A mutual fund often just called a fund is a pool of investors money used to buy assets such as stocks bonds gold and sometimes cash. The four main types of private investors a.

Both provide opportunity for returns on your investment but the primary difference is that if you choose a publically traded company you would be required to purchase stocks and shares from that company but for private companies you would need to go into contract.

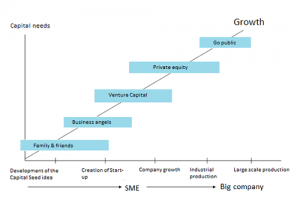

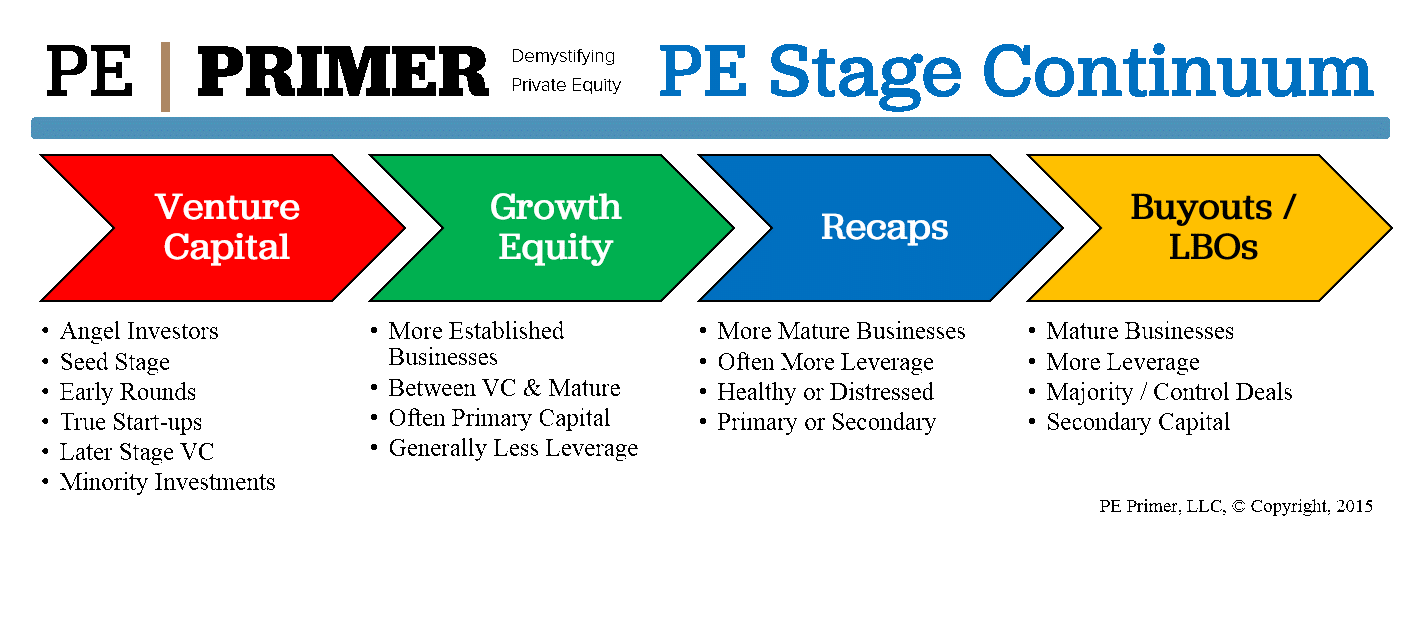

Types of private investment. Investors should consider each type of investment before determining an asset allocation that aligns with their goals. The long answer. Private equity is a generic term used to identify a family of alternative investing methods.

Each type of investment offers a different level of risk and reward. SmartAssets free financial advisor matching. Besides private equity funds hedge funds also implement this type of investment.

A financial advisor helps you put together an investing plan that will utilize a number of the above types of investments. Understanding a Private Investment Fund Private funds are. If investment does not depend either on incomeoutput or the rate of interest then such investment is called autonomous investment.

Investment may be autonomous and induced. Although the traditional categories of investing include stocks bonds and cash equivalents we have divided the many different types of investments into our own categories Ownership investments lending investments investment funds and retirement plans. Private investment from a macroeconomic standpoint is the purchase of a capital asset that is expected to produce income appreciate in value or both generate income and appreciate in value.

Nearly all types of private equity funds eg including buyout growth equity venture capital mezzanine distressed and real estate can be sold in the secondary market. Usually investment decision is governed by output andor the rate of interest. Thus autonomous investment is.

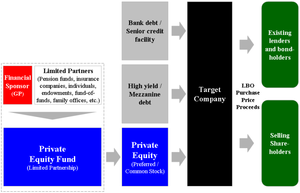

A fund of funds FoF is an investment strategy whereby investments are made in other funds rather than directly in securities stocks or bonds. The two types of investments are discussed below. A Feeder Fund invests or feeds this capital into an umbrella fund often called a Master Fund Main which directs and oversees all investments held in the Master portfolio.

The field of private investment is more varied than the short answer might make it seem at first. In contrast to registered investment companies which must always be organized within the United States private funds are often organized in offshore jurisdictions for tax regulatory and marketing reasons. The transfer of the fund interest typically will allow the investor to receive some liquidity for the funded investments as well as a release from any remaining unfunded obligations to the fund.

Common types of private funds include hedge funds private equity funds and managed futures funds also known as commodity pools. Investing in a mutual fund allows you to invest in a range of assets by adding your financial contribution to others creating a large pool of investment money. Hedge funds and private equity funds are two of the most common types of private investment funds.

We review the nine types in this gallery like leveraged buyouts venture capital and more. It can include leveraged buyout funds growth equity funds venture capital funds certain real estate investment funds special debt funds mezz distressed etc. Private Equity Fund structure Master-Feeder Fund A Feeder Fund is an investment vehicle that consists in the pooling of capital commitments from investors.

Its important to note that while private investors may be from firms that focus solely on investments like venture capital firms and angel investors they are never from banks. For investments you could invest in companies that trade publically or those listed as private. What are the types of private equity strategies that exist today.

Private Equity Funds 19 Contributions Onetoone Corporate Finance

Private Equity Funds 19 Contributions Onetoone Corporate Finance

Private Equity Industry Overview Street Of Walls

Types Of Private Equity Investments Download Scientific Diagram

Types Of Private Equity Investments Download Scientific Diagram

Private Equity Industry Overview Street Of Walls

Carried Interest Guide For Private Equity Professionals

Carried Interest Guide For Private Equity Professionals

What Is Private Equity Private Equity Primer

What Is Private Equity Private Equity Primer

Investment Partners By Private Equity Type Download Scientific Diagram

Investment Partners By Private Equity Type Download Scientific Diagram

The Strategic Secret Of Private Equity

The Strategic Secret Of Private Equity

Private Capital Industries Hogan Lovells

Private Capital Industries Hogan Lovells

Private Equity Funds Know The Different Types Of Pe Funds

Private Equity Funds Know The Different Types Of Pe Funds

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.