How does an ETF work. Shareholders own a portion of an.

What Is The Creation Redemption Mechanism Etf Com

What Is The Creation Redemption Mechanism Etf Com

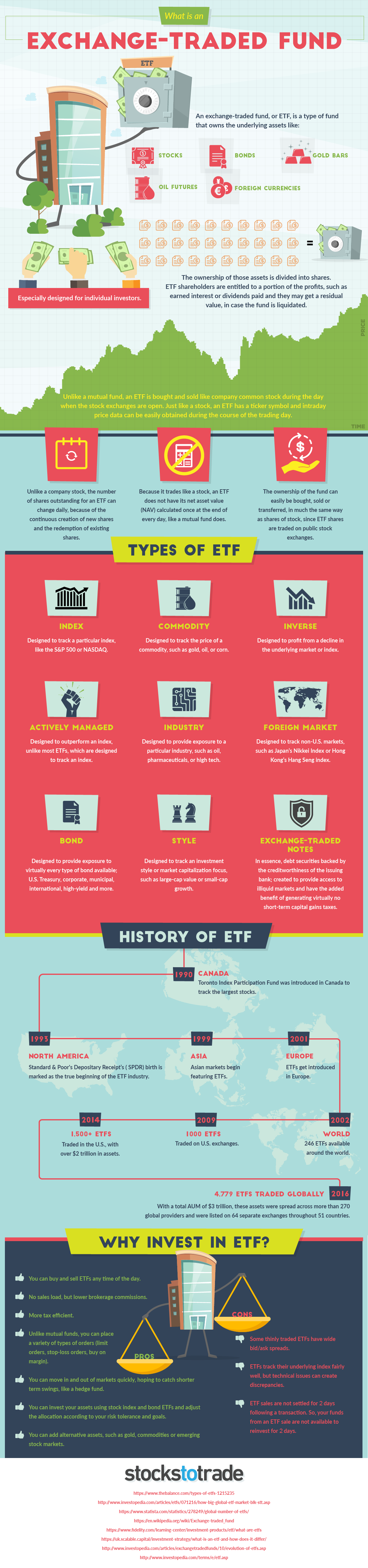

ETFs have grown in popularity over the last decade but what exactly are they and how do they work.

What is an etf and how does it work. An ETF works like this. An ETF can hold shares in a broad spectrum of companies or choose to curate specific stocks to make a narrow ETF. A physical ETF is an open-ended fund that owns the underlying assets relative to the index its tracking and divides ownership of the assets into shares that investors can purchase through the.

An ETF is an investment plan that can be traded as shares on many of the stock exchanges around the world. Todays piece will walk you through the mutual funds cousin the ETF. You can think of it like a basket.

Ive written a few 101-type articles on investing in the past. ETFs are passive investments that track an underlying index and there are index mutual funds that are also passively managed. While an ETF tracks asset value it will trade at.

In this video we will explain what an exchange traded fun. How ETFs work A fund that trades like a stock ETFs work like mutual funds except that theyre listed bought and sold on a regulated stock exchange typically through a broker or brokerage platform. They combine features and potential benefits of stocks mutual funds or bonds.

