MAIN STREET LENDING PROGRAM. The Main Street New Loan Facility.

Fed Expands And Releases New Details Of Main Street Lending Program Choate Hall Stewart Llp

Fed Expands And Releases New Details Of Main Street Lending Program Choate Hall Stewart Llp

Main Street loans are not grants and cannot be forgiven.

Main street loan program. The program supports two-. The Main Street Lending Program is a new offering created by the Federal Reserve to help businesses during the ongoing COVID-19 crisis and accompanying economic downturn. If you are not a lender.

Allows eligible lenders to extend unsecured or secured term loans. Instead businesses that take out a loan under this program will be required to pay it back in full. KEY PRACTICAL POINTS FOR CONSIDERATION Borrower Eligibility.

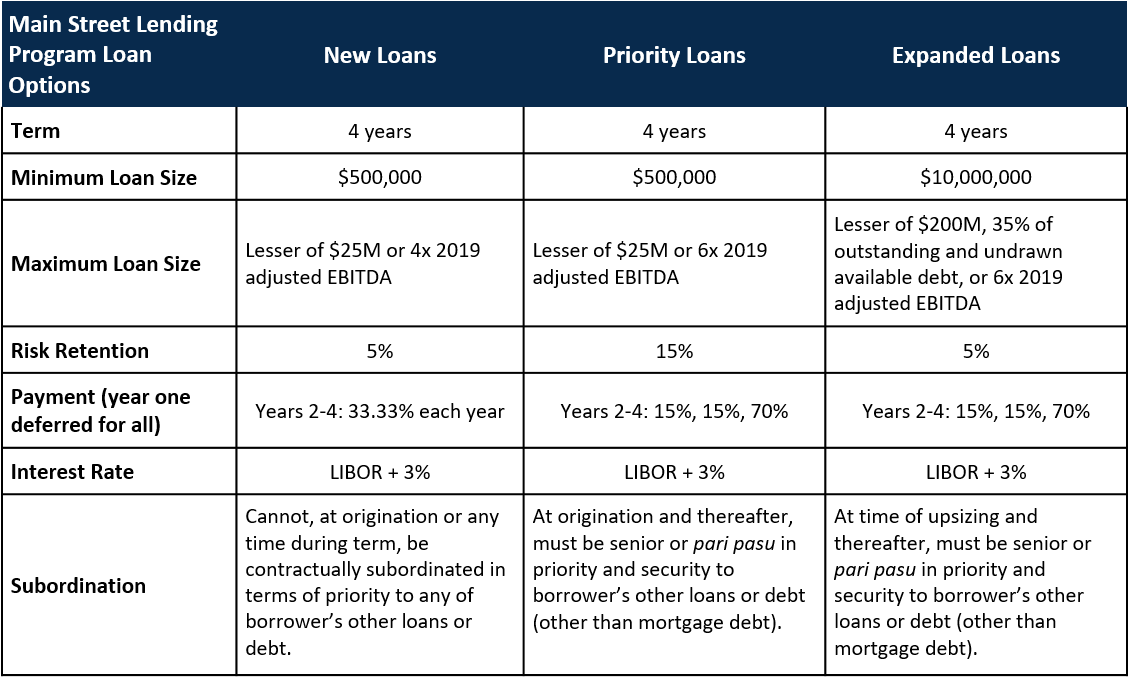

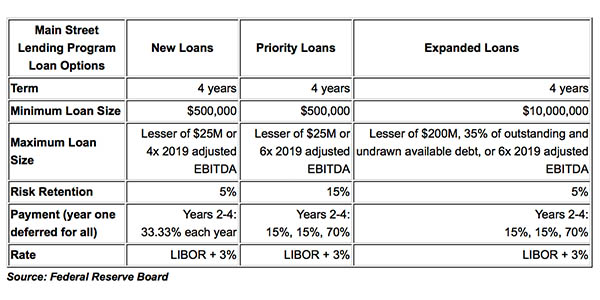

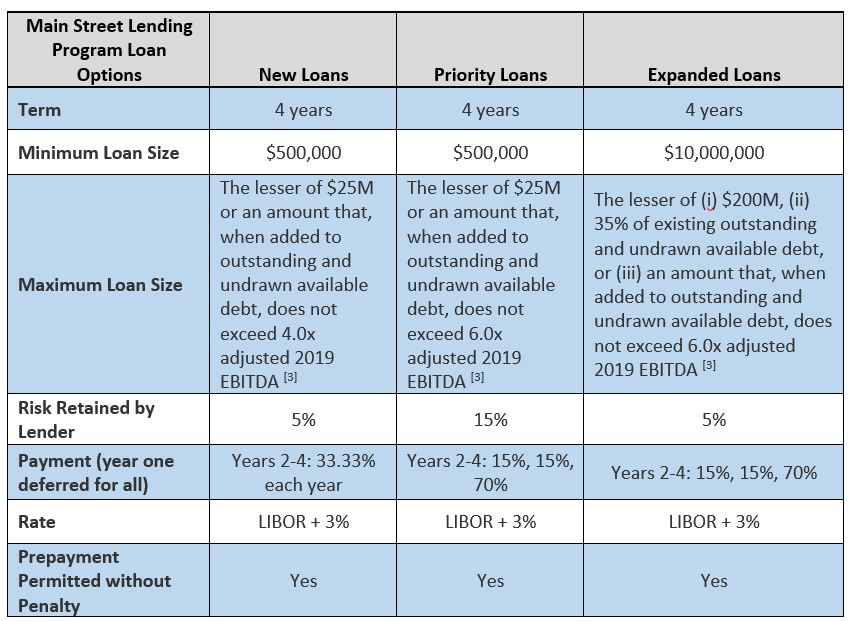

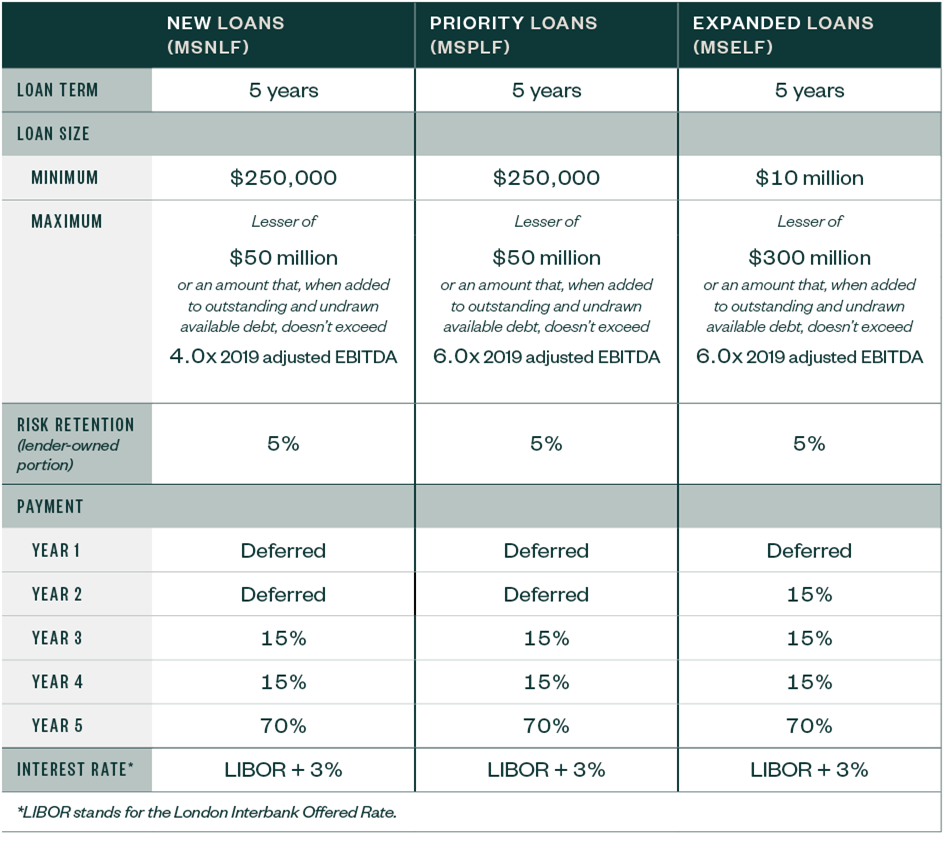

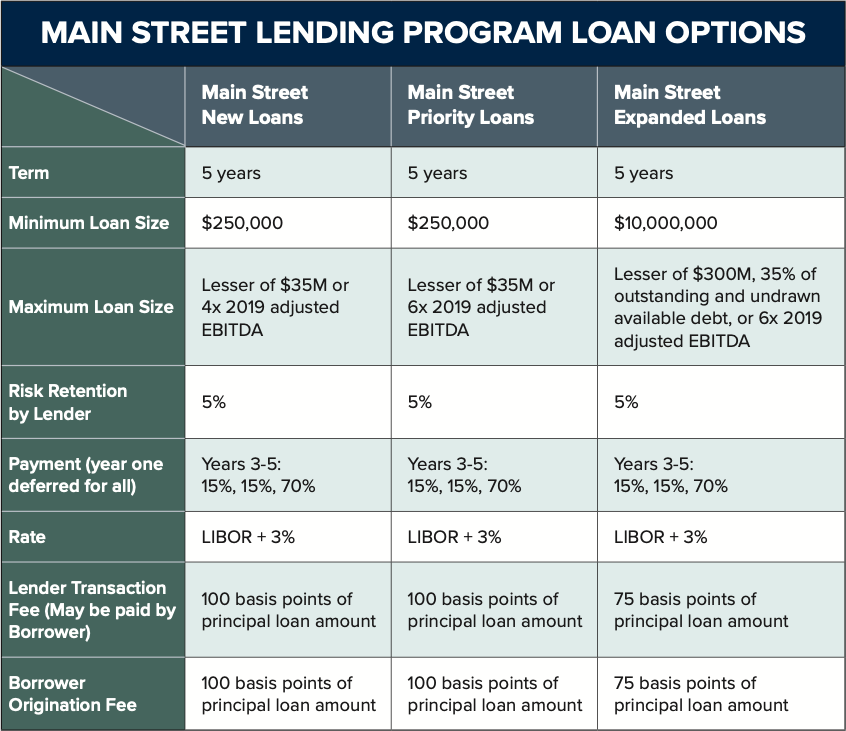

Loan features are detailed in the charts on the following slides and in the Program term sheets. The portal is intended for lenders only. All loans under the Main Street Lending Program must permit prepayment without penalty.

Treasury Secretary Mnuchin announced that this loan program will make a significant. Under the Main Street program the maximum amount of the