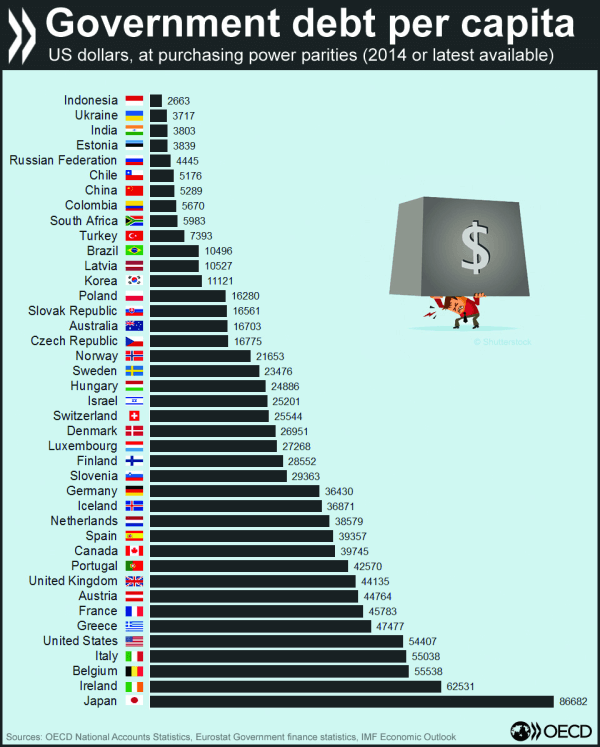

In the table below the. Net Debt Per Capita and Debt Burden.

Towards Sustainable Public Finances Oecd

Towards Sustainable Public Finances Oecd

The United States household debt has continued to rise with economic stress and favorable borrowing conditions accelerating most families debt burden.

Us debt per capita. 93 rijen Debt by Year Compared to Nominal GDP and Events. Hence the legal capacity of borrowing can be estimated by comparing the outstanding debt levels with the current demographic Demographics Demographics refer to the socio. The Five States with the Highest Debt per Capita 1.

Household debt per capita has hit 44054 as of Q1 2021 representing an increase of about 1291 from 2017 Q1s figure of 39011. US Public Debt Per Capita is at a current level of 8139K down from 8140K last month and up from 7045K one year ago. List of countries with respect to external debt Rank CountryRegion External debt US dollars.

Here are the 10 states with the highest debt per capita. Data acquired by Finbold indicates that the US. 2648964 2019 Gross Debt.

The United States owes 183000 per taxpayer. Massachusetts 1114590 Connecticut 1090856 Rhode Island 841478 Alaska 817513 New Jersey 742283 New York 721424 Hawaii 686581 New Hampshire 564017 Vermont 562046 Illinois 491844. Carries 50090 of debt.

Consumer debt is continuing to increase with the main causes being auto loans credit card debt student loans and mortgages. The total debt per capita across the United States is 50090 West Virginia has the lowest total debt per capita at 29430 Federal debt is rising at alarming rates and is expected to reach 92 of the GDP by 2029 US. So thats equivalent to us owing that amount now -- instead of.

In a sense the liability of every taxpayer present and future rises as the national debt grows. 6916219 2019 Gross DebtGDP. On average each person in the US.

According to the nonpartisan Congressional Budget Office CBO the US debt. Dollars over 32 trillion more than a year earlier when it was around 249 trillion US. The United States currently has 125 trillion yes trillion in unfunded liabilities.

The debt obligations place a burden on the countrys taxpayers. So for example if the Japanese wanted to pay off their national debt they would owe 90345 each. One way to think about government debt is in per capita terms.

The United States owes 68400 per citizen. And remember this is adjusted for inflation. In 2016 for example the net debt per capita of the.

Among OECD countries Ireland the US and Italy are next with 62687 61539 and 58693. How much is it per person. 23983 Debt Per Person.

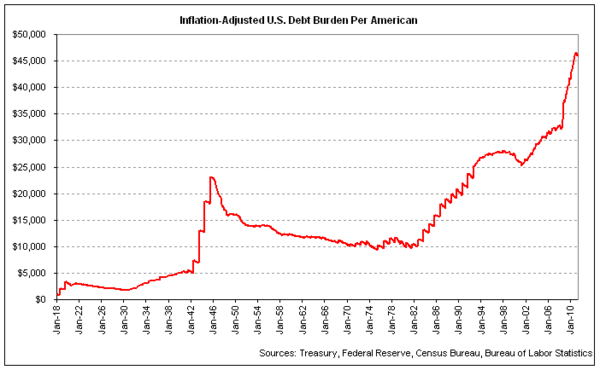

The capital improvement needs can be fairly identified by national governments with political support. 185 rijen Portugal National Debt. Debt per person was just 894 in January 1918.

