The question of whether New York would consider employees who are working remotely due to the pandemic as doing so for convenience or necessity has been vexing. Nattys Caribbean Cuisine Pizzeria.

Your support ID is.

New york department of taxation. Silberberg and Robert G. Use Zip Code 12210 to locate the Albany Office. New York State Department of Taxation and Finance March 23 The Tax Department has extended the due date for New York State personal income tax returns originally due on April 15 2021 to May 17 2021.

The Department of Finance DOF administers business income and excise taxes. Vedi altri contenuti di New York State Department of Taxation and Finance su Facebook. Department of State Albany Location.

New York State Department of Taxation and Finance et al Respondents. Dorsey Whitney New York City Richard H. Department of State New York City Location.

Court of Appeals of the State of New York. DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. Argued September 7 1993.

A key department focus is the balance of efforts to promote voluntary compliance - the cornerstone of New York States system of taxation - with the duty to enforce New Yorks tax laws. Your support ID is. Please enable JavaScript to view the page content.

Decided October 19 1993. 123 William Street New York. The Department of Taxation and Finance Department collects tax revenue and provides associated services in support of government operations in New York State.

See Tax Department response to novel coronavirus COVID-19 to view guidance and stay up to date. New York residents must file Form IT-370 with the Department of Taxation and Finance by May 17. Filers that do not pay taxes by May 17 may owe interest on both state and federal taxes.

One Commerce Plaza 99 Washington Ave. In regard to real property taxes the department oversees the administration of more than 50 billion annually and works directly with nearly 1000 local governments. We will update this page as new information becomes available.

The New York State Department of Taxation and Finance recently updated their New York State tax implications of recent federal COVID relief webpage adding the following FAQ to their list of Frequently Asked Questions about how the State will treat specific relief provisions for tax. Please enable JavaScript to view the page content. In fulfilling its responsibilities the Department collects and accounts for almost 60 billion in State taxes.

Tax Department that they are registered to collect New York State and local sales and compensating use taxes if they made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of 300000 measured over a specified period. The Tax Department has extended the due date for New York State personal income tax returns originally due on April 15 2021 to May 17 2021. New York State Department of Motor Vehicles.

Apply for a Certificate of Authority for your business to start making taxable sales in New York State. Without notice or fanfare the New York Department of Taxation updated guidance on its website to address the application of its convenience of the employer rule to COVID-19 telecommuters. Quarterly withholding tax returns Forms NYS-45 and NYS-45-ATT are due Friday April 30 2021.

New York State Department of Taxation and Finance Withholding tax filers. Vedi altri contenuti di New York State Department of Taxation and Finance su Facebook. New York State Department of Taxation and Finance Agency New York State Department of Taxation and Finance collects tax revenues in support of State services and programs while administering the tax laws of New York State.

Non ricordi più come accedere allaccount. Non ricordi più come accedere allaccount. State Office Campus Albany NY 12227.

NYS Tax Refund discussion. NYSDOH - New York State Health Department. Manson of counsel and Simon Uncyk Borenkind New York City Eli Uncyk of counsel for appellant.

