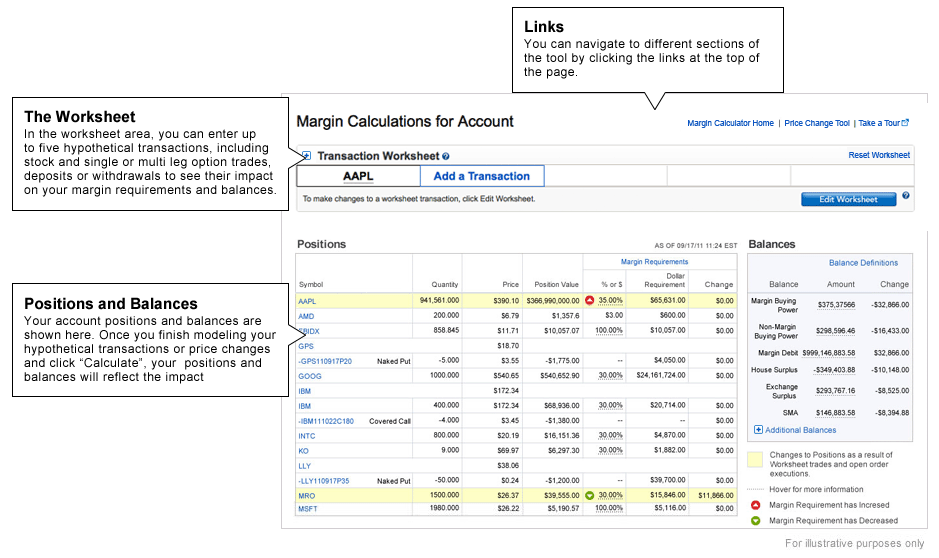

How to get cash from your Fidelity Account Learn how to set up Electronic Funds Transfer EFT instructions on your Fidelity Account for transferring cash out. In a Cash Account all trades are accepted on the basis of receiving full payment in cash for purchases and good delivery of securities for sales by the trade settlement date.

Managing The Strike Count How To Avoid Good Faith Vi Ticker Tape

Managing The Strike Count How To Avoid Good Faith Vi Ticker Tape

The ETF settlement date is three days after a trade is placed whereas traditional open-end mutual funds settle the next day.

What is settled cash in fidelity. What is a settlement period. This cash cannot be withdrawn until it has gone through a settlement process. 7 rows Settled Cash The portion of your Cash Core balance that represents the amount of securities you can Buy and Sell in a Cash Account without creating a Good Faith Violation.

