75 of the corporate tax rate 2128 Eliminate exclusion for 10 of QBAI. The tax rate on profits earned by foreign subsidiaries of US.

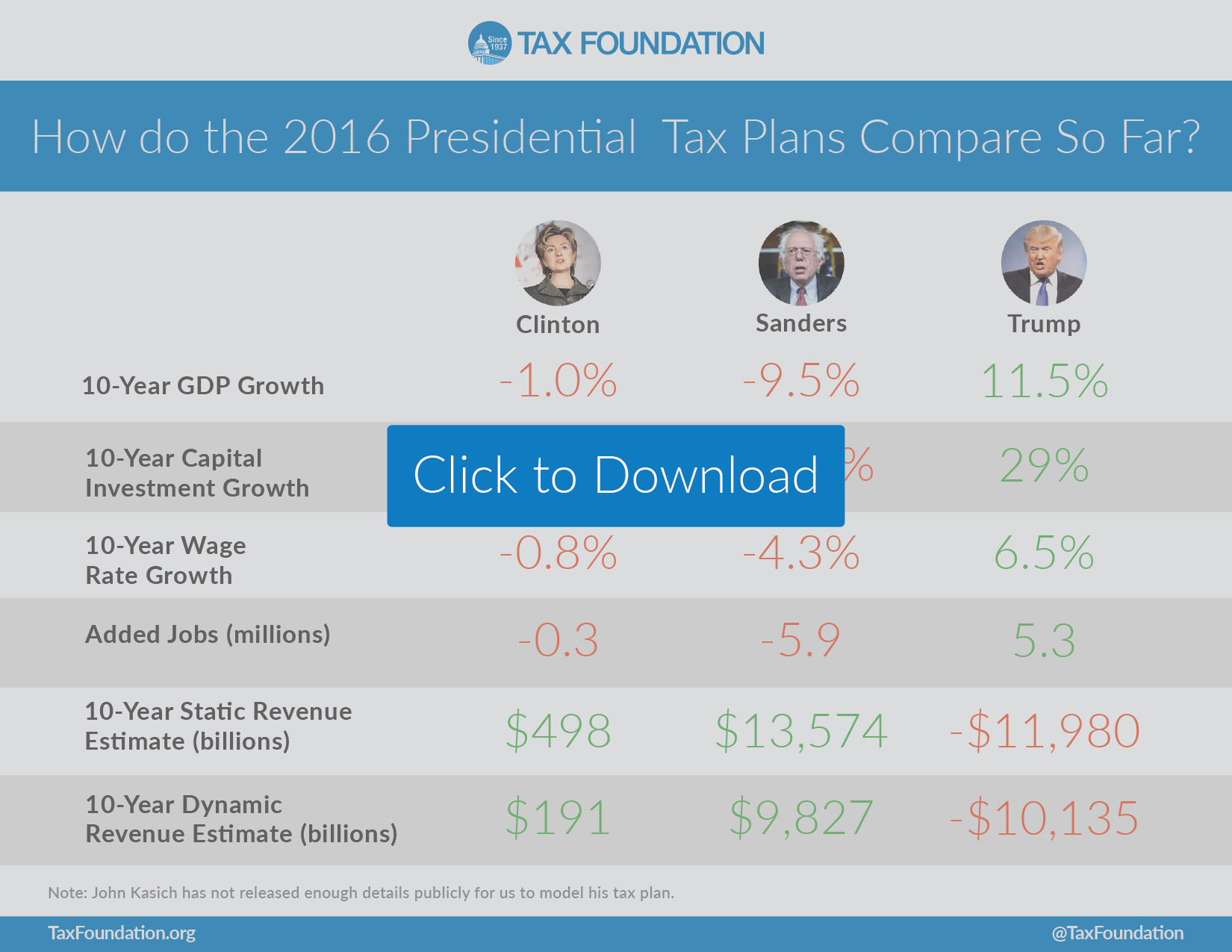

A Comparison Of Presidential Tax Plans And Their Economic Effects Tax Foundation

A Comparison Of Presidential Tax Plans And Their Economic Effects Tax Foundation

How does the US tax plan compare to other countries.

Tax plan comparison. 7 Zeilen If we consider Bidens tax plan over the entire budget window 2021 to 2030 as a percentage of. Biden plans to increase the top income tax rate from 37 to 396. 60-100 of the corporate tax rate eg.

