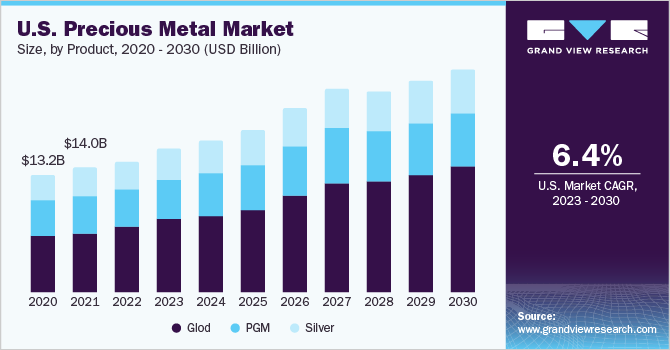

These metals are rare hard less reactive and have high economic value compared to base metals. This section of the report offers a deeper analysis of the latest and future trends of the Precious Metal Catalysts market.

Precious Metal Catalysts Market Growth Trends And Forecast 2020 2025

Global Industry Trends Share Size Growth Opportunity and Forecast 2020-2025 report has been added to ResearchAndMarkets.

Precious metal trends. The rarity of precious metals has traditionally given them a high economic value throughout history. Demand for the product in jewelry application is likely to emerge as an influential factor for the industry growth over the forecast period. Take A Tour Discover The Worlds First Gold Silver Home Business Claim Your FREE Silver Bar.

While we had been seeing some selling as the price rose last autumn on that day we had not expected to be swamped with so many sellers at once and neither our facilities nor our staff were adequate to. These metals possess high luster and are usually ductile. Gold prices silver prices platinum prices and much more.

Precious metals Minor metals Designed to meet the needs of the minor metals communities participants can trade molybdenum and cobalt futures to transfer or take on risk against daily and transparent prices. Platinum has taken a pause down 4 to 1192 and palladium is up 2 to 2721 amidst news that the flooded Russian mine is now coming back online. The global precious metal market size was valued at USD 1821 billion in 2019 and is expected to grow at a compound annual growth rate CAGR of 90 in terms of revenue from 2020 to 2027.

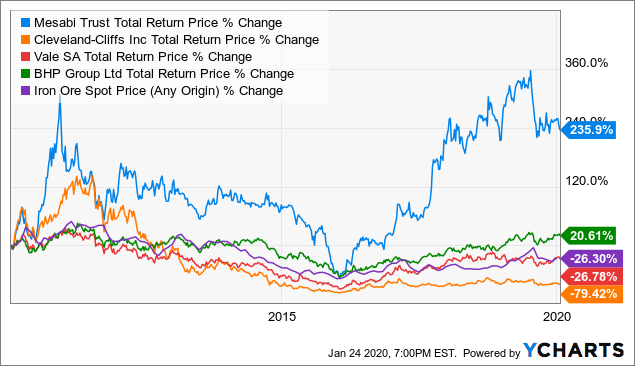

It will likely result in the entire precious metals sector moving higher in some form whereas the leading ETFs Miners and Spot will drive the trends. Precious Metals Patterns Prices in financial and commodity markets exhibit seasonal trends. Interactive access to live precious metal prices and charts.

Precious metals are naturally occurring elements that are characterized by their high luster. The production of the precious metal is estimated to witness a hike of 12 in North America and 1 in South Africa. Some of the best known precious metals are gold silver and coinage metals.

Rhodium output in South Africa is also expected to increase in 2020. Precious metals are naturally occurring and rare metallic elements which tend to have lower reactivity and high lustre. The global Precious Metals market was valued at USD 270140 million in 2019 and it is expected to reach USD 354480 million by the end of 2027 growing at a CAGR of 39 during 2021-2027.

Shifting the focus to silver Josip Heit expects its price to rally by 49 percent in the coming year which will see its price push closer to 19 per ounce with the growth rate for this year being predicted to be 31 percent. All were now offered for sale. Precious metals such as gold silver and platinum are among the most valuable commodities worldwide.

The remaining PGMs rhodium ruthenium osmium and iridium have much smaller markets compared to the main four. Although gold and silver have various industrial applications they are better known for. Buyers of the report will have access to accurate and validated estimates of the total market size in terms of value and volume.

Study on Key Market Trends. The main precious metal utilized by speculators as a trading vehicle. Precious metals are naturally occurring metals that are relatively rare and difficult to find.

They are also ductile malleable resistant to corrosion and good conductors of. The global precious metals market exhibited moderate growth during 2014-2019. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand or the end-of-year rally phenomenon last issue which can be observed almost every year.

According to Heit gold is expected to outperform other precious metals in the space due to higher demand. Why Are Precious Metals Traded. Metals Minute Precious Metals Trends Gold and silver continued their upward trend from last week with gold up 610 to 1752 and silver up 2 to 2552.

Dublin April 09 2021 GLOBE NEWSWIRE -- The Precious Metals Market. Inside those bags were gold bullion and coins platinum bullion and coins precious metal jewellery and precious metal handicrafts. Includes inflation adjusted prices.

The value of the materials is determined by their relative scarcity. The precious metals with active commodities markets include gold silver platinum and palladium. Precious metals are valued for as investments art jewelry and commodities.

A series of current and historical precious metals charts.