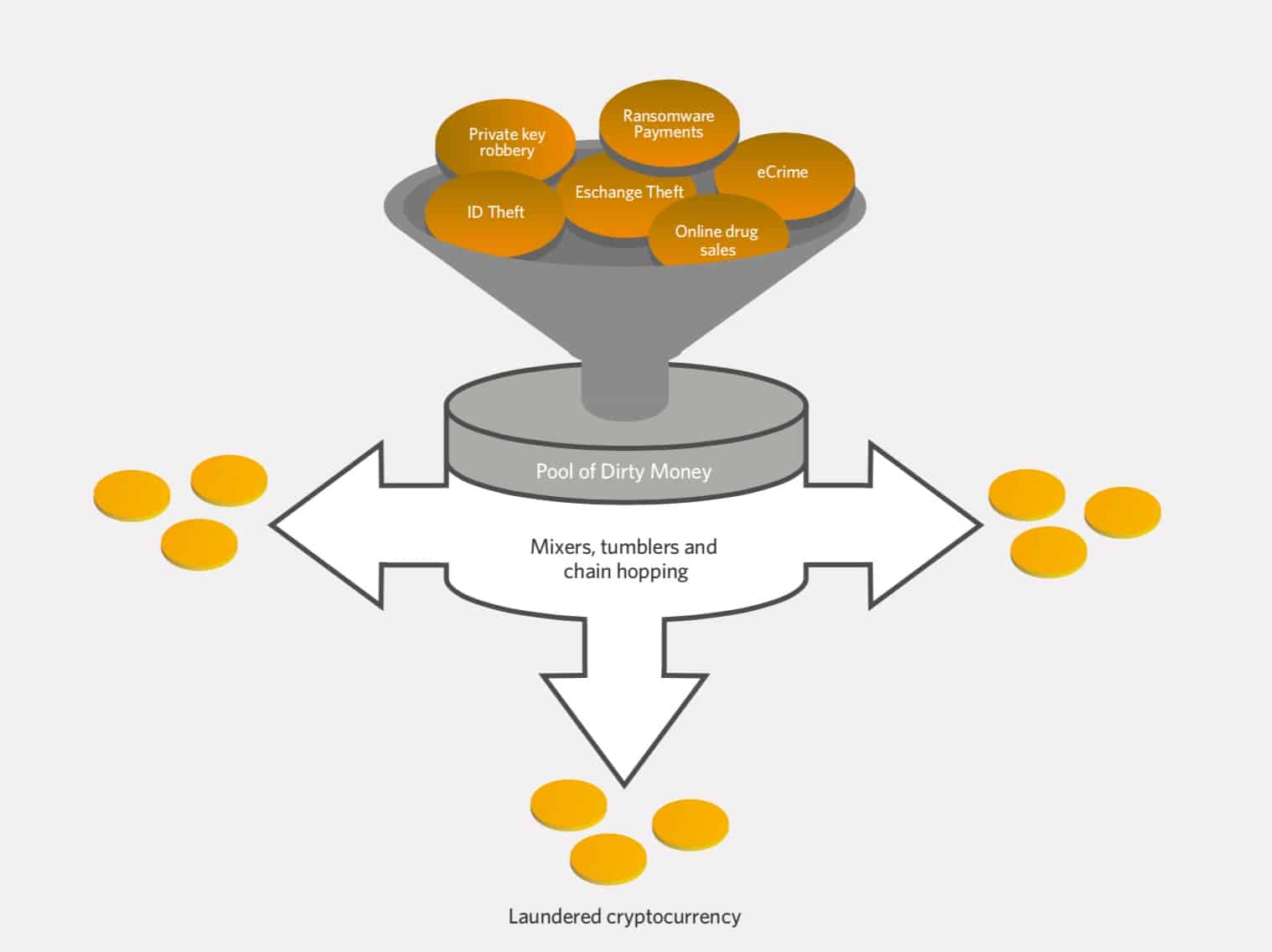

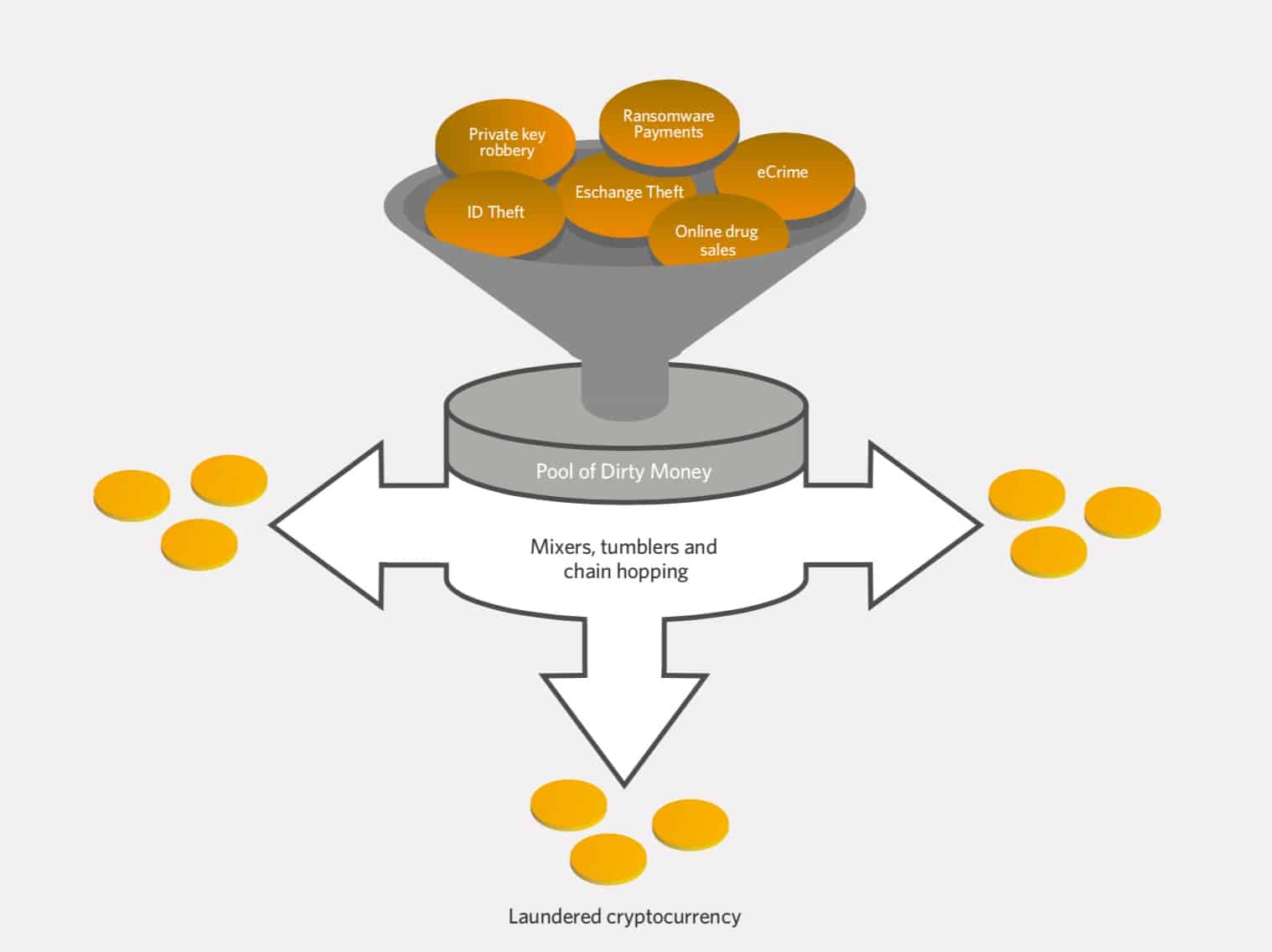

Launderers typically make use of mixers tumblers and chain hopping collectively referred to as a cross-currency process. Money Laundering the Crypto Way.

