Established in 2014 our South Dakota office serves clients from the United States and the international high net worth community. Your trust is a private contract between you and your trustee and doesnt need to be filed with any South Dakota court.

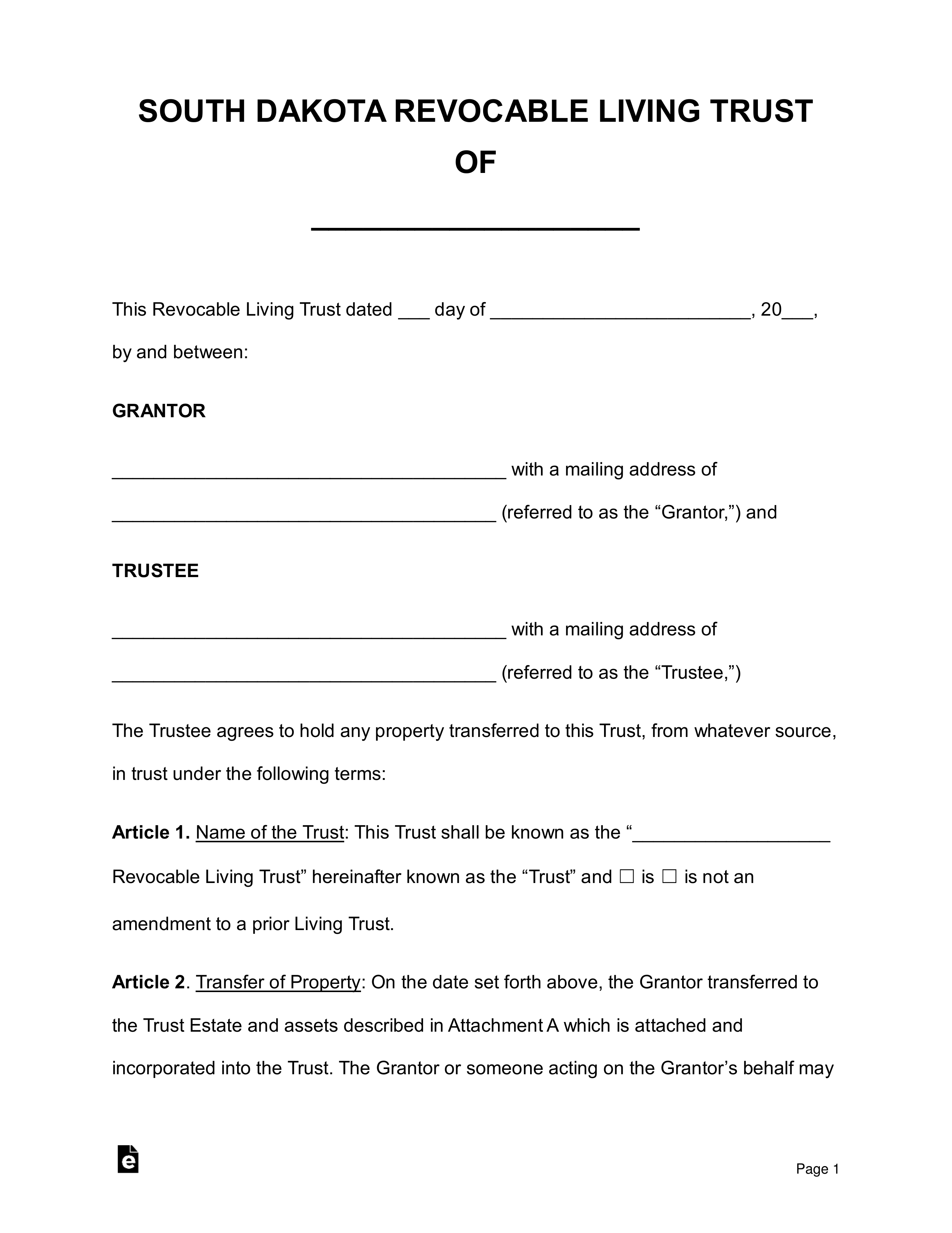

Free South Dakota Revocable Living Trust Form Pdf Word Eforms

Free South Dakota Revocable Living Trust Form Pdf Word Eforms

The office has been one of the top ranked trust companies in South Dakota in the respected Chambers Partners High Net Worth Guide every year for the last five years.

South dakota trust. And expanding to the first floor of 212 S. Trusts in South Dakota are perpetual meaning a wealthy family can put assets into a trust that are held in perpetuity rather than for a limited period of time. Sometimes disputes arise regarding trusts.

South Dakota laws also allow changes to be made to trusts. What are other benefits of a South Dakota dynasty trust. South Dakota Trust is keeping its office at 201 S.