The District of Columbia has the greatest average per capita debt at 86730 73 percent more than the national average while West Virginia at 29430 is the least 41 percent less than the national level. 2277320 Debt Per Person. According to the data by the end of the fourth quarter of 2019 the debt stood at 42935 representing an all-time high figure.

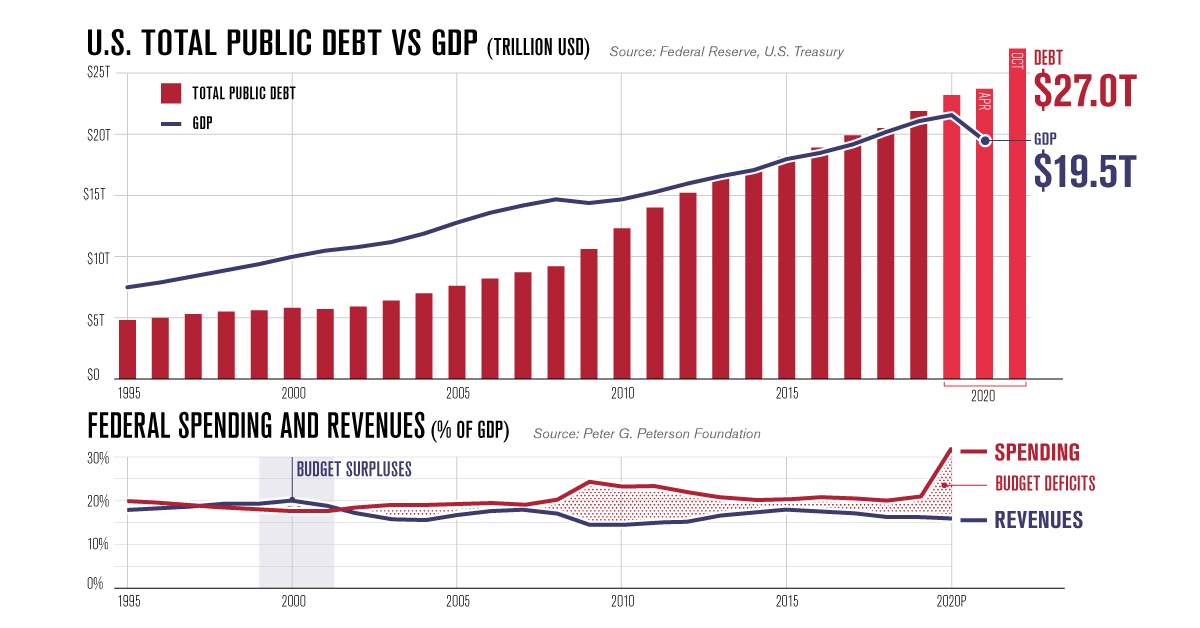

232 billion 264 billion US Italy National Debt. In April 2021 the public debt of the United States was around 2817 trillion US. This is a change of.

