Cooper does report mortgage accounts to credit bureaus. Power in 2019 Mr.

Mr Cooper Reports Profit Surge Looks Into Mortgage Servicing Issue National Mortgage News

Mr Cooper Reports Profit Surge Looks Into Mortgage Servicing Issue National Mortgage News

The overall rating of the company is 13 and consumers are mostly dissatisfied.

Does mr cooper report to credit bureaus. It ranked last in the About average grouping earning only 738 out of 1000 points. I sold my home and paid them in full. Nationstar Mortgage ranks 215 of 891 in Loans and Mortgages category.

Creditors and lenders are not required by law to report anything to credit bureaus. NationstarMrCooper did not report my payments to the credit bureau. Your previous servicer is required to forward to us any payments you make to them for 60 days after your transfer date.

Can I report this information to a credit bureau. 1 However many businesses choose to report on-time payments late. Cooper loan officer will call to schedule a closing date and time.

If you negotiate a lower interest rate or reduced repayment the account might also be reported as settled or paid for less than originally agreed which also will hurt your credit scores. Recent recommendations regarding this business are as follows. When you list a creditor in bankruptcy the creditor receives a letter or email notifying them of the bankruptcy.

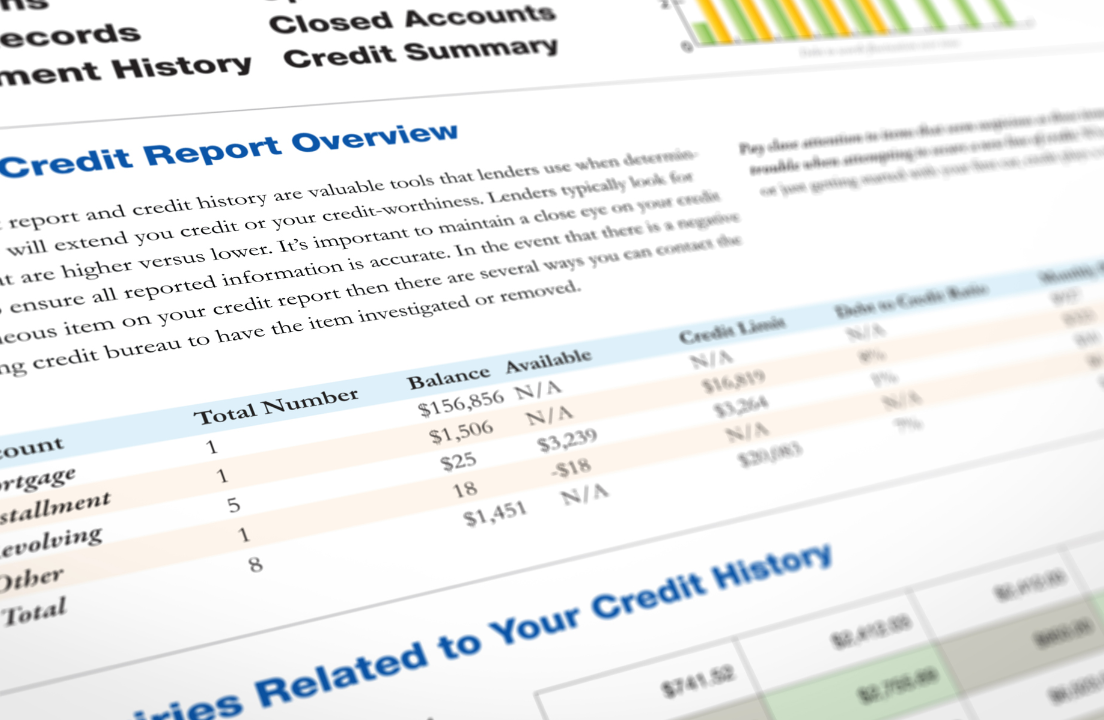

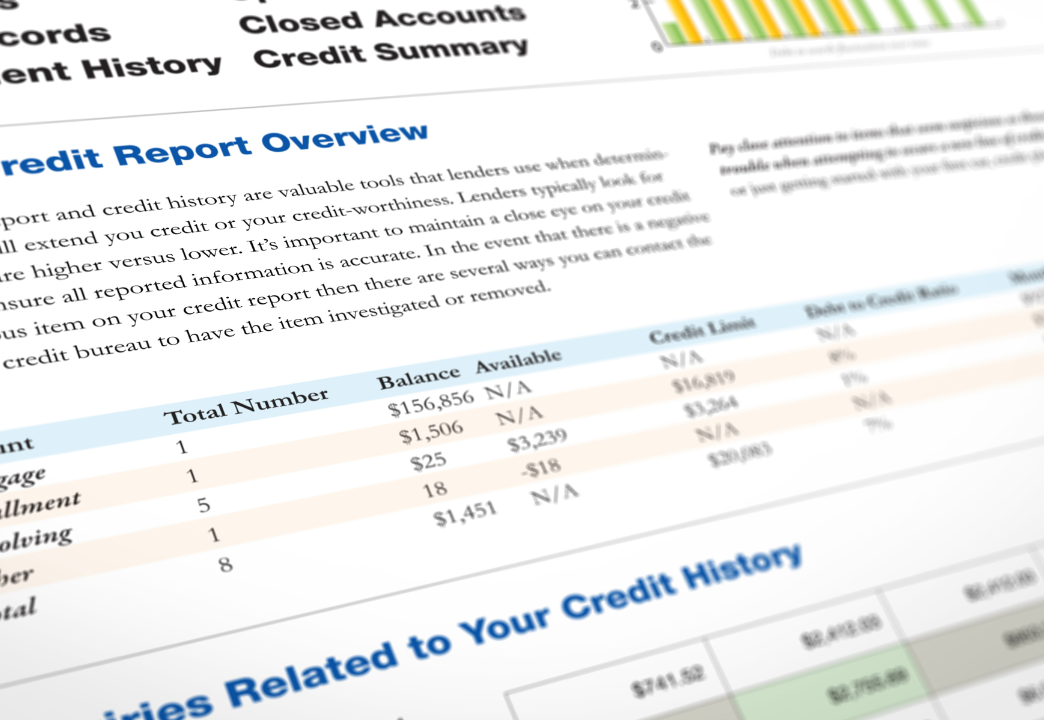

The payment history on your account typically has a significant impact on your credit score. Nationstar Mortgage was first mentioned on PissedConsumer on Sep 20 2010 and since then this brand received 490 reviews. Dear Samantha It is possible to report information to a credit bureau but generally it is not practical unless youre running a larger small business because of the requirements to become a data furnisher to the major credit bureaus.

The most common was related to trouble during the payment process. Although I have made every payment on time for 36 months the previous lates are reported as late 120s as 15 separate entries. Upon approval your Mr.

Cooper reviews and complaints. Nationstar recently rebranded as Mr. After they get this notification the creditors then report to the credit bureaus that the loan was included in bankruptcy Creditors are allowed to do this even if you keep paying the loan.

Has anyone here have any luck in GW lettering to them. Three years ago I was fortunate enough to get a Mortgage Loan Modification from Nationstar now Mr. The Bureau alleges that Nationstar violated.

Cooper covers the latest changes in credit reporting so that homeowners know what changes mean to them as well as why credit scores might have changed. I believe this is capping my FICOs around 630-640. There are no late fees or negative reporting to the credit bureaus during the first 60 days after your transfer.

Nationstar provided the CFPB with a timely response in all instances. Heres what you need to know about credit in the year 2019. Mortgage companies such as Nationstar Mr.

Cooper report to credit bureaus. Cooper agrees to submit updates to credit bureaus requesting change from 30 day markings to Not Report for July 2015 January 2016. Out of the 34 mortgage servicers rated by JD.

In 2020 the Consumer Financial Protection Bureau received 1244 mortgage-related complaints about Nationstar Mr. Beginning September 21 2018 all Americans can freeze their credit reports for free. Credit Freezes are Now Free for Everyone.