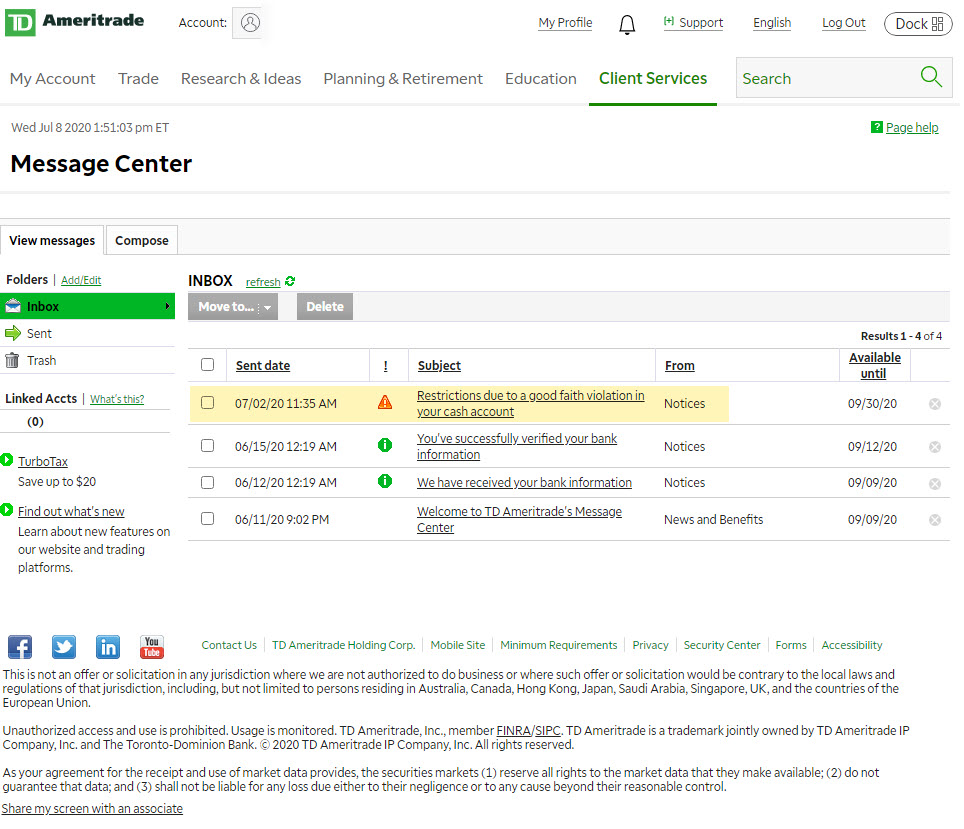

This amount includes proceeds from transactions settling today MINUS unsettled buy transactions short equity proceeds settling today and the intraday exercisable value of option. As the term implies a cash account requires that you pay for all purchases in full by the settlement date. Good faith violation- you can buy with unsettled cash but you want to avoid selling before the money settles.

The main violation types are good faith freeriding and liquidation. Where your money is held until you invest it or distribute it from your account. The settlement period is the time from the date on which the trade is executed on the market to the date on which the trade is finalized.

Transactions must be settled within a number of working days from the date of the transaction. The settlement date is the day you must have the money on hand to pay for your purchase and the day you get cash for selling a fund. Unsettled Cash is the cash you received from the sale of an investment on the platform.

Stock settlement violations occur when new trades to buy are not properly covered by settled funds. What does settled cash in fidelity means keyword after analyzing the system lists the list of keywords related and the list of websites with related content in addition you can see which keywords most interested customers on the this website. A cash settlement is a settlement method used in certain futures and options contracts where upon expiration or exercise the seller of the financial instrument does not deliver the actual.

The portion of your Cash Core balance that represents the amount of securities you can Buy and Sell in a Cash Account without creating a Good Faith Violation. When you ask us to buy sell or switch an investment a transaction takes place with the fund provider in the relevant market. Under Federal Reserve Board Regulation T securities transactions in a cash account must be paid for in full.

In a Cash Account the following transactions are allowed. Although settlement violations generally occur in cash accounts they can also occur in margin accounts particularly when trading non-marginable securities. If you buy and sell shares with unsettled funds back to back fidelity considers it good faith violation.

For example if you bought 1000 shares of ABC stock on Monday for 10000 you would need to have 10000 in cash available in your account to pay for the trade on settlement date. Settled Cash is the term given to the proceeds of the sale of an instrument product on the platform that has gone through the 5 business working day settlement period and is available for withdrawal. Fidelity allows you to buy shares with pending transfer funds unsettled fund and once you buy shares using unsettled funds you cannot sell it until your transfer becomes settled takes approx 4-5 business days.

12 rows Cash core Account settlement position for trade activity and money. When you sell out of an investment on the platform it takes a period of 5 business days the Settlement period for the cash proceeds of that sale to be settled and to show in. The purchase and sale of securities Options purchases and covered call writing if approved for options trading.

That is why it is the same amount as you can withdraw. Settled cash money that is officially cleared in your fidelity account. Different investments have different settlement periods.

For a detailed explanation on unsettled cash and the settlement period please visit our What is unsettled cash. Money in your core position is used for buying and selling securities and to process checks electronic funds transfers EFTs cash transactions wire transfers deposits authorized credit card transactions and Fidelity BillPay if available on your account.