By charging you a flat fee of on average 500 up-front. Mortgage brokers make money in different ways.

How Much Do Mortgage Brokers Make The Truth About Mortgage

How Much Do Mortgage Brokers Make The Truth About Mortgage

How Do Lenders Make Money.

How do mortgage lenders make money. Banks and other lenders are in business to make money. An origination fee is a percentage of the total loan usually half a percent to one percent that you pay up front when getting the loan source. Mortgage brokers have to put food on the table as well so its important to understand how mortgage brokers make money.

The first and foremost step within the mortgage process is pre-approval. Some receive a flat salary but most are paid on. The good news is good mortgage brokers will always work in your best interest no matter how theyre paid.

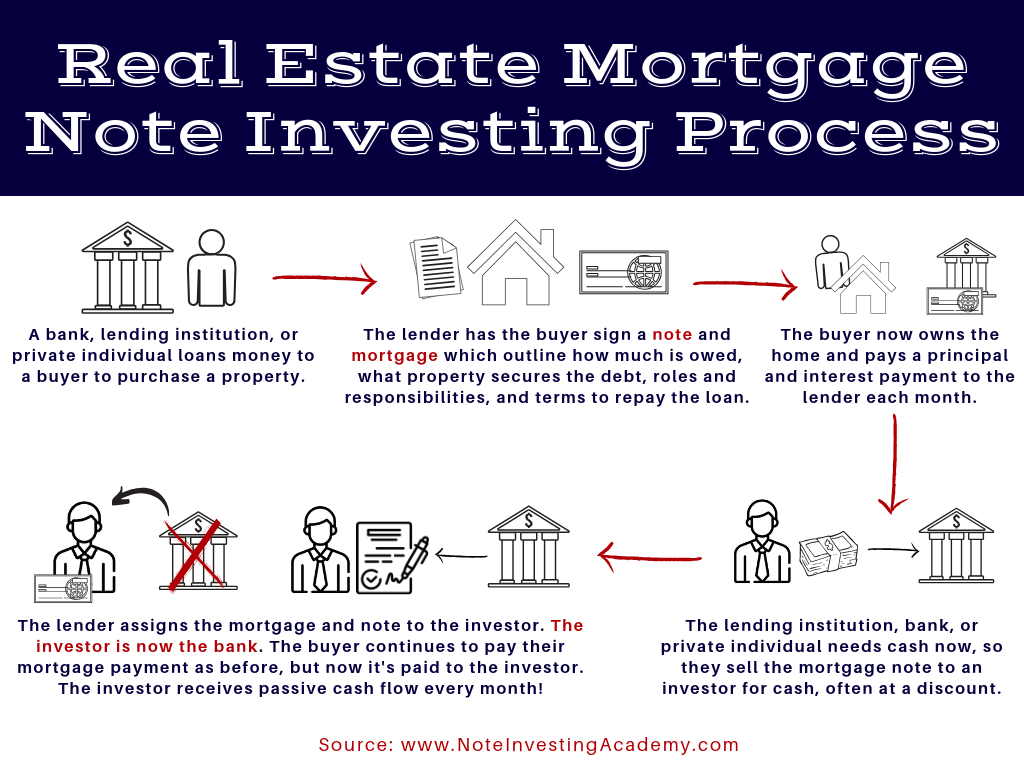

This is a form of an investment that has certain similarities with the bonds. Loan agent compensation varies widely. If you have ever taken a loan you probably heard about this term.

If you study how do mortgage brokers get paid and how much brokers may make then youll know just how profitable being a mortgage broker is. Lenders are in the business of making money from loans. Because lenders use their own funds when extending mortgages they typically charge an origination fee.

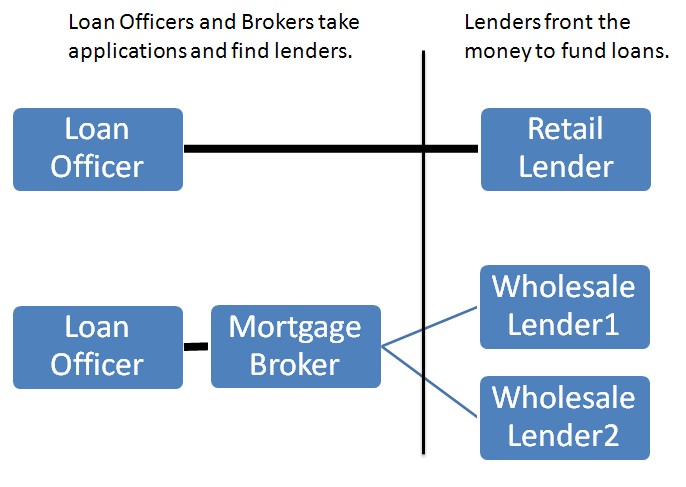

The mortgage originator will most often sell the mortgage into the secondary mortgage market. This is partly because they are legally required to do so but also because mortgage brokerages live and die on. They charge a fee for their service which is paid by either you the borrower or the lender.