loans is four times EBITDA or six times EBITDA depending on the elected facility. Loans will be issued through regular banks who will then sell 85-95 of the loan back to a special purpose vehicle created by the Federal Reserve.

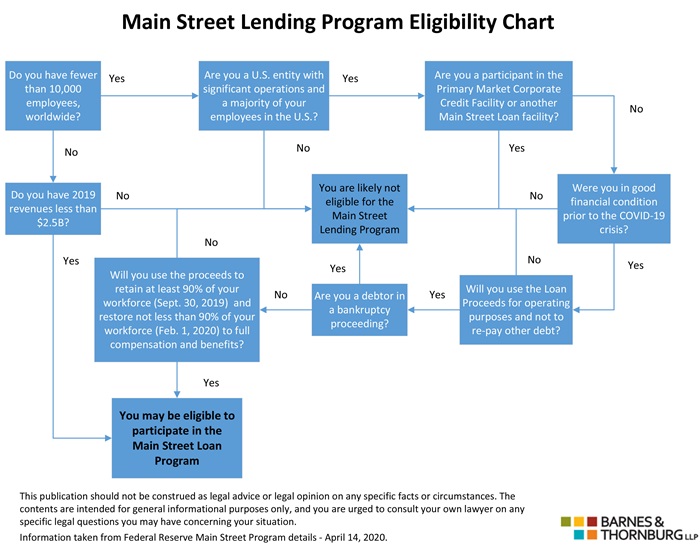

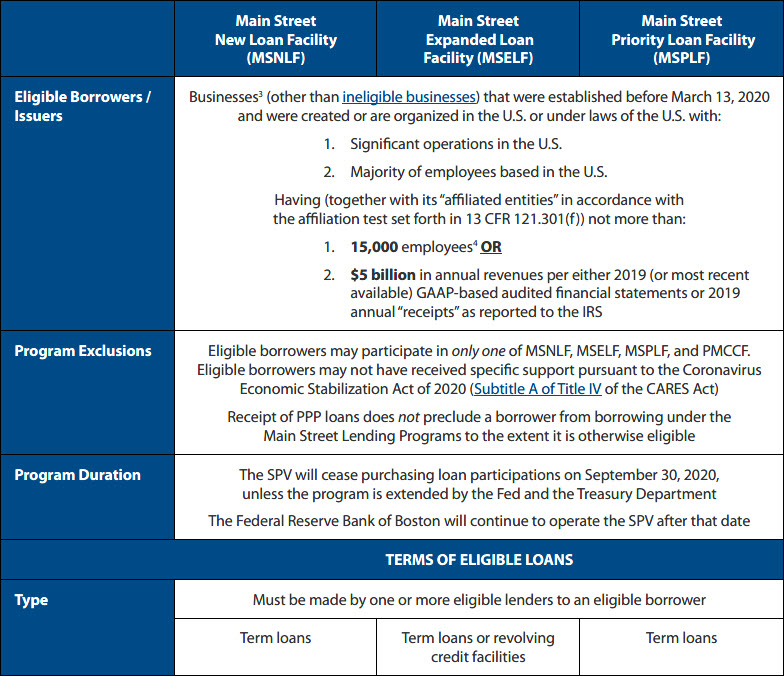

The Main Street Lending Program is next in the Federal Reserves efforts to provide capital to businesses. The Main Street Lending Program was a series of government loan programs from the Federal Reserve for small and midsize businesses struggling during the coronavirus outbreak. To participate in the Program each lender must meet certain eligibility requirements.