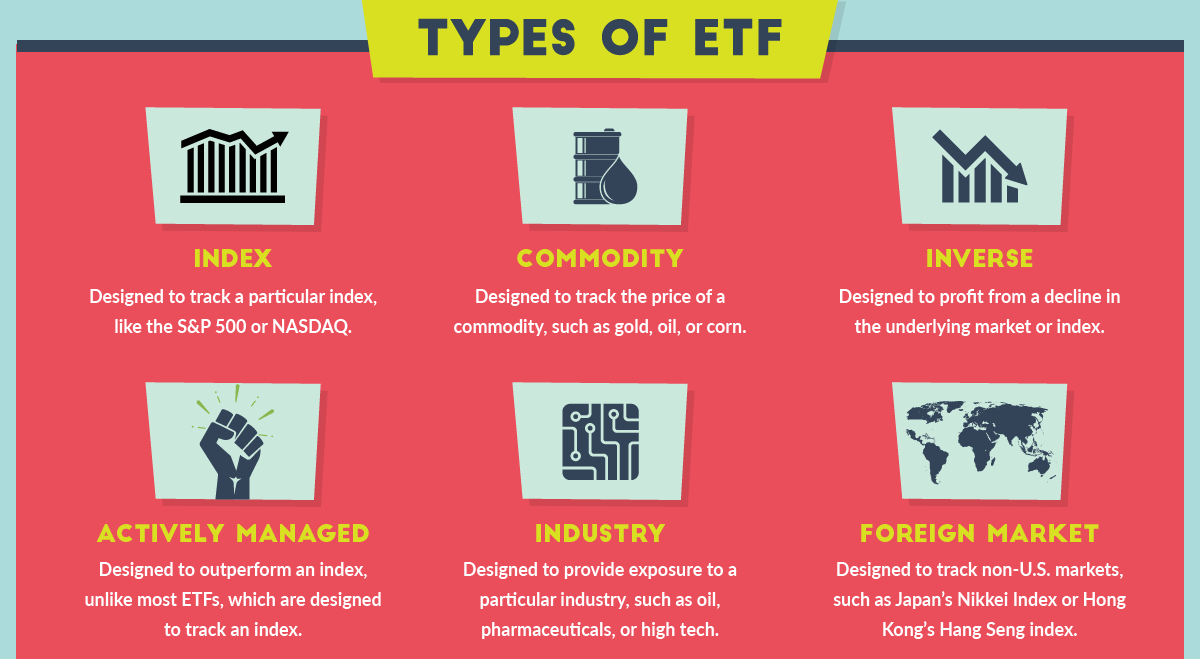

Those funds aim to mirror the performance of or track indices like the SP 500 sectors like manufacturing industries like tech themes like clean energy or strategies like dividend investing. Right so what does that look like. It tracks an index representing a basket of securities bonds commodities.

They create a unique ticker for this basket designing the ETF to track performance. You can buy or sell an ETF instantly when the market is open whereas with a mutual fund orders are filled after. Though they arent entirely different think of ETFs as a basket of stocks.

Although exchange-traded funds ETFs are primarily associated with index-tracking and growth investing there are many that offer income by. The fund provider owns the underlying assets designs a fund to track their performance and then sells shares in that fund to investors. Are ETFs and stocks the same.

What Is an ETF and How Does it Work. An Exchange Traded Fund might also try to replicate a specific market such as the technology market or the automotive market. What is an Exchange Traded Fund and how does it work.

The fund provider purchases a basket of underlying assets like stocks bonds currencies or commodities. ETFs offer the opportunity to invest in a portfolio of securities that provide the same diversification. But for all of their similarities they are in fact quite different.

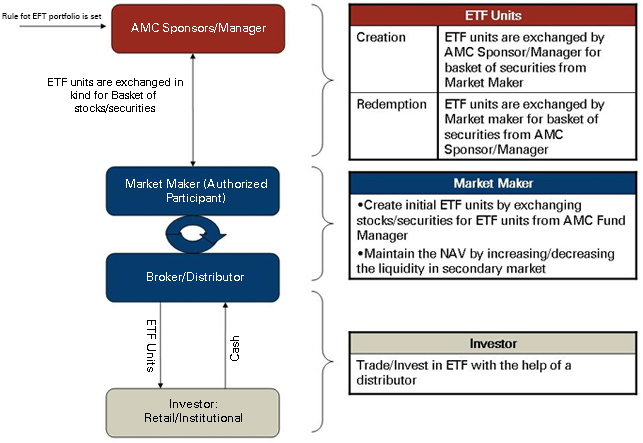

ETFs work via a creationredemption process. An ETF is a collection of securities packaged and sold in a single basket or fund. Like individual stocks ETF shares are traded throughout the day at prices that change based on supply and demand.

Learn about what is etf and how does it work in hindi what is etf in share market in hindi etf kya hai Please Subscribe my YouTube Channel httpswww. An ETF performs the same as a company like Apple on the stock exchange except it is not a company it is a overarching fund that holds shares from many companies. An exchange traded fund ETF is a type of security that tracks an index sector commodity or other asset but which can be purchased or sold on a stock exchange the same as a regular stock.

For starters ETFs are traded like stocks on the exchange. According to Bursa Malaysia ETF is an open-ended fund listed or traded on a stock exchange. Generally an ETF works to replicate a standard element within the stock exchange such as the Standard Poor 500 index.

Because ETFs trade on exchanges their prices can fluctuate based on supply and demand of the ETFs which might not be the same as the supply and demand. Save for Your Future. An ETF is a basket of securities shares of which are sold on an exchange.

An ETF contains an assortment of securities. Exchange Traded Funds or ETFs are a financial instrument born out of a 1988 840-page SEC Black Monday postmortem. The fund provider then sells shares in the fund to investors who own a portion of the fund but not its underlying assets.

Exchange Traded Funds Benefits Of Investing In An Etf Icici Direct

Exchange Traded Funds Benefits Of Investing In An Etf Icici Direct

What Is An Etf How Does It Work A Quick Overview

What Is An Etf How Does It Work A Quick Overview

Etf Fundamentals How Etfs Work And What Hidden Risks Really Exist Youtube

Etf Fundamentals How Etfs Work And What Hidden Risks Really Exist Youtube

How Do Etfs Work Financial Times

How Do Etfs Work Financial Times

What The E T F Happened On August 24

What The E T F Happened On August 24

Exchange Traded Funds What Is An Etf Justetf Academy

Exchange Traded Funds What Is An Etf Justetf Academy

How Is An Etf Created Education Ishares

How Is An Etf Created Education Ishares

How Does A Levered Etf Work Youtube

How Does A Levered Etf Work Youtube

How Do Exchange Traded Funds Etfs Actually Work By How To Money Australia How To Money Medium

Exchange Traded Funds What Is An Etf Justetf Academy

Exchange Traded Funds What Is An Etf Justetf Academy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.