Facebook is showing information to help you better understand the purpose of a Page. In November 2003 Select Portfolio Servicing then known as Fairbanks Capital agreed to pay 40 million to settle with the FTC and the US.

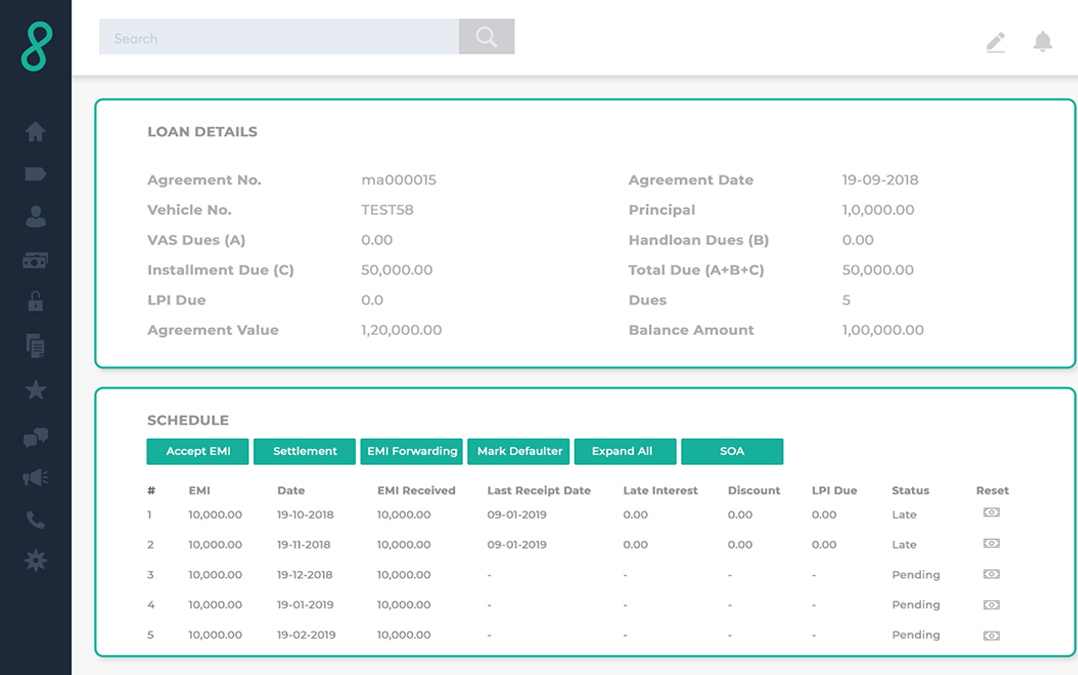

Loan Servicing Software 2021 Best Application Comparison Getapp

Loan Servicing Software 2021 Best Application Comparison Getapp

In 2005 Select Portfolio Servicing was acquired by Credit Suisse Switzerland base company.

Select loan servicing. Online payments should only be made through your account at Specialized Loan Servicing. 63 65 VERNON ST Street SELECT PORTFOLIO SERVICING No. The company primary corporate offices are located in the foothills of the Rocky Mountains outside Denver Colorado.

Of Units Social Security No. About Select Portfolio Servicing SPS Select Portfolio Servicing Inc. Your Select Home Loan is administered by Bluestone Servicing Limited FSP181924 Level 5 125 Queen Street Auckland 1010 New Zealand on behalf of the lender NZGT Custodians Bluestone Limited FSP40011.

Specialized Loan Servicing LLC. Any interest rate quoted throughout this website is expressed as a nominal Annual Percentage Rate. Price Range Impressum.

Fannie Mae and Freddie Mac approved SellerServicer. All payments should be made to Specialized Loan Servicing LLC or SLS LLC. NMLS ID Main Office 2168.

Specialized Loan Servicing LLC SLS was incorporated in 2003 by a group of Mortgage Industry professionals. CRIF Select helps financial institutions grow their lending portfolios through our indirect lending programs. NMLS ID Branch 1634251 For licensing information go to.

We recommend that you first file a claim with your insurance company then call us at 8888186032 so we can assist you. We specialize in helping lenders with indirect Auto. NMLS ID Branch 972456.

Servicing loans in all US states DC Puerto Rico and Guam since 1999. Terms and conditions fees and charges and Select lending criteria apply. Select Portfolio Servicing Inc.

The associates of the company are equipped with the latest in Internet and call center technology extensive industry specific training and the proper attitude. 49 likes 1 was here. Is a loan servicing company.

You retain full ownership of your home. We then entered a trial phase with a ridiculously low payment for 3 months. NMLS ID Branch 1634251 For licensing information go to.

180 people follow this. PHEAA conducts its student loan servicing operations for federally-owned loans as FedLoan Servicing. Federal Student Aid is committed to providing electronic and information technologies that are accessible to individuals with disabilities by meeting or exceeding the requirements of Section 508 of the Rehabilitation Act 29 USC 794d.

Settlement A mutual agreement between you and Select Portfolio Servicing Inc. If you have received a request to mak e a payment to a different company please contact Customer Care at. 178 people like this.

Whereby Select Portfolio Servicing Inc on behalf of the loan owner agrees to accept less than the full amount of your loan balance in full satisfaction of your loan. Mon-Fri 8 AM to 9 PM ET. See actions taken by the.

NMLS ID Main Office 2168. We were instructed to skip payments to get process started so we did. The company was founded in 1989 under the name Fairbanks Capital Corporation in Salt Lake City Utah.

I should have saw a problem because we never missed before but was a good faith. SPS is a nationally recognized mortgage servicer specializing in the servicing of single-family residential mortgages. Page Transparency See More.

Under no circumstances would Specialized Loan Servicing LLC SLS request borrowers to wire or submit funds to an individual. Select Loan Servicing Loan Number. As a mortgage servicer SPS manages the day-to-day administration of mortgage accounts including collecting regular monthly mortgage payments.

Department of Housing and Urban Development. The software includes functionality for funds disbursal payments scheduling and applications assigning. Select portfolio servicing had already purchased our loan.

NMLS ID 41998 Computershare Limited 1996 - 2021. NMLS ID Branch 972456. Select Portfolio Servicing Incs website has scheduled maintenance planned from 200 PM Eastern Time on Saturday May 8th through 800 AM Eastern Time on Sunday May 9th.

Specialized Loan Servicing LLC. SPS was founded in 1989 and is headquartered in Salt Lake City Utah with an office in Jacksonville Florida. NMLS ID 41998 LenderLive Network LLC.

Loan servicing may also refer to the borrowers obligation to make timely payments of principal and interest on a loan as a way to maintain creditworthiness with lenders and credit-rating agencies. We contacted them about a principal reduction modification so we could afford to keep our house. Loan Servicing comes as part of an end-to-end tools suite that can be easily integrated with your core lending solution or be used within our all-in-one lending automation platform.

Loan Service in São Paulo Brazil. Both agencies claimed the company was engaging in unfair deceptive and illegal practices in the servicing of subprime mortgage loans. From outside the US 305 646-3980.

Short Sale Allows you to sell your home for less than the remaining balance on your loan.