Large international banks began using internal stress tests in the early 1990s. A bank stress test is a simulation or analysis conducted to analyze how a bank will be impacted under adverse market conditions for example a financial market crash or recession Recession Recession is a term used to signify a slowdown in general economic activity.

Synpulse The Magazine Synpulse Magazine

Synpulse The Magazine Synpulse Magazine

The ECB conducts several types of stress test.

Bank stress test. Putting adequate stress-testing in place to manage liquidity risk. Describes stress tests as a quantitative what if exercise to estimate the resilience of banks or the financial systems as a whole if certain shocks were to materialise. Following the postponement of the 2020 exercise due to the COVID-19 pandemic this years EU-wide stress test will provide valuable input for assessing the resilience of the European banking sector.

Types of banking stress test. A bank stress test is a simulation based on an examination of the balance sheet of that institution. In the early 1990s stress tests became a popular internal tool for international banks to examine risks and gain a better understanding of threats to the institutions balance sheet.

Stress testing helps gauge investment risk. From there the Basel Accord was amended in the mid- 90s and required banks and investment firms to conduct stress tests. A bank stress test is an exercise that helps bank managers and regulators understand a banks financial strength.

The European Banking Authority EBA launched today the 2021 EU-wide stress test and released the macroeconomic scenarios. Stress test results depend on how pessimistic the scenarios assumptions are and should be interpreted in light of the assumptions made. Federal Reserve announces temporary and additional restrictions on bank holding company dividends and share repurchases currently in place will end for most firms after June 30 based on results from upcoming stress test.

