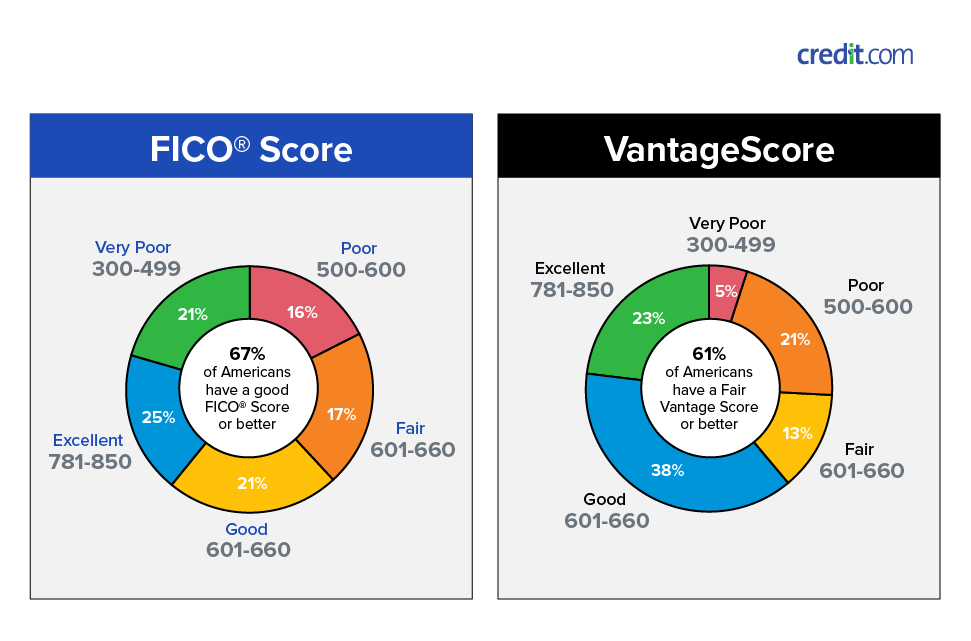

To get the highest credit score possible you will need to improve your standing in each of the major categories. Poor This indicates a poor Equifax credit score.

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Credit Com

Only 39 of people have obtained a copy of their credit report.

What is the best possible credit score. An excellent credit score is good enough You dont need a perfect credit score to get the best deals. But even if you have pretty good credit habits dont be surprised if you check your scores and find that youre below 850. There are however some credit scoring models that go up to 900 or 950 including industry-specific scores used by certain institutions.

Perfect credit scores can. Most credit scoring systems use a scale that ranges from 300 to 850. Make sure you pay at least your minimum payment each month.

For example most lenders consider 800 to 850 to be excellent credit. Additionally you should check your credit report for any errors or suspicious activity. What is a credit score.

466 Excellent This indicates an excellent Equifax credit score. Lenders generally see those with credit scores 670 and up as acceptable or lower-risk borrowers. The best credit score and the highest credit score possible is 850 for both FICO and VantageScore models.

Working your way up to an 850 credit score might sound appealing but it isnt necessary. The highest credit score you can achieve under perfect circumstances is 850 using the FICO. The average credit score is 710 and most Americans have scores between 600 and 750 with 700 considered to be good.

A score of 720 or higher is generally considered excellent. Its a number that credit reference agencies use to gauge how creditworthy a lender may find you. For most credit-scoring models including VantageScore 30 and FICO the highest credit score possible is 850.

Good This indicates a good Equifax credit score. Brad Stevens of Austin Texas and John Ulzheimer of Atlanta. According to some experts CNBC Select spoke to a perfect credit score is not necessary to qualify for the best credit cards loans and interest rates.

Its based on a number of factors including your credit history and whether youre on the electoral registerYour score can go up or down according to your circumstances. Making payments in full and on time can help boost an individuals FICO score. 6 rows The best credit score that you can get is 850.

FICO considers a score between 800 and 850 to be exceptional while VantageScore considers a score above 780 to be excellent. Generally speaking the highest credit score in most consumer credit scoring models is 850 although there are less frequently used scoring models that go as high as 900. In fact reaching a credit score of 760 will.

Find out more on how you compare. But its neither easy to reach to this pinnacle of. The old VantageScore model went as high as 990 but under the new VantageScore 30 the.

Fair This indicates a fair Equifax credit score. For both the VantageScore and base FICO score models the lowest score is 300 and the highest credit score is 850. Scores above 800 are considered excellent while scores of 600 or less suggest bad credit or no credit history.

Those with credit scores from 580 to 669 are generally seen as subprime borrowers meaning they may find it more difficult to qualify for better loan terms. We were able to speak to two Americans who belong to the exclusive FICO 850 Club. Once your score clicks over to the next range you can be offered the available terms for that range.

Very poor This indicates a very poor Equifax credit score. However most lenders divide credit scores into ranges.