This Is How Much Debt Your Country Has Per Person World Economic Forum

This Is How Much Debt Your Country Has Per Person World Economic Forum

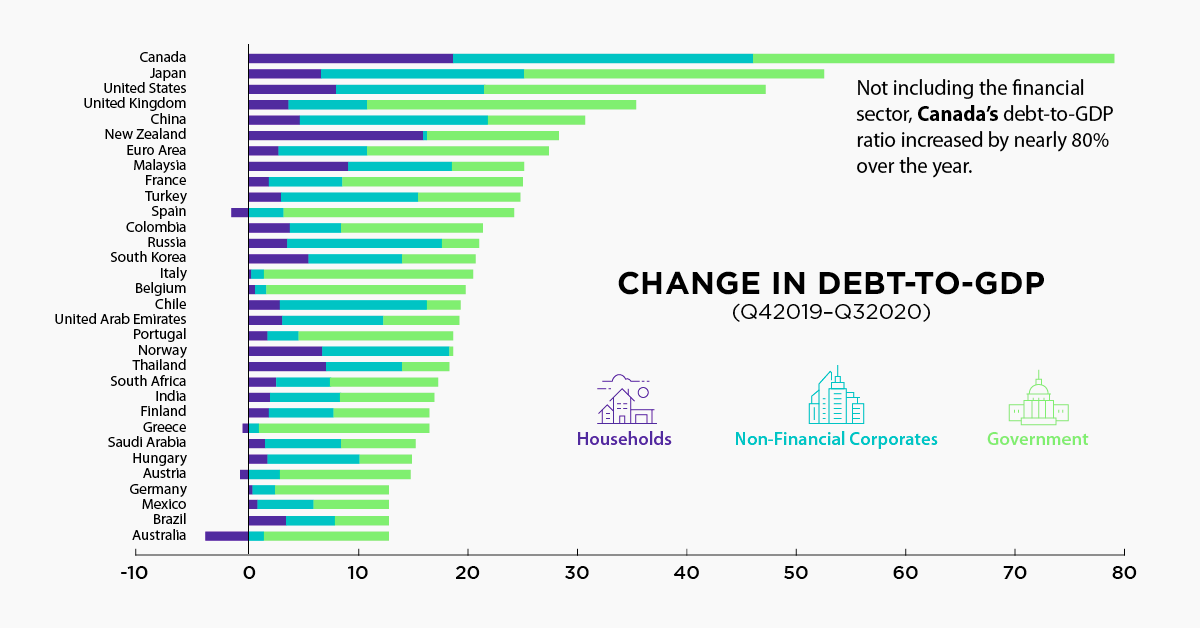

Chart Debt To Gdp Continues To Rise Around The World

Chart Debt To Gdp Continues To Rise Around The World

Charting America S Debt 27 Trillion And Counting

Charting America S Debt 27 Trillion And Counting

Us Debt Compared To Personal Income

The U S Debt Owed By Each American Throughout History The Atlantic

The U S Debt Owed By Each American Throughout History The Atlantic

Per Capita U S State And Local Government Debt Outstanding 2017 By State Statista

Per Capita U S State And Local Government Debt Outstanding 2017 By State Statista

Crushing Unrepayable U S National Debt Per Person Perspectives

Crushing Unrepayable U S National Debt Per Person Perspectives

The U S National Debt Burden Per Capita Mygovcost Government Cost Calculator

The U S National Debt Burden Per Capita Mygovcost Government Cost Calculator

Visualizing Your Country S Unsustainable Debt Per Person

Visualizing Your Country S Unsustainable Debt Per Person

National Debt Of The United States Wikipedia

National Debt Of The United States Wikipedia

National Debt Of The United States Wikipedia

National Debt Of The United States Wikipedia

The U S National Debt Burden Per Capita Mygovcost Government Cost Calculator

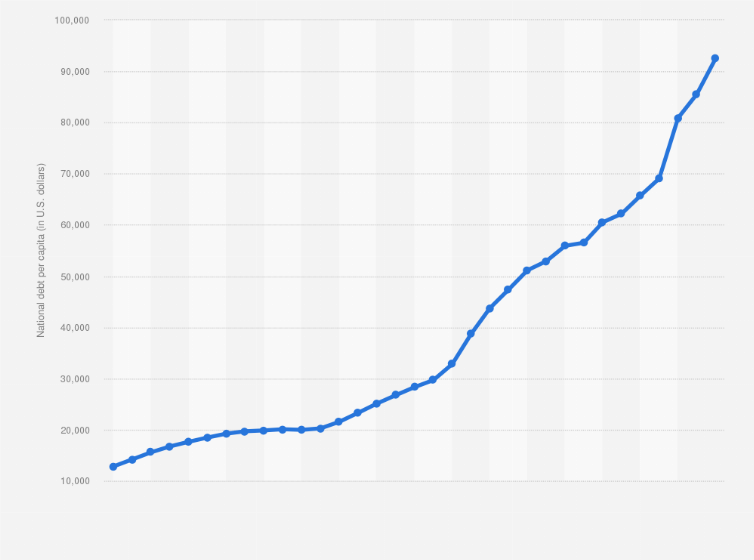

U S National Debt Per Capita Statista

U S National Debt Per Capita Statista

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.