Furthermore how can I overdraft my Wells Fargo account. You can remove the service at any time.

Set Up Overdraft Protection2 Set Up Overdraft Protection2 Demo

Set Up Overdraft Protection2 Set Up Overdraft Protection2 Demo

Overdraft andor non-sufficient funds NSF fees are not applicable to Clear Access Banking accounts.

How soon can i overdraft my wells fargo account. If you choose to link your Account to your Wells Fargo checking account for Overdraft Protection please note the following. Now I dont actually need all that much probably 150-300 will tide me over until payday but Ive only got literally 7 cents in my account. You can log onto the Wells Fargo online banking website and go to the Contact Us section.

Wells Fargo will not authorize your ATM and everyday one-time debit card transactions into overdraft unless you ask us to by adding Debit Card Overdraft Service 2 to your account. Transfer fees are charged daily. Then if you happen to spend more than you have in your checking account your available credit will be used to authorize the transaction 1.

It can return those obligations unpaid likely charging you a fee for having insufficient funds. There are 3 ways how to close a Wells Fargo account. You can add or remove Debit Card Overdraft Service at a Wells Fargo ATM Select More Choices Wells Fargo Services through Online Banking with a branch banker or talk to a phone banker anytime at 1-800-TO-WELLS 1-800-869-3557.

You can add Debit Card Overdraft Service. Wells Fargo also offers an Overdraft Rewind which is a free service that may waive your overdraft fee if a direct deposit is made one business day after the overdraft happens. Local time for online transfers.

The check you wrote would bounce but you would still have to pay a fee which may overdraft your account and the same applies to debit card transactions. Lets take a quick look at each. You can then send an e-mail to Wells Fargo.

With overdraft coverage however you can use your overdraft as soon as you open the account and opt-in. When this happens youre charged an overdraft fee. If you add the optional Debit Card Overdraft Service to your checking account the bank may approve at our discretion these transactions if you dont have enough money in your.

If you have a joint checking account you will be responsible for all advances including interest and charges from your credit card to cover overdrafts regardless of who writes the check makes the debit card purchase or engages in any other. Wells Fargo offers free financial health coaches and lots of free services to help you succeed financially and hopefully avoid having to overdraft in the future. I bank with Wells Fargo Ive got a somewhat good history with them - Ive never attempted to go overdrawn before and from January-August 2016 I regularly maintained 4-digits across my checkingsavings.

Steps for Closing a Wells Fargo Account. Failure to pay this fee and rectifying your negative balance quickly gives the bank the option of closing the account. Easier say than done we agree.

Anytime by calling us at 1-800-TO-WELLS 1-800-869-3557 signing on to Wells Fargo Online Banking from a computer or tablet search Overdraft Services visiting a Wells Fargo ATM select More Choices or speaking to a banker at any Wells Fargo branch. This is probably the easiest way to close a Wells Fargo account. 32K views Answer requested by.

You can sign up for Overdraft Protection at anytime but since it can take up to three business days to fully enable services opting in doesnt solve your immediate need for an overdraft. Wells Fargo overdraft limit. If you enroll in debit card overdraft service you may be eligible its not recommended until about 612 months of good account maintenance.

1 business day for Wells Fargo Online payments paid using Wells Fargo bank accounts By mail. We charge no more than three overdraft andor non-sufficient funds NSF fees per business day for Consumer accounts and eight per business day for Business accounts. Than 30 calendar days after the creation of the overdraft.

If there is an overdraft on an account with more than one owner on the signature card each owner and agent if applicable shall be jointly and severally liable for all overdrafts inclusive of fees. Same day for payments by Midnight Pacific Time You can choose to use a bill payment service other than Wells Fargo Online to make payments with us. Limited overdraft rewind program.

Well transfer a minimum of 25 to cover. How can I overdraft my Wells Fargo account. Unlike other big banks Wells Fargo reverses overdraft fees under two conditions.