It is a great alternative to the Paycheck Protection Program PPP the Economic Injury Disaster Loan EIDL program and the Express Bridge Loan program. Lawmakers business owners and. The program itself consists of three different types of loans referred to as facilities.

The Main Street Lending Program opened to lenders June 15 with the goal of providing credit for small and medium businesses that might not be able to access it during the pandemic. The Federal Reserve Act is intended to facilitate lending to small and medium-sized Businesses by Eligible. The Main Street lending program is a key component of the federal governments response to the economic impact of the COVID-19 pandemic.

The program is designed to help credit flow to medium-sized and small businesses that were in sound financial condition but now need loans to help until they have recovered from or adapted to the impacts of the pandemic. The Federal Reserve established the Main Street Lending Program Program to support lending to small and medium-sized for profit businesses and nonprofit organizations that were in sound financial condition before the onset of the COVID-19 pandemic. Thank you for your interest in the Main Street Lending Program.

The Main Street Lending Program was run by the Federal Reserve System to support small- and medium-sized businesses and nonprofit employers impacted by the COVID-19 pandemic. All loans are made by private financial institutions but backed by the Federal Reserve. 1 The program made.

The Program terminated on January 8 2021. The Main Street Lending Program was designed to support small and medium-sized businesses that are unable to access the Paycheck Protection Program PPP or that require additional financial support after receiving a PPP loan. The adjustments to the Main Street program follow months of talks between Congress and the White House that ultimately failed to deliver more fiscal stimulus.

The Main Street New Loan Program will provide new loan facilities to eligible borrowers and the Main Street Expanded Loan Program will provide eligible borrowers and eligible lenders with loan facilities in place prior to April 8 2020 financing to upsize existing loan facilities by adding a tranche of term loan debt. The Main Street Lending Program offers three different secured or unsecured 5-year term loan options set at an adjustable rate of LIBOR 1 or 3 month plus 300 basis points with principal deferred for two years and interest payments deferred for one year for eligible borrowers. While the PPP and the also newly-created Primary Market Corporate Credit Facility PMCCF are.

The Main Street Priority Loan Facility Facility which has been authorized under section 133 of. Under this program eligible businesses could apply for a new loan or to have more funds added to a current loan through one of five programs. Main Street Lending Program.

Implemented and primarily funded by the Federal Reserve the program is expected to facilitate hundreds of billions of dollars of low-interest loans to a wide range of businesses. Additionally unlike loans given out under the PPP Main Street loans arent forgivable. Main Street Lending Program.

Under the Facility the Main Street New Loan Facility MSNLF and the Main Street Expanded. Unlike Paycheck Protection Program PPP loans Main Street loans are full-recourse loans and are not forgivable. Through the Federal Reserve the Main Street Lending Program will purchase up to 600 billion in loans to small- and mid-sized businesses.

Federal Reserve Expands Main Street Lending Program

Federal Reserve Expands Main Street Lending Program

Guide To The Main Street Lending Program U S Chamber Of Commerce

Guide To The Main Street Lending Program U S Chamber Of Commerce

Money For Main Street Update Fed Releases Revised Main Street Lending Program Guidance And Terms Seyfarth Shaw Llp Jdsupra

Money For Main Street Update Fed Releases Revised Main Street Lending Program Guidance And Terms Seyfarth Shaw Llp Jdsupra

Main Street Lending Program Summary Corporate Securities Law Blog

Main Street Lending Program Summary Corporate Securities Law Blog

.png.aspx) Expansion Of The Main Street Lending Program June 2020

Expansion Of The Main Street Lending Program June 2020

Federal Reserve Main Street Lending For Small And Medium Sized Businesses Essex County Small Business Development Affirmative Action

Federal Reserve Main Street Lending For Small And Medium Sized Businesses Essex County Small Business Development Affirmative Action

Main Street Lending Program Eligibility Requirements

Main Street Lending Program Eligibility Requirements

Federal Reserve Expands Main Street Lending Program Conduit Street

Federal Reserve Expands Main Street Lending Program Conduit Street

Finance Advisory Federal Reserve Revises Main Street Lending Program Adds Third Option News Insights Alston Bird

Finance Advisory Federal Reserve Revises Main Street Lending Program Adds Third Option News Insights Alston Bird

Fed Introduces Main Street Lending Program Authored By Rsm Us Llp Gallagher Flynn Company Llp

Fed Introduces Main Street Lending Program Authored By Rsm Us Llp Gallagher Flynn Company Llp

Main Street Lending Program Harding Shymanski Company P S C

Main Street Lending Program Harding Shymanski Company P S C

Guide To The Main Street Lending Program U S Chamber Of Commerce

Guide To The Main Street Lending Program U S Chamber Of Commerce

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.