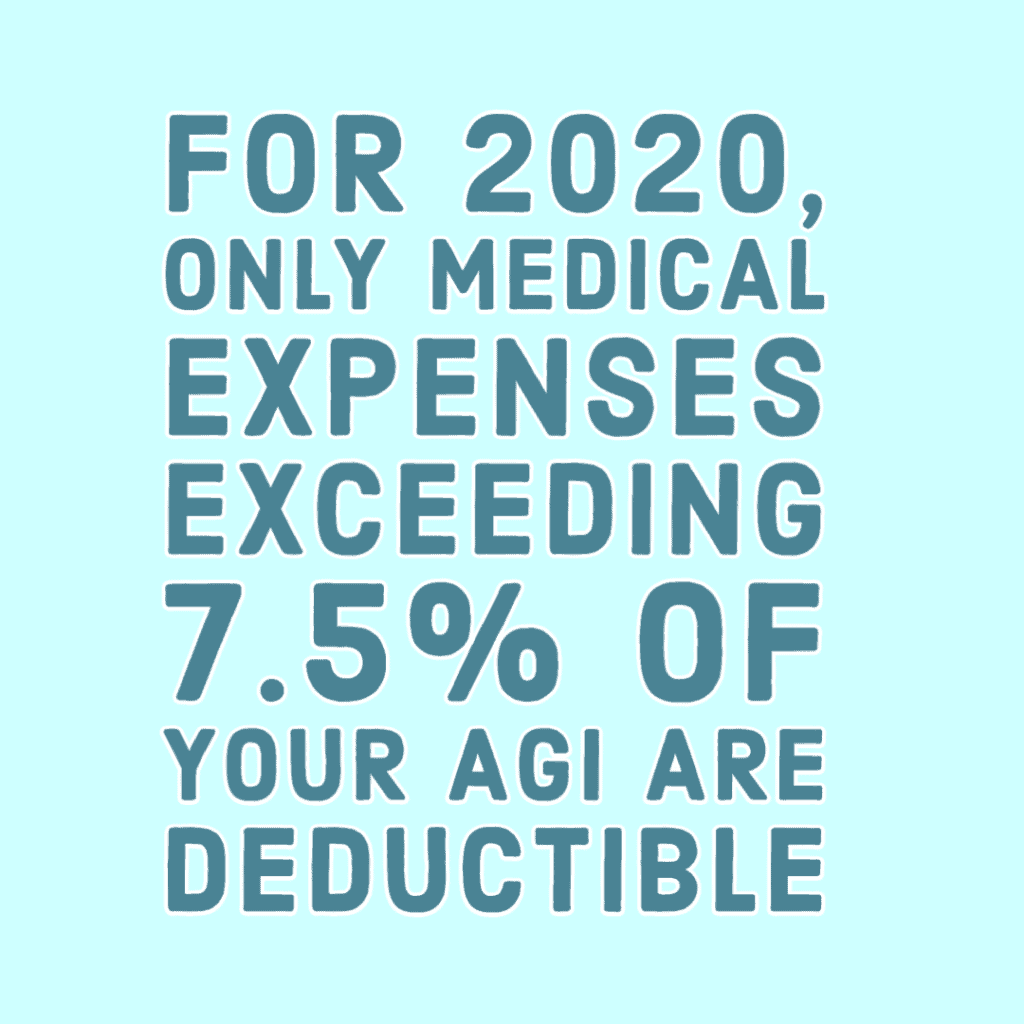

Buying a wig may be deductible. From 2019 which will be reflected in your tax return this amount goes up to 10 of adjusted gross income. For tax year 2020 the IRS permits you to deduct the portion of your medical expenses that exceeds 75 of your adjusted gross income or AGI.

Remember the additional medical expenses credits is 25 of the sum of the excess scheme fees credit and qualifying medical expenses on which 75 taxable income was deducted so lets work that out. Yes you can claim medical expenses on taxes. As long as your medical expenses exceed 75 of your AGI you can claim this deduction.

Allowable deductions include medical dental and eye care expenses. The medical expense tax credit is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. The list of eligible expenses you can claim is extensive.

Theres a ceiling where you can only deduct qualified medical expenses if they total more than 75 of your adjusted gross income for the years 2017 and 2018. If you paid for healthcare expenses you may be able to claim them as eligible medical expenses on your income tax and benefit return. And some expenses must meet certain requirements to be deductible.

Equipment and supplies You may deduct any expenses relating to back supports crutches and wheelchairs to name a few items. If you have impaired hearing you may deduct hearing aids. These expenses include a wide range of products procedures and services such as.

Taxpayers may deduct medical and dental expenses that exceeded 75 percent of their adjusted gross income in the tax year for which they are filing a return. Medical and dental expenses can be deducted if their total sum exceeds 75 of the tax filers Adjusted Gross Income AGI. Medical tax deductions dont work like other tax deductions.

In addition to your own expenses you can take medical deductions for your dependents as well. The threshold goes up.