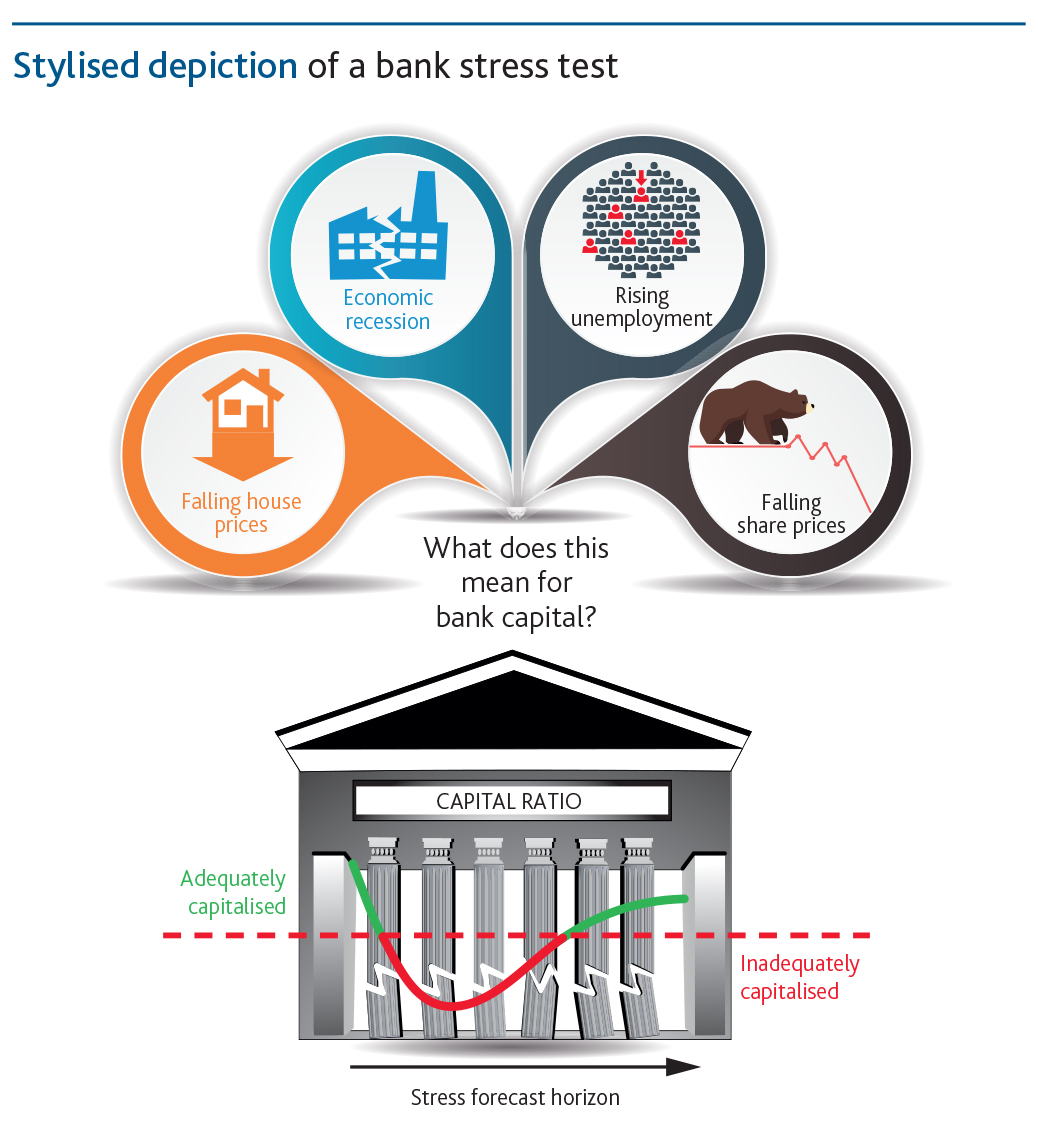

Banking stress tests assess how banks can cope with severe economic scenarios. A bank stress tests is an analysis of a banks ability to endure a hypothetical adverse economic scenario. The European Banking Authority EBA launched today the 2021 EU-wide stress test and released the macroeconomic scenarios.

European Banking Supervision uses stress tests to assess how well banks are able to cope with financial and economic shocks. And 2 stress tests that focus. Bank stress testing is a framework for analyzing the financial impact of unfavorable economic scenarios to ensure that banks have sufficient capital to.

In general there are two types of tests. Fed stress tests predict European banks high rate of loan losses Forecast adds more pressure on regions financial institutions to reduce US presence Save. Stress test results help supervisors identify banks vulnerabilities and address them early on in the supervisory dialogue with banks.

There are three types of banking stress test. Following the postponement of the 2020 exercise due to the COVID-19 pandemic this years EU-wide stress test will provide valuable input for assessing the resilience of the European banking sector. Stress testing is a computer-simulated technique to analyze how banks and investment portfolios fare in drastic economic scenarios.

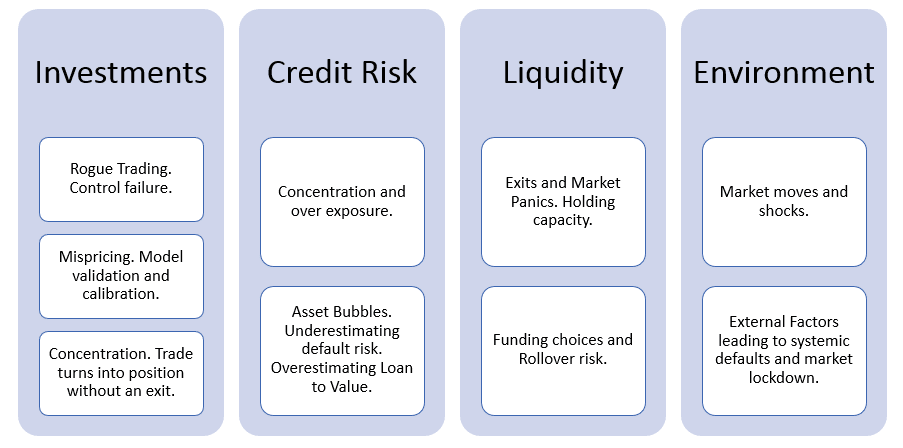

Types of stress tests. Liquidity and liquidity risk. Liquidity is a banks ability to raise funds and meet its commitments as a nd when they fall due without incurring unacceptable losses The second half of this definition is relatively new and comes on top of the internal control regulations.

1 system - wide stress tests conducted by central banks andor supervisory agencies. The Federal Reserve on Thursday released the initial results of its annual bank stress tests in which it puts bank holding companies through various adverse economic scenarios to see if their. Dodd-Frank Act Stress Tests.

We look at banks resilience making sure they have enough capital to withstand extreme shocks and are able to support the economy. The Banks approach to concurrent solvency stress testing aims to use periods when the economy is growing to build up banks buffers of capital ready to be drawn on to support the economy in a stress. In 1996 the Basel Capital Accord was amended to require banks and investment firms to conduct stress tests to determine their ability to respond to market events.

To complete the test banks run what-if scenarios to determine if they have sufficient assets to survive during periods of economic stress. The exercise evaluates the resilience of large banks by estimating their loan losses and capital levelswhich provide a cushion against lossesunder hypothetical recession scenarios that extend nine quarters into the future. The Boards stress tests help ensure that large banks are able to lend to households and businesses even in a severe recession.

Stress testing of banks. In 2012 an adverse scenario used in stress testing was. Stress tests are meant to find weak spots in the banking system at an early stage and to guide preventive actions by banks and those charged with their oversight.

Stress tests became widely used after the 2008 financial crisis. For example in the US.