A mortgage REIT on the other hand buys mortgage-backed securities. How Do Mortgage Lenders Make Money. They can choose to get paid by either the lender or the borrower They can charge an origination fee directly which comes out of the borrowers pocket Or elect to get paid by the lender which is indirectly paid by the borrower.

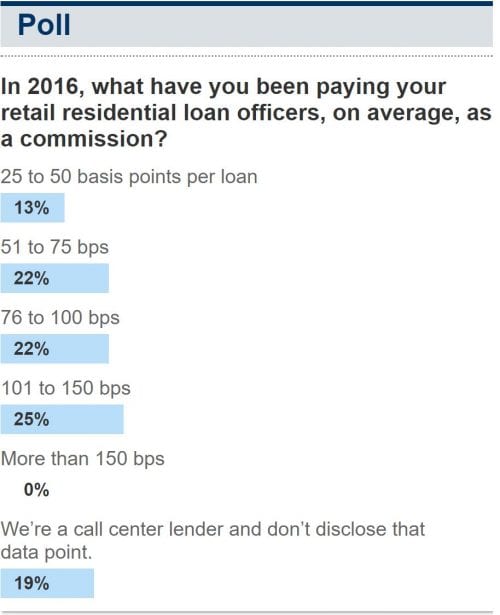

Financial institutions pay a low interest rate on depositor accounts such as savings and money market accounts then use that money to lend money to borrowers at a higher interest rate in the form of loans and credit cards. Mortgage brokers make a lot of money even if they dont charge those trailing commissions. How Much Do Brokers Earn.

By charging you a fee based on how much youre borrowing. Lenders make money on your mortgage loan by charging you an origination fee among other fees. Its investors buy the right to earn from these loans and earnings as well as principal are shared among them according to their shares.

In general mortgage originators make money through the fees that are charged to originate a mortgage and the difference between the interest rate given to a borrower and the premium a secondary. With your pre-approval its time for you to check out some of the properties that you deem appropriate. Origination Fees Because lenders use their own funds when extending mortgages they typically charge an origination fee of 05 to 1 of the loan value which is due.

Like many financial advisers mortgage brokers typically get paid by commission. The lender providing the mortgage pays the broker that commission finders fee for referring and managing the application and mortgage closing. When borrowing money to buy a house the bank providing your mortgage makes money on more than just the interest on your loan.

Mortgage lenders use funds from their depositors or borrow money from larger banks at lower. For example if youre borrowing 180000 they might charge a 1 fee which amounts to 1800. The fee is a small percentage of the loan amount generally between 1 and 2.

How Do Lenders Make Money 2020 Guide YSP Yield Spread Premium. This process can be started by. When homebuyers educate themselves on these methods they may be able to save thousands of dollars on their mortgage.

The lending bank is called the mortgage originator. Mortgage lenders lend directly from their own funds so they are different from brokers who. Those are some of the things that you need to take note of if you want to know how mortgage brokers get paid.

Explained in plain words. When a lender sells a loan service retained they receive less income initially however they will continue to make money on the servicing of the loan. 2 The lender can also sell the loan service.

How Do Mortgage Lenders Make Money. Mortgage lenders may get paid in multiple ways. The lowest ten percent earned less than 32870 and the highest ten percent earned more than 130630.

Mortgage Brokers Vs Banks The Truth About Mortgage

Mortgage Brokers Vs Banks The Truth About Mortgage

What Is The Difference Between A Loan Officer Mortgage Broker Banker And Other Lenders

What Is The Difference Between A Loan Officer Mortgage Broker Banker And Other Lenders

How Much Do Mortgage Lenders Make On Your Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Do Mortgage Lenders Make On Your Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Do Mortgage Lenders Make Money

/how-loans-work-315449-color-V22-4dcd4f3587dd412ba418600a644fed80.png) Learn How Loans Work Before You Borrow

Learn How Loans Work Before You Borrow

Credit And Debt How Do Lenders Make Money

Credit And Debt How Do Lenders Make Money

Collecting Fees Whether You Stay Or Go The New York Times

Collecting Fees Whether You Stay Or Go The New York Times

Finance 101 How Do Banks Make Money Money Under 30

Finance 101 How Do Banks Make Money Money Under 30

Real Estate Mortgage Notes A Complete Guide To Investing Millionacres

Real Estate Mortgage Notes A Complete Guide To Investing Millionacres

How Mortgage Lenders Make Money Callahan Real Estate Group

How Do Lenders Make Money Up Front On Your Mortgage Howstuffworks

How Do Lenders Make Money Up Front On Your Mortgage Howstuffworks

A Faq Is How Do We Mortgage Choice Brokers Get Paid Lending Institutions Pay Us And There Is No Charge To You The Lenders Are S Lenders Mortgage Home Loans

A Faq Is How Do We Mortgage Choice Brokers Get Paid Lending Institutions Pay Us And There Is No Charge To You The Lenders Are S Lenders Mortgage Home Loans

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.