You can connect 2 backup funding accounts to your main checking account. If you are a new account holder you may be able to use the overdraft privilege service 30 days after the account is opened assuming your account is in good standing as previously. Portfolio by Wells Fargo customers call 1-800-742-4932 and Business customers call 1-800-CALL-WELLS 1-800-225-5935.

You can add Debit Card Overdraft Service anytime by calling us at 1-800-TO-WELLS 1-800-869-3557 signing on to Wells Fargo Online Banking from a computer or tablet search Overdraft Services visiting a Wells Fargo ATM select More Choices or speaking to a banker at any Wells Fargo branch. Click here to know more about Wells Fargo Overdraft service. It also can pay the creditor as requested leaving your balance in the negative.

Contact your human resource department immediately to set up payment by check or to have the money deposited to another bank account if you have one. 3 - 5 business days using non-Wells Fargo bank accounts. If you did that yes you may be able to overdraft your account because of that payment plus the overdraft fees.

Overdraft Privilege should not be viewed as an encouragement to overdraw your account. Can I withdraw money from overdraft. Instead of figuring out how much can you overdraft your checking account OverdraftApps suggests to avoid from overdrafting altogether.

Sign up for Overdraft Protection and link your Wells Fargo Credit Card to your Wells Fargo checking account. Any account holder with transaction authority can add or remove the service on the checking account. If you did not opt-in the answer is still yes but this time because of the fees only.

7 - 10 business days. The overdraft andor non-sufficient funds NSF fee for Wells Fargo Teen. The bank can hold any money that you currently owe in overdraft fees and charges but you may need that money to pay your rent and other bills.

