Create your own screens with over 150 different screening criteria. Implied volatility is the markets prediction of how volatile the stock will be in the future or the expected volatility of a stock.

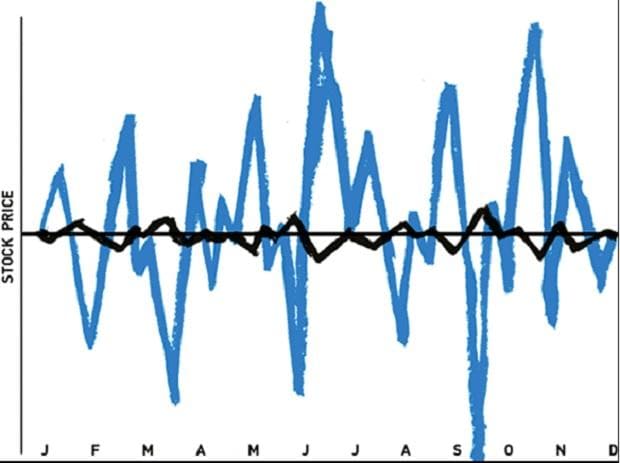

All stocks have some level of volatility.

High implied volatility stocks. If you want to buy those options strike price 50 the market is 255 to 275 fair value is 264 based on that 55 volatility. Implied volatility is often used to price options contracts. Stocks listed on the Dow Jones are value-stocks so a lot of movement is not expected thus they have a lower implied volatility.

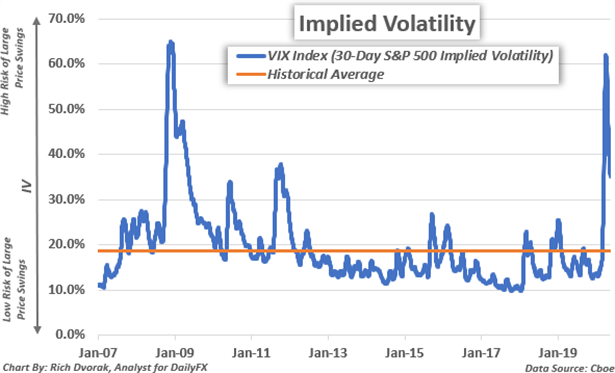

High volatility refers to drastic swings in value while low volatility refers to smaller swings over time. High implied volatility results in options with higher premiums and vice versa. 103 rows The most volatile stocks have a higher beta.

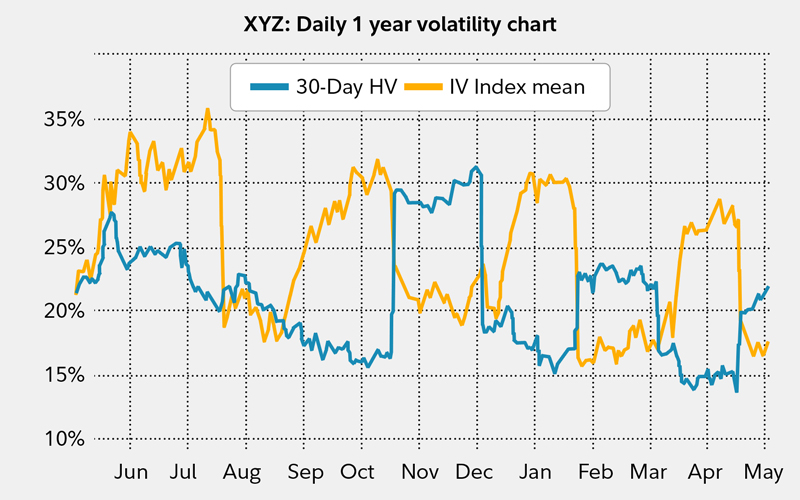

It is an important factor to consider when understanding how an option is priced as it can help traders determine if an option is fairly valued undervalued or overvalued. Writing High Implied Volatility This position is put on when 1 implied volatility is high but 2 the stock is not especially volatile. You will see higher-priced option premiums on options with high volatility.

23 rows See a list of Highest Implied Volatility using the Yahoo Finance screener. High Implied Volatility Call Options 27052021. In financial mathematics the implied volatility of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model will return a theoretical value equal to the current market price of said option.