Ciphertrace Publishes Report On Cryptocurrency Money Laundering Say Crypto Theft On The Rise

Ciphertrace Publishes Report On Cryptocurrency Money Laundering Say Crypto Theft On The Rise

After all if there were no way for bad actors to cash out cryptocurrency theyve received through illegal means thered be far less incentive for them to commit crimes in the first place.

Cryptocurrency money laundering. However as technology has advanced the prevalence of money laundering has grown as well. The criminal purchases a basic cryptocurrency at a. Typically a cleansing process follows the following stages1 1.

The money laundering infrastructure driven by OTC brokers enables nearly every other type of crime we cover in our Crypto Crime Report. Officials have expressed concerns that cryptocurrencies are being used to conceal illegal transactions including theft and drug deals and that Americans whove made windfalls betting on. In 2019 money laundering within the crypto sector totaled around 30 million in the United States.

On the other hand criminals exploited the banking loopholes to wash around 250 billion. Cryptocurrencies and blockchains are set to be a key compliance theme of 2019 with the upcoming Fifth Money Laundering Directive setting out to regulate cryptocurrencies. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow.

Criminals are able to expertly use new technology to launder huge sums of money in the blink of an eye. While techniques to launder cryptocurrencies differ from those used in conventional money laundering the overall process may be described according to the same three stages. Cryptocurrency and money laundering.

Using crypto cleansing to launder money In certain countries crypto cleansing is used to evade international sanctions. New York CNN After a hype-filled week for cryptocurrencies Bitcoin experienced a flash crash over the weekend plunging nearly 14 in less than an hour from about 59000 to 51000 on. CipherTraces 2020 Cryptocurrency Crime and Anti-Money Laundering Report reveals that in 2020 major crypto thefts hacks and frauds totaled 19 billionthe second-highest annual value in crypto crimes yet recorded.

The Standard Chartered Bank has been negligent to anti-money laundering protocols over the years. Under this update the crypto-asset sector is considered a regulated entity which is now subject to AML rules and legislation. Why Cryptocurrencies Are Susceptible to Money Laundering Activity There are several reasons why cryptocurrencies are used to facilitate money laundering but the predominant reason is anonymity.

With such an. According to a blockchain analytics firm Chainalysis criminals appear to have laundered 28 billion using cryptocurrencies and crypto exchanges in 2019. CRYPTOCURRENCY AND MONEY LAUNDERING THE PROBLEM.

Individuals and criminal organizations can mask their true identities by using different aliases and pseudonyms essentially allowing transactions to be. The most prominent example of cryptocurrency misuse involves Mexican drug cartels particularly the Sinaloan cartel which laundered money through Chinese Crypto brokers. Cryptocurrency Money Laundering Money laundering is a crime that has been around for hundreds of years.

This process usually involves organized digital money laundering. For large financial institutions regulations and oversight are of paramount importance to protect. FINTRAC issues red flag guidance DLA Piper Canada December 18 2020 Any dealing by a reporting entity in virtual currency.

The Regulation of Cryptocurrency. Money Laundering Cryptocurrency Money laundering in cryptocurrency primarily involves transferring the illegal money into the cryptocurrency networks. New Anti-Money Laundering Regulations The Money Laundering and Terrorist Financing Amendment Regulations 2019 came into effect on the 10th January 2020 to combat the global issue of money laundering and terrorist financing.

The first stage involves obtaining a cryptocurrency and creating a wallet to hold the tokens similar to a bank account. Many people take advantage of the anonymous nature of cryptocurrency in order to launder money avoid. Massive exit scams have dominated cryptocurrency crimes.