Denison Customers who hold these Municipal Bonds and does not represent our current inventory of available Bonds. 396--After Taxes on Distributions.

Rx For High Salt Investors Municipal Bonds Envestnet Institute

Rx For High Salt Investors Municipal Bonds Envestnet Institute

HighMark Wisconsin Tax-Exempt Fiduciary WTEFX Nuveen.

Wisconsin municipal bonds. General obligation bonds authorized to fund the Zoo interchange I 94 north-south corridor and high-cost state highway bridge projects Sec. Due to a recent change in ownership Neighborly will be closing and has filed for withdrawal from the Financial Industry Regulatory Authority FINRA which will be effective on or about December 27 2019. The agencys bonds have been the subject of 10 of the 105 reports of impairment in the municipal market so far this year according to research firm Municipal Market Analytics by far the.

Bonds with double tax exempt status in the State of Wisconsinfor Wisconsin residents only are shaded in yellow. The revised issue price is par for a bond originally issued at a price greater than or equal to par. The Fund seeks a high level of current interest income exempt from regular federal state and in some cases.

However interest earned on specific state and municipal bond obligations is exempt from Wisconsin and federal income tax. Barclays is the lead underwriter for a bond issue scheduled to be sold through the Public Finance Authority an agency in Wisconsin set up to rent its access to the municipal-debt market. This means that offerings of municipal.

Nuveen Wisconsin Municipal Bond Fund Class A since 112011 Nuveen Kansas Municipal Bond Fund Class C2 since 112011 Nuveen Wisconsin Municipal Bond Fund Class I since 112011 SPDR Nuveen Bloomberg Barclays Municipal Bond ETF since 412010 Nuveen Louisiana Municipal Bond Fund Class C2 since 112011. Wells Fargo Advantage WI Tax-Free A WWTFX Wells Fargo Advantage WI Tax-Free C WWTCX. Nuveen Wisconsin Municipal Bond Fund has an expense ratio of 093 percent.

Wisconsin Double Tax Exempt Municipal Bond Information FOR WISCONSIN RESIDENTS ONLY This information is provided to current H. Real-time data on all CUSIPs the latest muni bond news the ins and outs of bond investing and track your municipal bond portfolio at the Premier site for Municpal bond investors. 271 Zeilen What are municipal bonds.

If you purchase a municipal bond in the secondary market at a market discount to the revised issue price you will have to pay tax on the difference when the bond is redeemed. Municipal bonds may still be purchased by retirement and tax-exempt accounts if they are determined to be appropriate despite the fact that the tax exemption will not apply. Generally interest earned on state and municipal bond obligations is subject to Wisconsin income tax and should be included as an addition to federal adjusted gross income on your Wisconsin income tax return.

Such transaction data andor related information may not exist for all municipal securities and may not be required to be submitted to the MSRB for certain types of municipal. BOLD RED TEXT is Fed Taxable but Wisconsin. 174 Zeilen Wisconsin Double Tax Exempt Municipal Bond Information.

Nuveen Wisconsin Municipal Bond Fund is an open-end fund incorporated in the USA. Fees are Below Average compared to funds in the same category. The Key Benefit of Municipal Bonds.

Muni Single State Long. Nuveen Wisconsin Municipal Bond Fund Class A. 334 484 1537 - Act 20 Highway project design inventory.

Information About Municipal Bonds Municipal bonds are exempt securities under the Securities Act of 1933. The transaction data provided through the Real-Time Transaction Subscription Service represents municipal securities transaction data made available by brokers dealers and municipal securities dealers to the MSRB and related information. Nuveen Wisconsin Municipal Bond Fund Class A Load Adjusted-075.

The Series 2018-D Bonds Community Bonds Olbrich Botanical Gardens Expansion were issued by the City on November 7 2018 and were underwritten by Neighborly Securities Neighborly. 1517 - Act 20. Nuveen WI Municipal Bond A FWIAX Nuveen WI Municipal Bond B FWIBX Nuveen WI Municipal Bond C FWICX Nuveen WI Municipal Bond I FWIRX Wells Fargo Advantage.

Estimated costs requirement reduced Sec. For a bond issued below par an original issue discount bond the revised issue price will be the original price plus the accredited.

Muni Bonds Safe Haven Investing Money Answers Resources For Personal Finance

Muni Bonds Safe Haven Investing Money Answers Resources For Personal Finance

How To Buy Municipal Bonds Thestreet

How To Buy Municipal Bonds Thestreet

Https Www Lwm Info Org Documentcenter View 1491 17 7 Payment Security And Finance

The Definitive Resource For Wisconsin Municipal Bonds

The Definitive Resource For Wisconsin Municipal Bonds

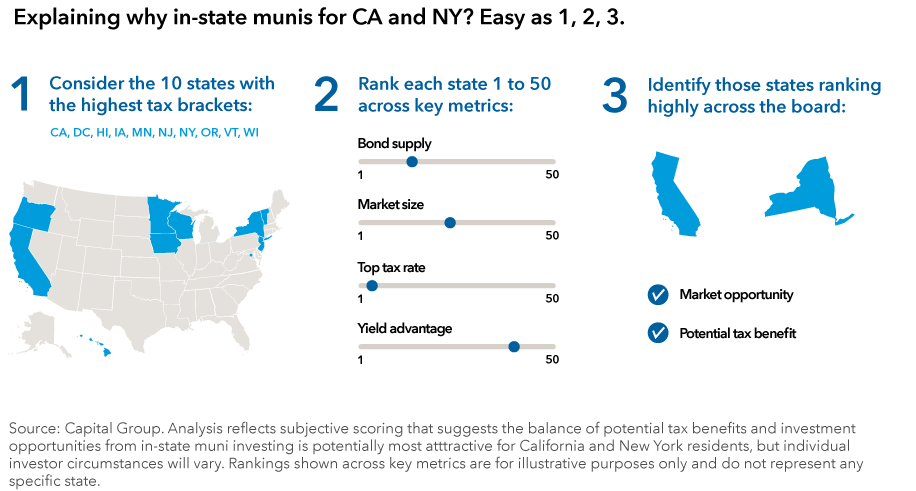

Muni Mania Why Municipal Bonds Are Breaking Records In 2019 Capital Group

Muni Mania Why Municipal Bonds Are Breaking Records In 2019 Capital Group

Taxfreeincome Bkm Wealth Management Brookfield Wi

Taxfreeincome Bkm Wealth Management Brookfield Wi

Investing In Municipal Bonds How To Balance Risk And Reward For Success In Today S Bond Market In Apple Books

Investing In Municipal Bonds How To Balance Risk And Reward For Success In Today S Bond Market In Apple Books

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

Fwiax Nuveen Wisconsin Municipal Bond Fund Class A Portfolio Holdings 13f 13g

Fwiax Nuveen Wisconsin Municipal Bond Fund Class A Portfolio Holdings 13f 13g

Primary Sees Taxable Pobs Out Of Cal Green Bonds From Wisconsin While Secondary Feels Pressure Bond Buyer

Primary Sees Taxable Pobs Out Of Cal Green Bonds From Wisconsin While Secondary Feels Pressure Bond Buyer

What Are Municipal Bonds The Motley Fool

What Are Municipal Bonds The Motley Fool

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.