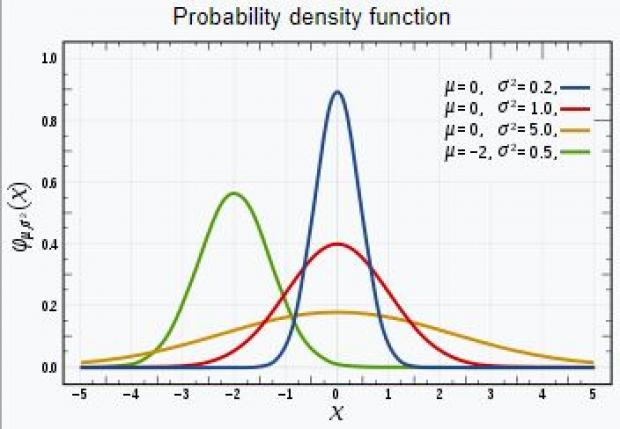

This can show the list of option contract carries very high and low implied volatility. Implied volatility has many implications and relationships that should be grasped. Implied volatility is a theoretical value that measures the expected volatility of the underlying stock over the period of the option.

You will see higher. Implied volatility is a statistical measurement that attempts to predict how much a stock price will move in the coming year. The customary implied volatility for these options is 30 to 33 but right now buying demand is high and the IV is pumped 55.

The Implied Volatility Options Package is designed for investors and analysts who need implied volatility predictions for options trading. It can help trader to find the strike to buy or sell. It includes 20 stocks with high implied volatility and indicates the best options to buy and sell.

The higher the implied volatility the more people think the stocks price will move. Right now for example the Microsoft 100 call option that expires in about a month has an IV of 34. Microsoft stock is currently trading at 100 per share.

Implied volatility is relative to itself mostly. Implied volatility is directly influenced by the supply and demand of the underlying options and by the markets expectation of the share prices direction. Growth stocks or small caps found on the Russell 2000 conversely are expected to move around a lot so they carry a higher implied volatility.

As noted in the previous chapter this happens because an impending event causes IV to spike well above historical volatility. 6 rows Stock Option Screener with High Implied Volatility for near next far month - NSE. Stocks with high volatility are especially risky for investors close to retirement age due to the possibility of quickly losing money combined with a lack of time to recover any losses.

Supplydemand and time value are major determining. And traders look to write options when implied volatility is high as option premiums tend to be higher in hopes of seeing the underlying stock move in a favorable direction to hisher position. Stocks With High Implied Volatility.

Its expressed as a percentage. On the other hand implied volatility decreases with a lesser demand and when the underlying stock has a negative outlook. Companies with a high.

Before we start scanning for stocks with high implied volatility IV lets make sure that we have a really solid understanding of exactly what IV is. Implied volatility rises when the demand for an option increases and when the markets expectations for the underlying stock is positive. A better way to look at IV is through the lens of IV Rank which helps you understand if the current level is high or low relative to the usual behavior of the stock you are observing.

Implied volatility Top 10 put. As expectations rise or as the demand. The higher the IV rank the wider the expected range of the underlying stock movement becomes.

Implied volatility Top 10 call options.

Stocks With High Implied Volatility Based On Deep Learning Returns Up To 16 41 In 3 Days

Stocks With High Implied Volatility Based On Deep Learning Returns Up To 16 41 In 3 Days

5 Must See Studies That Explain The Importance Of Implied Volatility Tastytrade Blog

How To Explain Implied Volatility To A Layman Quora

Stocks With High Implied Volatility Based On Ai Returns Up To 112 97 In 1 Month

Stocks With High Implied Volatility Based On Ai Returns Up To 112 97 In 1 Month

Best Ways To Scan For Stocks With High Implied Volatility

Best Ways To Scan For Stocks With High Implied Volatility

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png) Implied Volatility Buy Low And Sell High

Implied Volatility Buy Low And Sell High

Implied Volatility What It Is Why Traders Should Care

Implied Volatility What It Is Why Traders Should Care

How To Measure And Interpret Implied Volatility For Trading Options Business Standard News

How To Measure And Interpret Implied Volatility For Trading Options Business Standard News

Implied Volatility Revisited The Skew Investing Com

Implied Volatility Revisited The Skew Investing Com

Managing Winning Trades For High Implied Volatility Stocks The Blue Collar Investor

Managing Winning Trades For High Implied Volatility Stocks The Blue Collar Investor

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png) Implied Volatility Buy Low And Sell High

Implied Volatility Buy Low And Sell High

Implied Volatility Explained Best Guide W Examples Projectoption

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png) Implied Volatility Buy Low And Sell High

Implied Volatility Buy Low And Sell High

What Is Implied Volatility Ally

What Is Implied Volatility Ally

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.