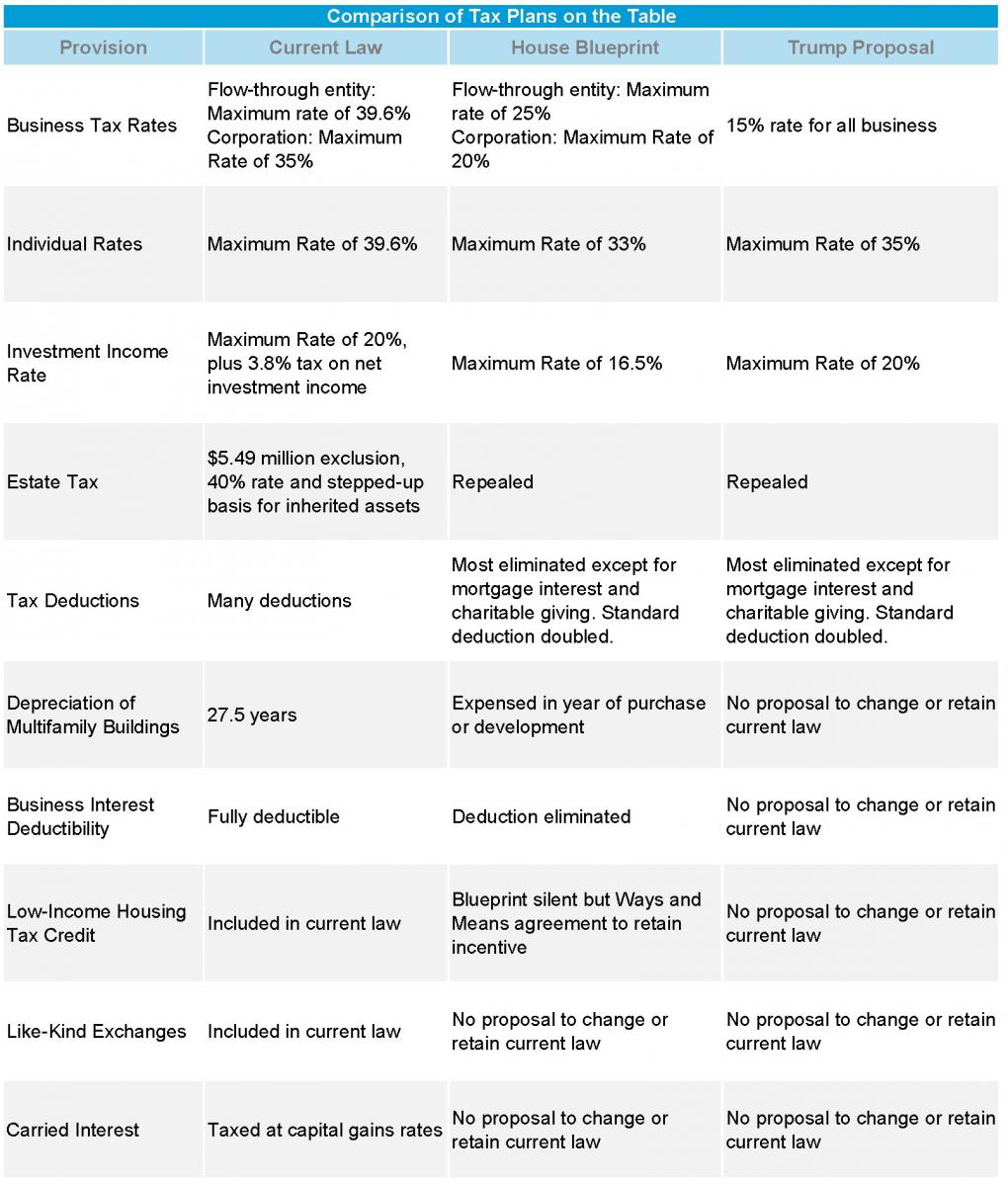

In late 2017 then-President Donald Trump signed into law the Tax Cuts and Jobs Act TCJA. CORPORATE TAXES 210 Trump 280 Biden INCOME PAYROLL TAXES 370 Trump 520 Biden SMALL-BUSINESS TAXES 296 Trump 396 Biden INCOME PAYROLL TAXES 238 Trump 434 Biden At the bottom of the meme a yellow portion appeared to have been added after the fact and it read. Image copyright Getty Images.

Schedule your FREE Strategy Session by clicking on t. However the Biden tax plan would increase taxes for corporations and for most taxpayers with incomes over 400000. Bidens tax plan generally calls for.

The Senate Finance Plan. Labors long-term tax plan is simple in comparison. Firms will be doubled to 21.

5 Zeilen Key Differences between the Candidates Tax Plans. It would reinstate the pre-2017 top marginal individual tax rate of 396. Other than the immediate tax cuts mainly directed towards people earning 90000 a year or less.

Retained for 2017 and 2018 with an AGI threshold of 75 regardless of age. 75 threshold also applies for AMT purposes for 17 and 18. How President Bidens Tax Plan Compares to Trumps.

Comparing Trump and Bidens tax plans 0445. Anzeige Bloomberg Tax is a Comprehensive Global Compliance Resource. Taxpayers can elect to deduct sales tax in lieu of state income tax.

Biden also plans to. Depending on your current tax bracket and expectations for future tax rates consider contributions to a Roth 401 k. Tax evasion Tax avoidance and Tax planning are common terms when it comes to taxpayers manners for tax reduction.

I have decided to do a brief comparison on the proposed Biden Tax Plan and the current Trump Tax Plan. Former Vice President Joe Biden says he wont raise taxes on anyone with annual income of less. A reduction in individual income tax rates with the top rate dropping from 396 to.

According to the Tax Policy Center Bidens tax proposals will increase revenue by 4 trillion between. Increasing the corporate tax rate to a flat 28 from 21 now and creating a minimum corporate tax of 15 of companies book income if. Tax Notes reporters examine President Bidens Made in America Tax Plan and the international tax framework by Senate Finance Committee Chair Ron Wyden D-Ore and their international impact.

Taxes Property taxes and state and local income taxes are deductible. Anzeige Bloomberg Tax is a Comprehensive Global Compliance Resource. Trumps signing resulted in.

The Latest International Tax News Developments in Over 220 Countries. In this article BBCIncorp will clarify the meaning features as well as differences between tax evasion tax avoidance and tax planning. The figure for income and payroll tax is correct only for business owners in the highest tax bracket.

The Made in America Tax Plan. Threshold increases to 10 after 2018. The Latest International Tax News Developments in Over 220 Countries.

Published 30 September 2017.