The company must file a 12-page application. Combined with the federal estate tax exemption and Generation Skipping Tax GST exemption of over 50 million South Dakotas tax structure creates an ideal environment for dynasty trusts. South Dakota combines top rated trust privacy tax and asset protection laws with a dedicated workforce strong economy and supportive state government.

South Dakota has been at the forefront of creating the most progressive trust laws in the country for over 30 years. What are the benefits of an irrevocable trust. Another reason people like having a trust in South Dakota is their ability to maintain control.

Trust legislation that allows for unlimited duration trusts trust protector statutes decanting and asset protection. SDALT is an organization founded by South Dakota farmers and ranchers for South Dakota farmers and ranchers. Probate is a process where court officials approve a wills provisions.

We work with landowners to conserve South Dakotas agricultural heritage and working landscapes for the benefit of future generations. The probate process can be expensive and take many months but South Dakota uses something called the Uniform Probate Code. A trust must have at least 200000 of assets to receive a South Dakota charter.

People often use living trusts to avoid probate. Understanding South Dakotas Dynasty Trusts Preserving Your Wealth. Modifications reformation and decanting have gained popularity as a result of new trust laws.

First Dakota Wealth Trust is the fiduciary arm of First Dakota National Bank providing trust services for individuals and families. This code simplifies the probate process allowing you to save time and money. As a result South Dakota is routinely ranked among the best Trust Jurisdictions in the United States by industry publications law review articles white papers and surveys of leading trust and estate professionals.

This is often the most recognized benefit of a revocable trust. South Dakota is the only state that does not levy any taxes on trust assets. Were not busting at the seams but were approaching the point where we would be full so this is a move looking ahead that gives us room to grow both our core personal trust business as well as our private trust company business Tobin said.

In fact South Dakota has no state income tax no capital gains tax and no estate tax. Second a revocable trust allows you to avoid probate. No one enjoys an uncomfortable conversation.

Most trusts permit trustees to pay trust principal to one or more beneficiaries also known as the power to invade the trust. However SDCL 10-43-90 imposes a minimum financial institution tax on South Dakota chartered trust companies. If a trust protector is appointed a trust company will do the administrative work but the family can still have control over investments or distributions.

Once chartered there is an annual state fee of 7 cents per 10000 of. South Dakotas decanting statute permits a South Dakota trustee to transfer all trust property to another trust for the same beneficiarybeneficiaries as long as the trustee has any discretion over income or principal distributions. Trusts do not incur income estate inheritance gift or transfer taxes.

Why Get a Living Trust in South Dakota. Leading trust jurisdiction with extremely supportive Governor legislature regulator and judiciary. South Dakota chartered trust companies are defined as a financial institution pursuant SDCL 10-43-1 which imposes a net-income-based tax on South Dakota sitused financial institutions.

Initially South Dakotas so-called dynasty trusts were advertised for their ability to dodge inheritance tax thus allowing wealthy people to cement their familys long-term control. US South Dakota Key Facts. The power to pass along money to your children grandchildren and generations beyond your.

And part of the second floor.

Unique South Dakota Laws South Dakota Trust Company Llc

Unique South Dakota Laws South Dakota Trust Company Llc

South Dakota Trust Law Benefits 5 Reasons They Make Sense For You 250 Happy Clients Served

South Dakota Trust Law Benefits 5 Reasons They Make Sense For You 250 Happy Clients Served

South Dakota Trust Law Benefits 5 Reasons They Make Sense For You 250 Happy Clients Served

South Dakota Trust Law Benefits 5 Reasons They Make Sense For You 250 Happy Clients Served

South Dakota Trust Company Llc

South Dakota Trust Company Llc

South Dakota Trust Company Llc

South Dakota Trust Company Llc

South Dakota Trust Company Llc Step Global Congress

South Dakota Trust Company Llc Step Global Congress

Trust Business Swells In South Dakota With International Changes Siouxfalls Business

Trust Business Swells In South Dakota With International Changes Siouxfalls Business

South Dakota Trust Company Siouxfalls Business

South Dakota Trust Company Siouxfalls Business

International Families South Dakota Planning Company Trust Company South Dakota

The Great American Tax Haven Why The Super Rich Love South Dakota Tax Havens The Guardian

The Great American Tax Haven Why The Super Rich Love South Dakota Tax Havens The Guardian

About South Dakota Trust Association

About South Dakota Trust Association

International Families South Dakota Planning Company Trust Company South Dakota

Why South Dakota Is A Tax Haven For The Rich Local Rapidcityjournal Com

Why South Dakota Is A Tax Haven For The Rich Local Rapidcityjournal Com

South Dakota Trust Company Llc

South Dakota Trust Company Llc

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.