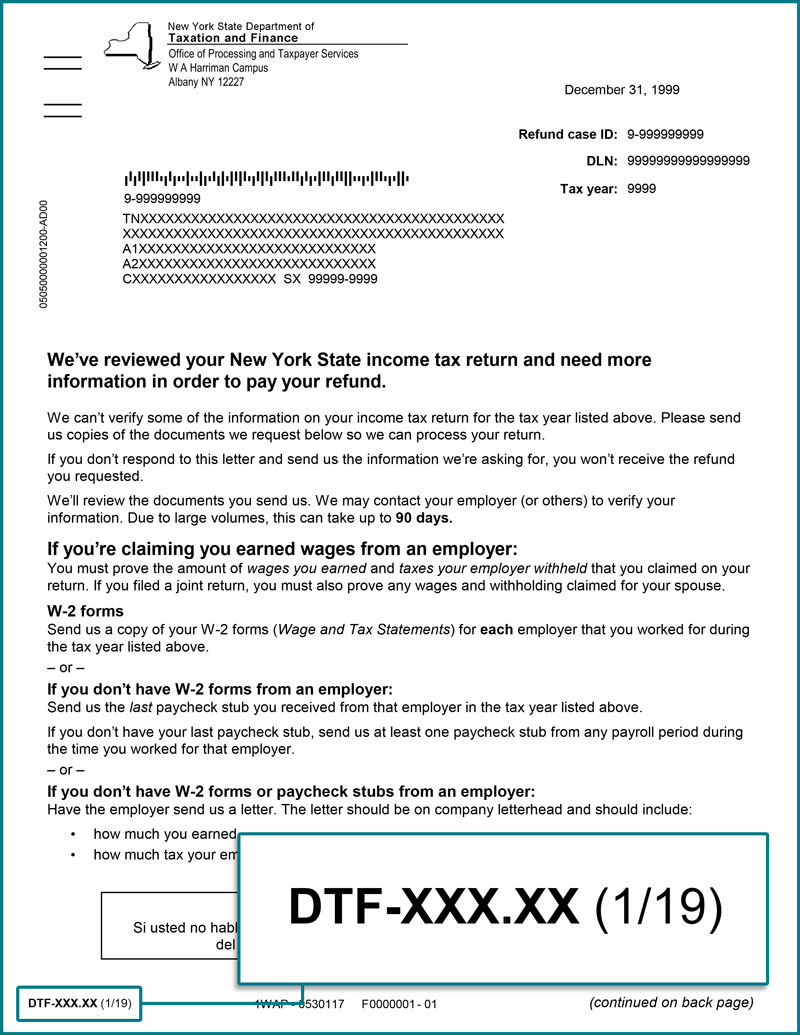

Respond To A Letter Requesting Additional Information

Respond To A Letter Requesting Additional Information

Https Www Tax Ny Gov Pdf Enforcement Delinquent Taxpayers Businesses Pdf

Ny Department Of Taxation Employee Benefits And Perks Glassdoor

Ny Department Of Taxation Employee Benefits And Perks Glassdoor

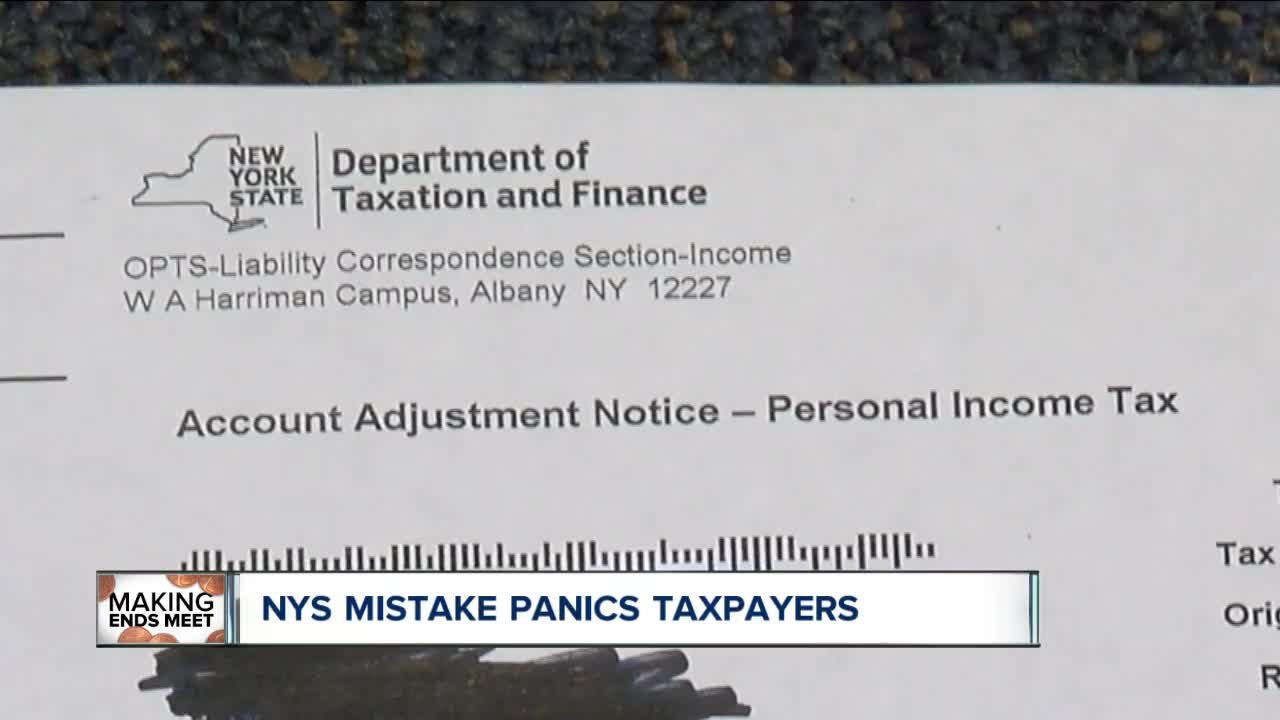

New York State Mistake Panics Taxpayers

New York State Mistake Panics Taxpayers

Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com

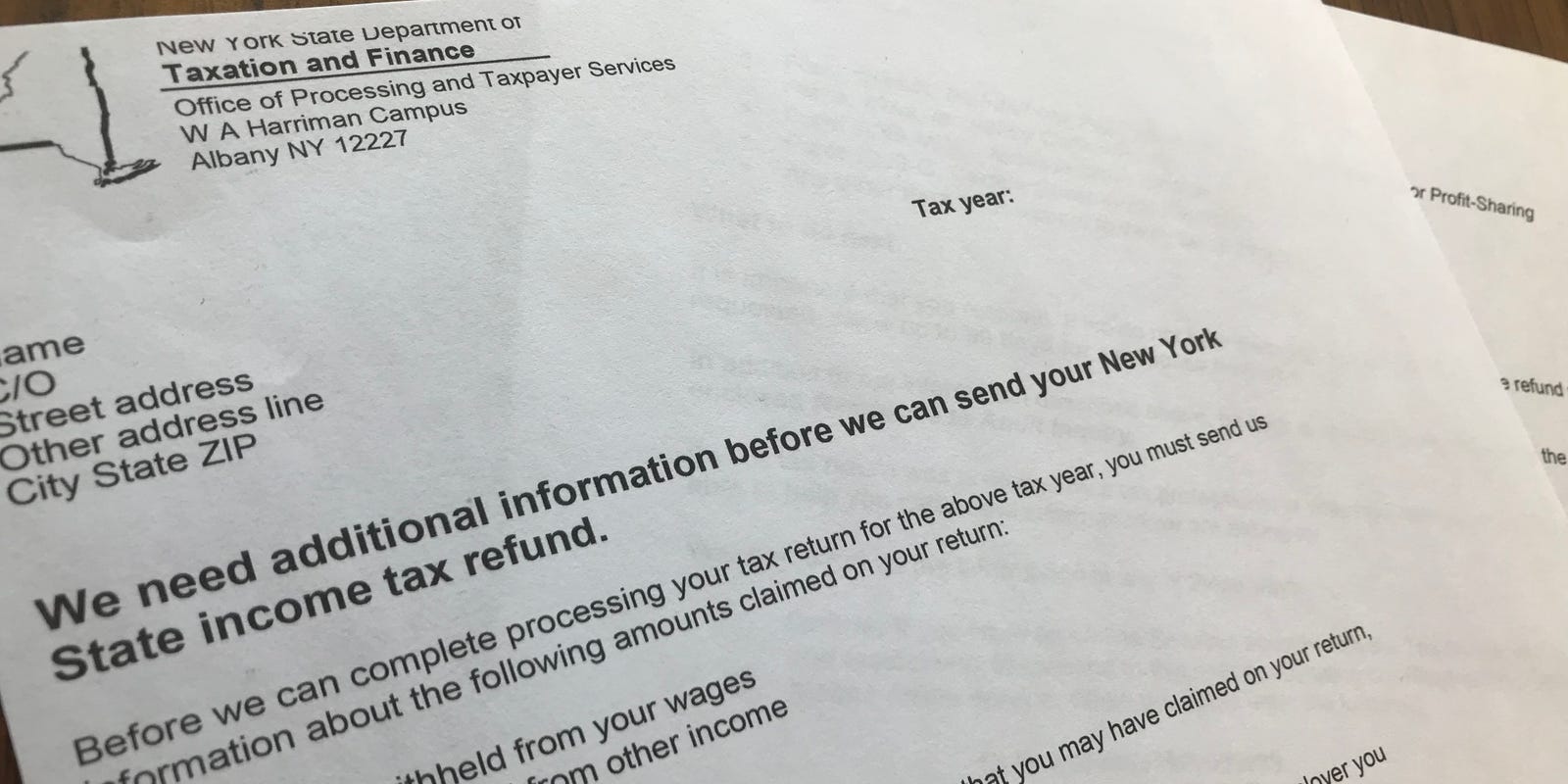

Get An Nys Tax Dept Letter Don T Throw It Out Or You Might Delay Your Refund

Get An Nys Tax Dept Letter Don T Throw It Out Or You Might Delay Your Refund

New York State Agrees To Waive Fines For Businesses That Miss Sales Tax Deadline Syracuse Com

New York State Agrees To Waive Fines For Businesses That Miss Sales Tax Deadline Syracuse Com

Didn T Get A 350 Check But Should Have Here S How To Air Your Grievances

Didn T Get A 350 Check But Should Have Here S How To Air Your Grievances

New York State Tax Department Warns Of New Scam Letter Newsday

New York State Tax Department Warns Of New Scam Letter Newsday

New York State Department Of Taxation And Finance Wikipedia

New York State Department Of Taxation And Finance Wikipedia

The Wandering Tax Pro What S New For 2018 Tax Forms New York

The Wandering Tax Pro What S New For 2018 Tax Forms New York

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.