How Coronavirus Could Alter Fed S Thinking About Stress Tests American Banker

How Coronavirus Could Alter Fed S Thinking About Stress Tests American Banker

What Is A Bank Stress Test Definition And Meaning Market Business News

What Is A Bank Stress Test Definition And Meaning Market Business News

Mercer Capital S Stress Testing Services Mercer Capital

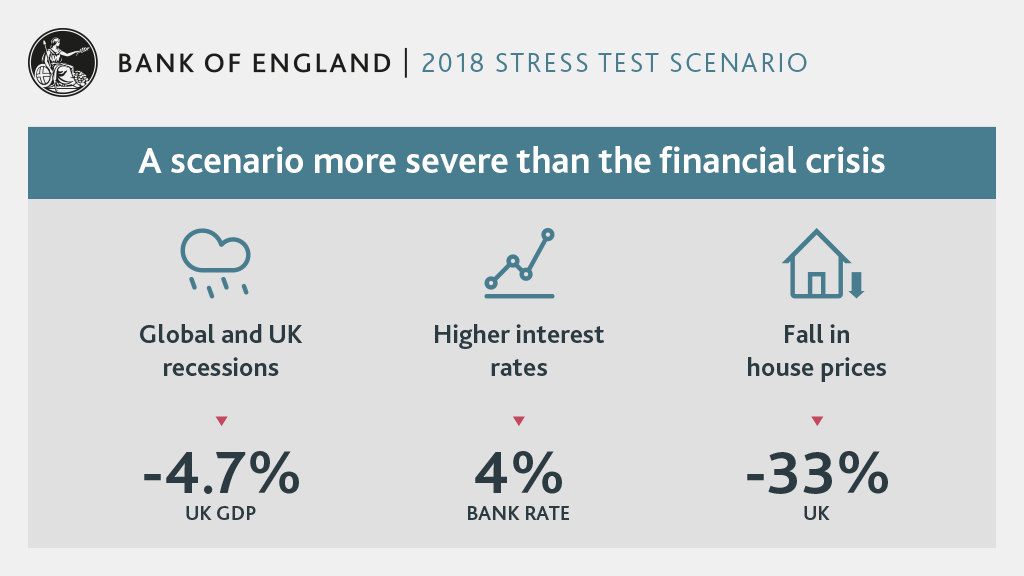

Key Elements Of The 2018 Stress Test Bank Of England

Key Elements Of The 2018 Stress Test Bank Of England

Eu Wide Stress Testing 2018 European Banking Authority

Eu Wide Stress Testing 2018 European Banking Authority

The Evolution Of Bank Stress Test Financetrainingcourse Com

The Evolution Of Bank Stress Test Financetrainingcourse Com

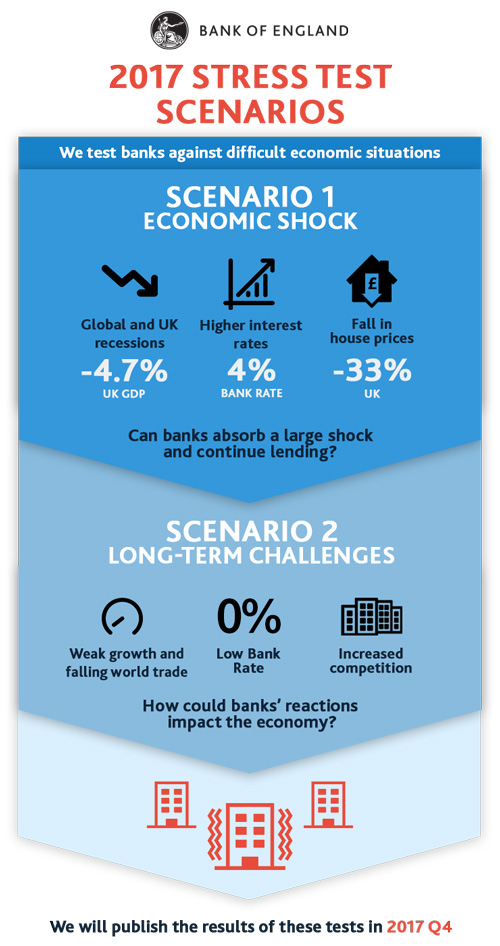

2017 Stress Test Scenarios Explained Bank Of England

2017 Stress Test Scenarios Explained Bank Of England

Bank Stress Testing Guide For Board Members

Bank Stress Testing Guide For Board Members

European Banking Authority Releases 2014 Bank Stress Test Scenarios Wsj

European Banking Authority Releases 2014 Bank Stress Test Scenarios Wsj

Stress Testing Of Banks An Introduction Bank Of England

Stress Testing Of Banks An Introduction Bank Of England

Stress Testing And Capital Planning The Federal Reserve S Approach Youtube

Stress Testing And Capital Planning The Federal Reserve S Approach Youtube

Climate Risks To European Banks A New Era Of Stress Tests Bruegel

Climate Risks To European Banks A New Era Of Stress Tests Bruegel

Fed Freezes Stock Buybacks Caps Dividends After Stress Test Results American Banker

Fed Freezes Stock Buybacks Caps Dividends After Stress Test Results American Banker

Stress Test Results Banks Face 75b Capital Shortfall May 7 2009

Stress Test Results Banks Face 75b Capital Shortfall May 7 2009

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.