Although some lenders begin sending information about your loan to the credit bureaus almost as soon as the ink dries on the closing documents its not uncommon to experience a 30 to 90 day delay in reporting. Cooper came in toward the bottom at 28 for customer satisfaction. And helping lots of lower-credit borrowers can skew a companys average rates higher.

When I got ready to close on my new home nation star reported that I had late payments after 6 months of NOT reporting which has now caused me to be denied on my new home loan. This says Nationstar now Mr. The Bureaus action is part of a coordinated effort between the Bureau a multistate group of state attorneys general and state bank regulators.

Cooper has been accused of wrong-doings by its customers including unfair and deceptive mortgage loan modifications mortgage abuse and fraud illegal debt collection and credit reporting errors. Cooper may be willing to help applicants with credit scores below 600. In addition Mr.

Intentionally allowing a mortgage or any debt to become delinquent will result in the account payments being shown as late in your credit history and your credit scores will suffer. If you only recently obtained your mortgage say within the past one to three months the lender may not have started reporting yet. Once 60 days have passed from your transfer date please be sure your payments are going directly to Mr.

Cooper and Ocwen have been accused of continuing to violate the Fair Credit Reporting Act or FCRA which is a federal law that regulates a consumers credit information and the way mortgage and loan servicing. Today the Consumer Financial Protection Bureau Bureau filed a complaint and proposed stipulated judgment and order against Nationstar Mortgage LLC which does business as Mr.

How To Boost Your Credit Score Before Buying A Home The Mr Cooper Blog

How To Boost Your Credit Score Before Buying A Home The Mr Cooper Blog

Mr Cooper Mortgage Review For 2021 The Mortgage Reports

Mr Cooper Mortgage Review For 2021 The Mortgage Reports

![]() 6 Ways To Protect Your Credit Score During The Pandemic The Mr Cooper Blog

6 Ways To Protect Your Credit Score During The Pandemic The Mr Cooper Blog

Mr Cooper Mortgage Review For 2021 The Mortgage Reports

Mr Cooper Mortgage Review For 2021 The Mortgage Reports

Mr Cooper Mortgage Review 2021 Nerdwallet

Mr Cooper Mortgage Review 2021 Nerdwallet

What Makes Up Your Credit Score The Mr Cooper Blog

What Makes Up Your Credit Score The Mr Cooper Blog

What You Need To Know About Credit In 2019 The Mr Cooper Blog

What You Need To Know About Credit In 2019 The Mr Cooper Blog

Credit Scoring Myths Debunked The Mr Cooper Blog

Credit Scoring Myths Debunked The Mr Cooper Blog

Removing Closed Accounts From Credit Report Bankrate

Removing Closed Accounts From Credit Report Bankrate

Mr Cooper Reviews 228 Reviews Of Mrcooper Com Sitejabber

Mr Cooper Reviews 228 Reviews Of Mrcooper Com Sitejabber

Do Lenders Have To Report To Credit Bureaus

Do Lenders Have To Report To Credit Bureaus

Removing Closed Accounts From Credit Report Bankrate

Removing Closed Accounts From Credit Report Bankrate

Https Oag Ca Gov System Files Breach 20notification 20template 0 Pdf

How Credit Scores Affect Mortgage Applications More The Mr Cooper Blog

How Credit Scores Affect Mortgage Applications More The Mr Cooper Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.