Making Sense Of Overdraft Rewind Checking Accounts Wells Fargo

Making Sense Of Overdraft Rewind Checking Accounts Wells Fargo

Set Up Overdraft Protection2 Set Up Overdraft Protection2 Demo

Set Up Overdraft Protection2 Set Up Overdraft Protection2 Demo

What Is Wells Fargo Overdraft Rewind Magnifymoney

What Is Wells Fargo Overdraft Rewind Magnifymoney

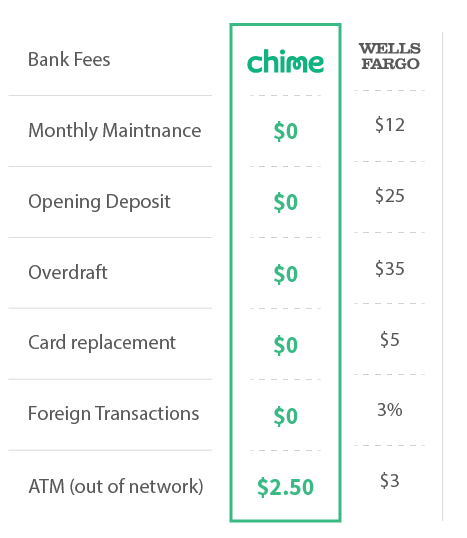

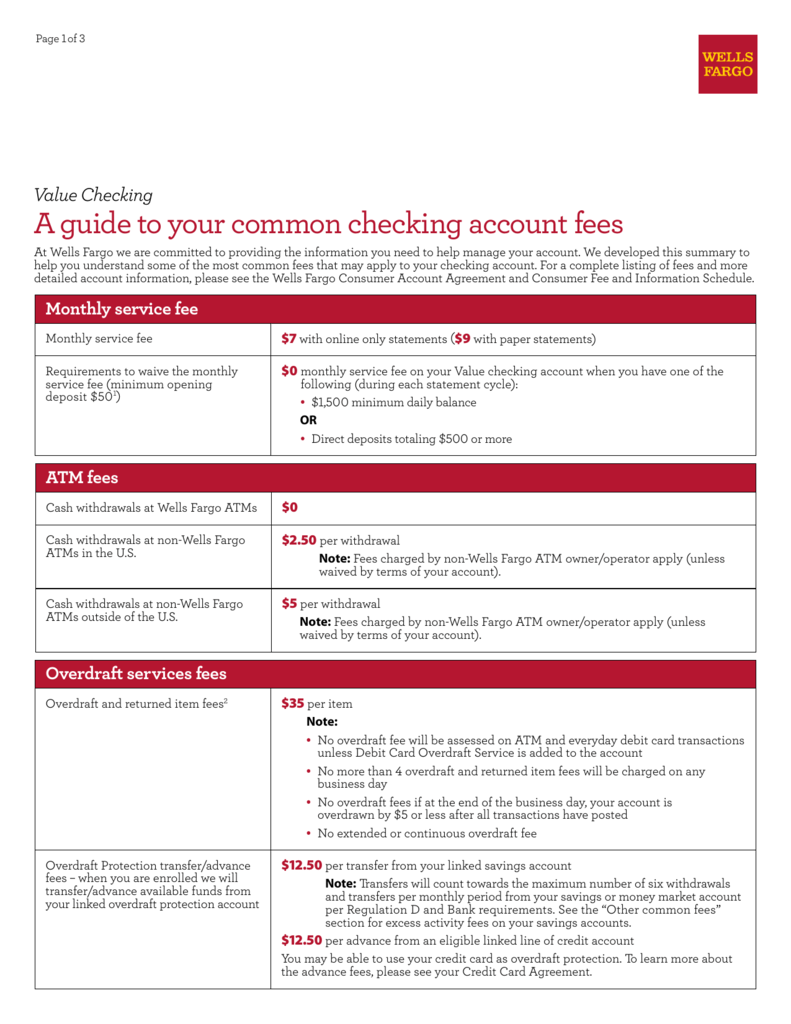

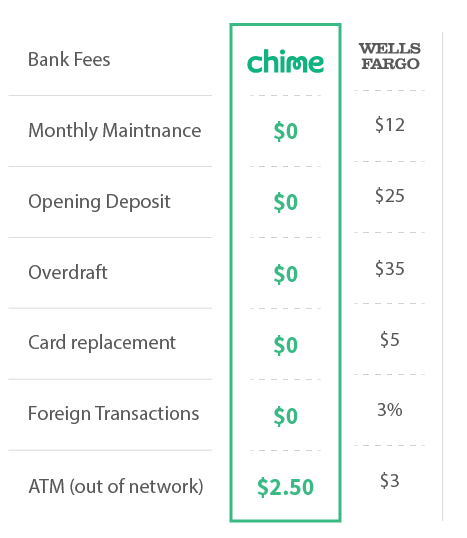

A Guide To Your Common Checking Account Fees

A Guide To Your Common Checking Account Fees

Wells Fargo Bank Review Smartasset Com

Wells Fargo Bank Review Smartasset Com

Wells Fargo Debuts Accounts With Limited Overdraft Fees

How To Get Your Wells Fargo Overdraft Fees Waived A Step By Step Guide

How To Get Your Wells Fargo Overdraft Fees Waived A Step By Step Guide

Wells Fargo Overdraft Fees Youtube

Wells Fargo Overdraft Fees Youtube

Why You Should Never Sign Up For Overdraft Protection Clark Howard

Why You Should Never Sign Up For Overdraft Protection Clark Howard

Making Sense Of Overdrafts Checking Accounts Wells Fargo

Making Sense Of Overdrafts Checking Accounts Wells Fargo

Wells Fargo Checking Account 2021 Review Should You Open Mybanktracker

Wells Fargo Checking Account 2021 Review Should You Open Mybanktracker

How Much Can I Overdraft My Checking Account Answered First Quarter Finance

How Much Can I Overdraft My Checking Account Answered First Quarter Finance

Wells Fargo Fees Updated 2020 What To Know And How To Avoid Them

Wells Fargo Fees Updated 2020 What To Know And How To Avoid Them

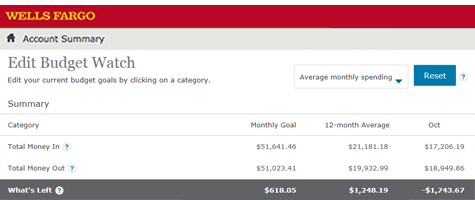

Online Budget Tools Budget Watch Wells Fargo

Online Budget Tools Budget Watch Wells Fargo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.